China stocks erase losses on policy easing bets while Hong Kong cancels trading due to typhoon Kompasu warning

- Stocks advanced for the first time this week as consumer companies attract buyers on valuations appeal

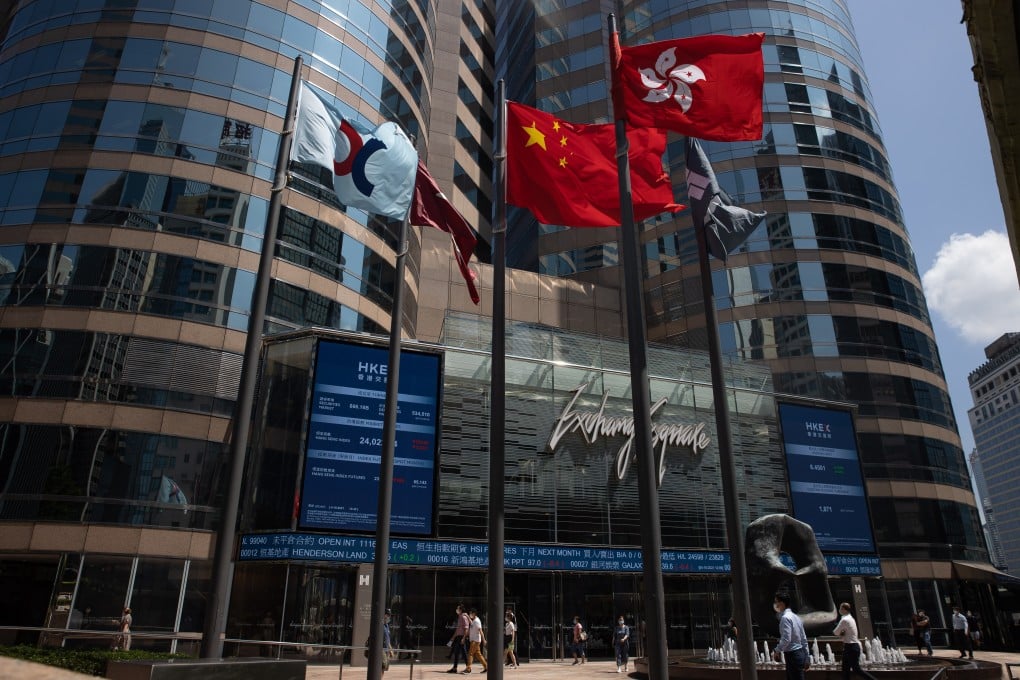

- Financial markets in Hong Kong were closed because of typhoon Kompasu, and will also be shut on Thursday for a public holiday

The Shanghai Composite Index added 0.4 per cent to 3,561.76 at the close, reversing an earlier loss of as much as 0.9 per cent. The CSI 300 Index, which tracks the biggest companies on the Shanghai and Shenzhen bourses, jumped 1.2 per cent.

Hong Kong cancelled trading because of typhoon Kompasu warning, and will remain shut on Thursday for a public holiday.

Liquor distiller Luzhou Laojiao paced gains among consumer stocks, providing the biggest push to the broader market. Offcn Education Technology surged by the 10 per cent daily cap to lead the pack of vocational education tutors after the State Council encouraged listed companies to engage in the industry.

03:17

Scaffolding collapses as heavy wind and rains lash Hong Kong amid typhoon warning