Advertisement

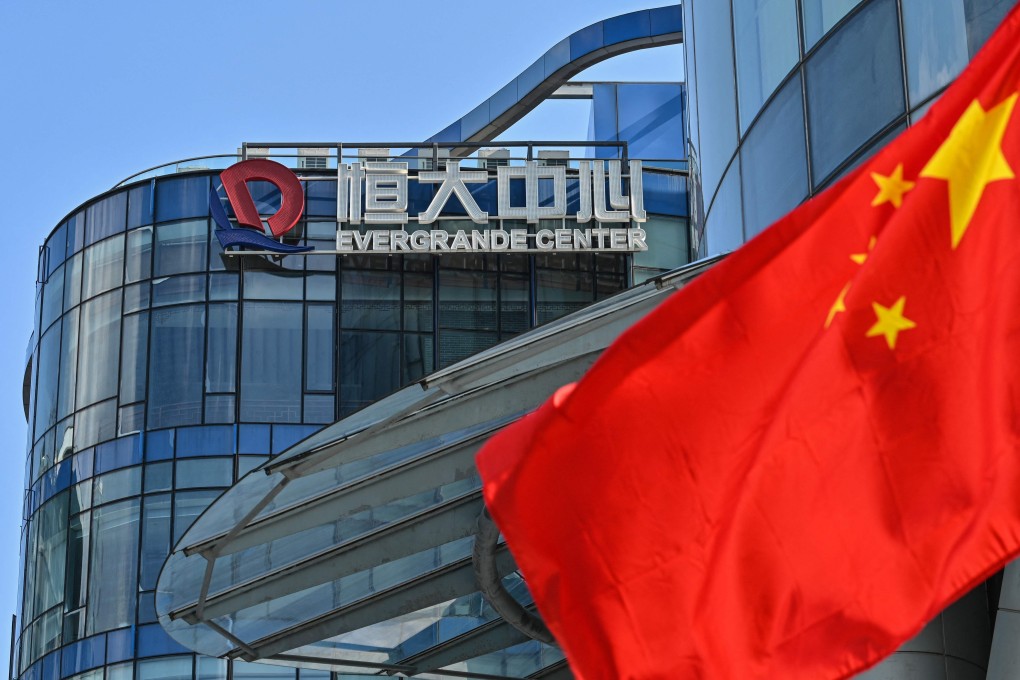

Hong Kong stocks surge as China injects more liquidity amid speculation Evergrande to avert full-blown default

- Stocks rallied on mounting speculation Evergrande to restructure debt and stem a sector-wide crisis as China’s central bank injected more liquidity

- Mainland markets also gained following a record streak of robust trading volume in Shanghai and Shenzhen

Reading Time:2 minutes

Why you can trust SCMP

Zhang Shidongin Shanghai

Hong Kong stocks jumped by the most in almost two weeks as trading resumed after a holiday break with property and tech stocks leading the charge. China Evergrande Group posted its biggest gain in a year on speculation it will avert a full-blown default.

The Hang Seng Index climbed 1.2 per cent to 24,510.98 from Tuesday’s level at the close. The Hang Seng Tech Index added 0.9 per cent. The city’s financial markets were closed on Wednesday for a holiday after the Mid-Autumn Festival.

Shanghai Composite Index advanced 0.4 per cent, as transaction volume on the nation’s two main bourses surpassed the 1 trillion yuan (US$155 billion) for a record 45 days. China’s central bank pumped liquidity into the banking system in the biggest net injection since January on Thursday to alleviate concerns about a liquidity crunch.

Advertisement

The property developer surged as much as 32 per cent before closing 18 per cent higher at HK$2.67. Evergrande, which last reported more than US$300 billion of liabilities, on Wednesday resolved the interest payment due on an onshore bond. Its property management unit rallied 7.9 per cent to HK$4.53, while the new energy vehicle arm added 0.3 per cent to HK$2.91.

“We’re still relatively sanguine about the risk that Evergrande’s collapse triggers a financial crisis or economic crash in China,” Mark Williams, chief Asia economist at Capital Economics wrote in a report. “Policymakers will use their control of the banking system to prevent financial strains spreading beyond highly-leveraged developers.”

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x