China Evergrande’s restructuring ‘quasi unavoidable’ amid distress as ‘free pass’ on debt binge ends

- SC Lowy has actively traded Evergrande bonds including with new investors as prices dropped to distressed levels, co-founder says

- Evergrande’s free pass appears to have ended as regulators slapped ‘three red lines’ on borrowing limits to contain risk: Seafarer Capital

The developer boosted its chances of survival after regulators in Beijing handed it some breathing space. The Financial Stability and Development Committee approved the company’s proposal to negotiate repayment deadlines with lenders and other creditors, Bloomberg reported last week.

Lowy, a former Cargill and Deutsche Bank trader, co-founded the privately-owned investment bank and asset management firm in 2009 after the Lehman Brothers crisis. The firm traded US$10.5 billion of high yield bonds globally in the first half this year and US$22.5 billion in 2020.

Suning founder Zhang Jindong faces hostile creditors in bid to delay US$600 million bond repayment

Its shortest-maturity bonds due in March 2022 fetched 35 cents on the dollar, versus 99.6 cents at the end of May, showing that markets have already priced in the risks of default and haircut, according to Jackson Chan, assistant manager of fixed income research in Hong Kong at iFast Financial.

02:40

The rise and fall of Anbang’s deposed chairman Wu Xiaohui

“Although the probability of any debt restructuring involving maturity extension and haircut is increasing, we believe that the current price is already reflecting the maximum haircut level,” he said in a report. “The incentive to sell the bond now is quite low, and investors will miss the opportunity for a possible rebound.”

Evergrande’s debt reckoning was long in coming even as its borrowings ballooned and China started clipping the wings of Anbang Insurance, HNA Group, CEFC Group and the Tomorrow Group from 2016, groups known for their debt-funded rapacious growth. Other entities linked to shadow financing, such as China Huarong Asset Management, are now facing severe financial stress and struggling to avoid bankruptcy.

Debt-laden Chinese conglomerate finds investors for airline, airport businesses

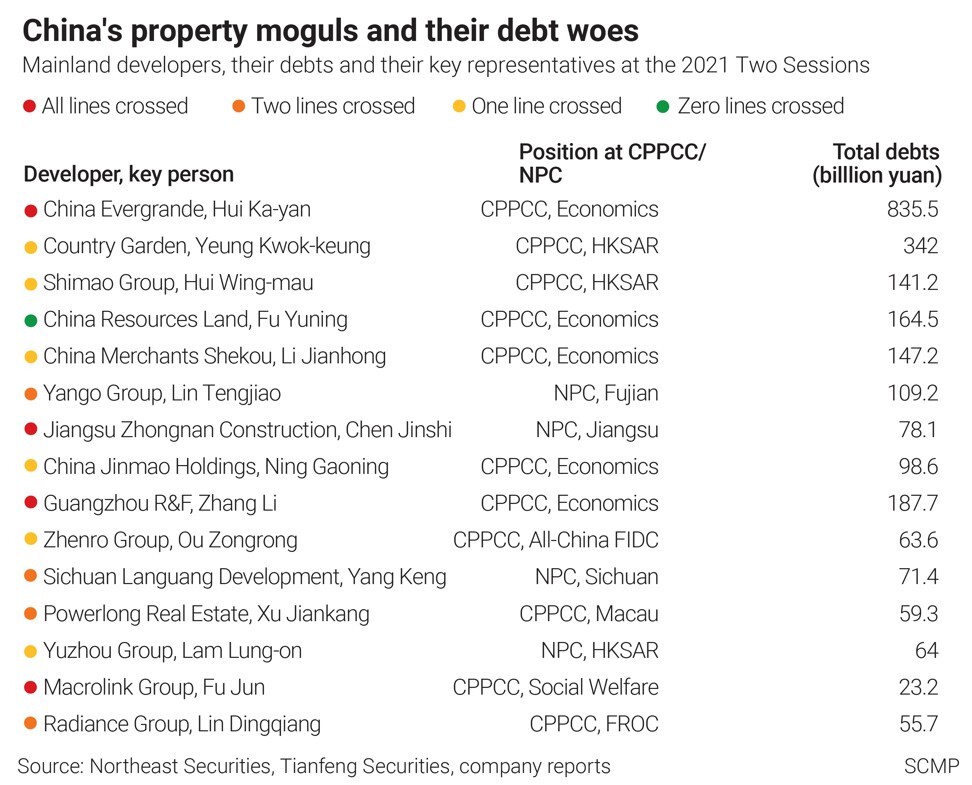

“For the first several years of the crackdown, Evergrande seemed immune from pressures to deleverage, becoming one of China’s largest and riskiest corporate borrowers,” Nicholas Borst, director of China Research at Seafarer Capital Partners, wrote in a report last month. “Evergrande’s free pass, however, now appears to be over as regulators target it and other property developers with the ‘three red lines’ borrowing regulation.”

Late last month, Hui warned of default risks if its effort to raise cash falls short and may face legal actions. The firm has reportedly put up its headquarters in Hong Kong for sale, as well as its equity stakes in listed car-making and property management units.

China Evergrande had 1.97 trillion yuan (US$305 billion) of liabilities on June 30, a source of consternation for policymakers trying to contain any potential systemic risk to the financial system. The amount included 240 billion yuan of borrowings and 951 billion yuan of payables, both due by June next year.

Hui has at least about four months to figure out his next moves. Evergrande does not have any bonds coming due until January when investors can ask for repayment on 8.2 billion yuan of local bonds, according to iFast Financial. However, it still needs to service 3.8 billion yuan of bond interest until then.

“At this point, we still think Evergrande has the resilience to survive for a longer period,” Chan at iFast Financial said. “However, if it really gets into any legal process, it may take a long time to come up with a recovery plan for the relevant bonds.”