Chinese property stocks, at 55 per cent discount to assets, are a valuation trap for funds fleeing tech regulatory storm

- Property stocks in Hong Kong and mainland China trade near record-low average book value per share, no appetite for re-rating yet

- Deep discount shows the market is already trying to price the risk of policy curbs, according to Wealthy Securities

Property developers fetched about 45 cents on the dollar on average in book value of their underlying assets, near a historic low of 43 per cent last month, according to Bloomberg data. The 55 per cent discount, or about twice the 10-year average, may be warranted as China tightens measures to ensure home affordability under its latest “common prosperity” drive.

“The government’s tone remains very hawkish and signals that they won’t allow the property sector to hijack the overall economy,” said Raymond Cheng, head of Hong Kong and China research at CGS-CIMB Securities. “The policy headwinds have caused great concern among investors about the developers’ operations and valuations.”

An index tracking 33 developers listed in Hong Kong and mainland China has dropped 19 per cent this year, with only eight of them posting gains, bogged down by the liquidity crunch at China Evergrande and defaults by China Fortune Land. Developers are the biggest culprits for the US$12 billion equivalent of onshore debt distress this year.

President Xi Jinping’s call for common prosperity is sending a signal to the market that Beijing has low tolerance for lofty home prices. House-price inflation may be an easy target to blame for social inequality and financial burdens on households, fanning speculation about more property taxes.

“The market is already trying to price or discount that outcome,” said Louis Tse Ming-kwong, managing director of Wealthy Securities in Hong Kong. “If the common prosperity scenario comes into play, the earnings could be affected by [increasing tax rates].”

The long-term outlook for China’s property sector is still uncertain, as Beijing has not yet developed a comprehensive, long-term plan for it, Nomura analysts led by Lu Ting wrote in a report this month. The ongoing curbs “may not deliver exactly what top leaders expect,” they added.

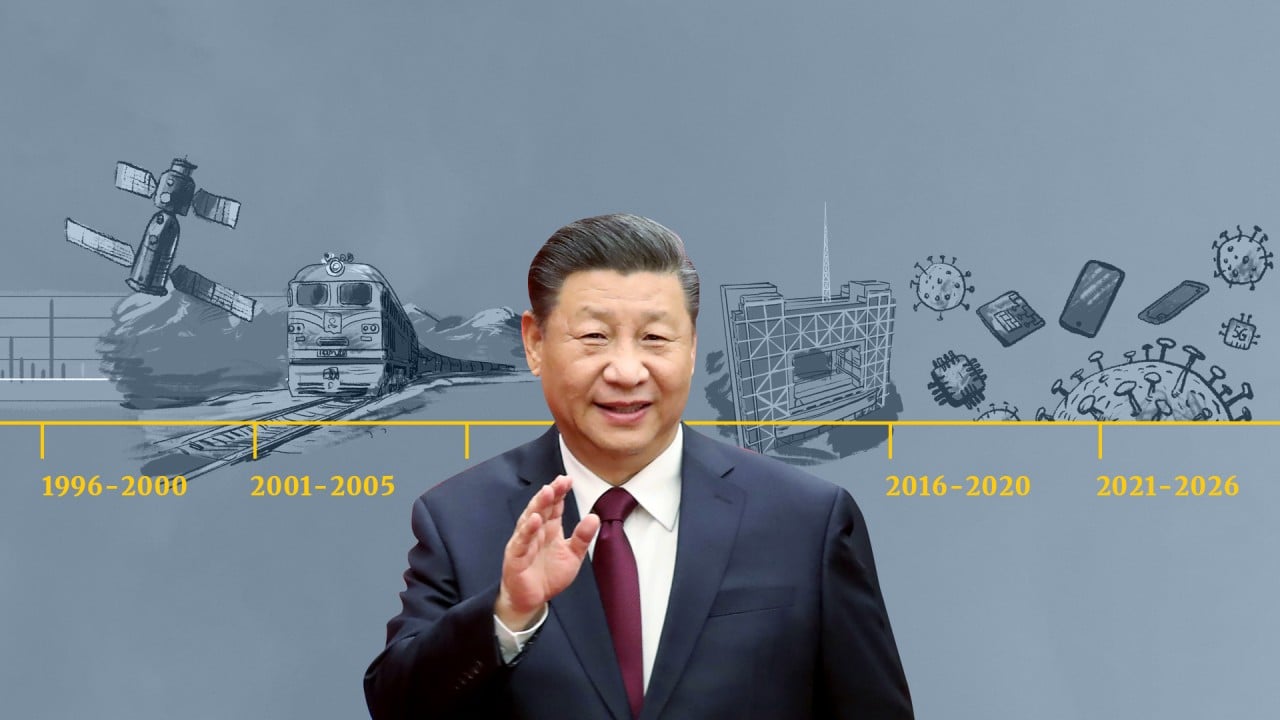

05:57

SCMP Explains: China’s five-year plans that map out the government priorities for development

“Markets over the near term need to be prepared for a likely marked growth slowdown, more developer defaults and home foreclosures, and perhaps some turmoil in stock markets,” they wrote.

Property stocks have been laggards historically with cooling measures, such as restrictions on home purchases and higher down payments, suppressing valuations. Tightening regulations, from tech to education and property sectors, are hurting valuations, according to UBS.

“With little-to-no clarity as to when the government will ease up, we would avoid regulatory targeted sectors [such as property] and recommend those shielded or supportive of policy ambitions,” Mark Haefele, chief investment officer at UBS Global Wealth Management, wrote in a report. “It’s arguably never been trickier to navigate Chinese markets than it is today.”

Additional reporting by Zhang Shidong