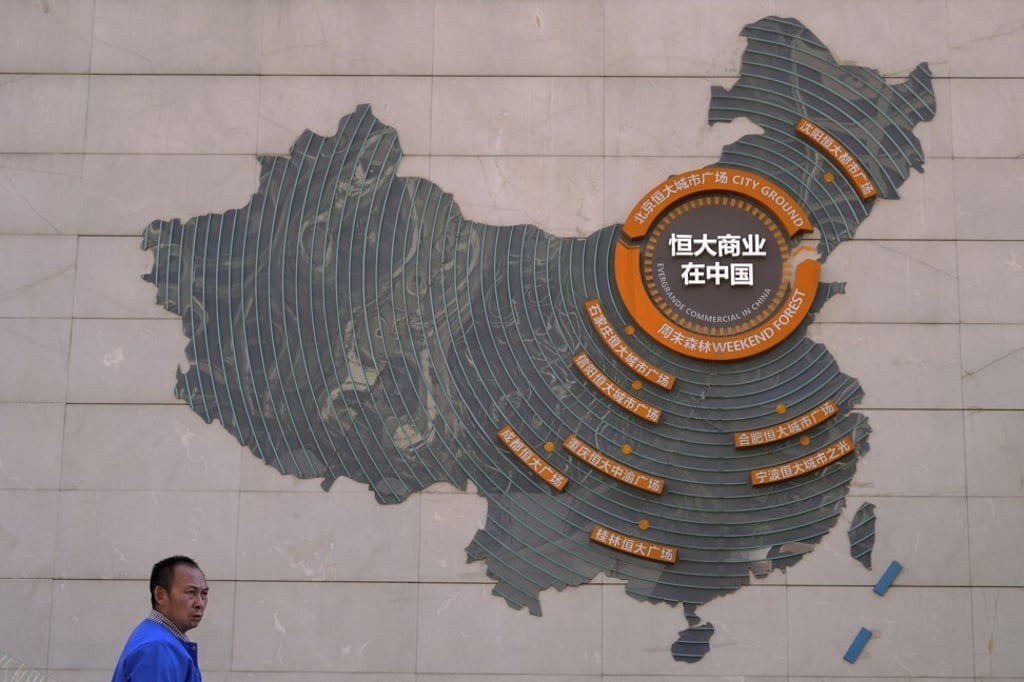

Chinese bankers swoop in on own shares on the cheap as Evergrande’s debt crisis rattles market, drives valuations lower

- Half a dozen Chinese banks said they would buy back their shares this month, as markets were roiled by concerns of exposure to China Evergrande Group

- Ping An Bank, Bank of Shanghai and China Zheshang Bank are the latest to announce their buy-backs

Major shareholders and senior executives of several Chinese banks have been on a buying spree, picking up the shares of their own organisations on the cheap, after China Evergrande Group’s debt crisis rattled capital markets and drove down valuations.

The wave of buy-backs may instil some confidence in China’s beleaguered banking stocks as they size up their exposure to Evergrande’s US$300 billion liabilities. Chinese bank stocks trade at an average discount of 44 per cent to their book value, cheaper than any other industrial sector in the equity markets, according to data provided by Shanghai DZH.

Their asset quality and bad loans remain a perennial concern among investors amid the relentless government campaign to cool the property market. Evergrande’s debt woes have exacerbated the angst, causing a gauge of 43 banks on the Shanghai and Shenzhen exchanges to fall by almost 5 per cent from a high this month.

Chinese banks are overly worried about any potential contagion risk from Evergrande, according to China Merchants Securities and China Everbright Securities.