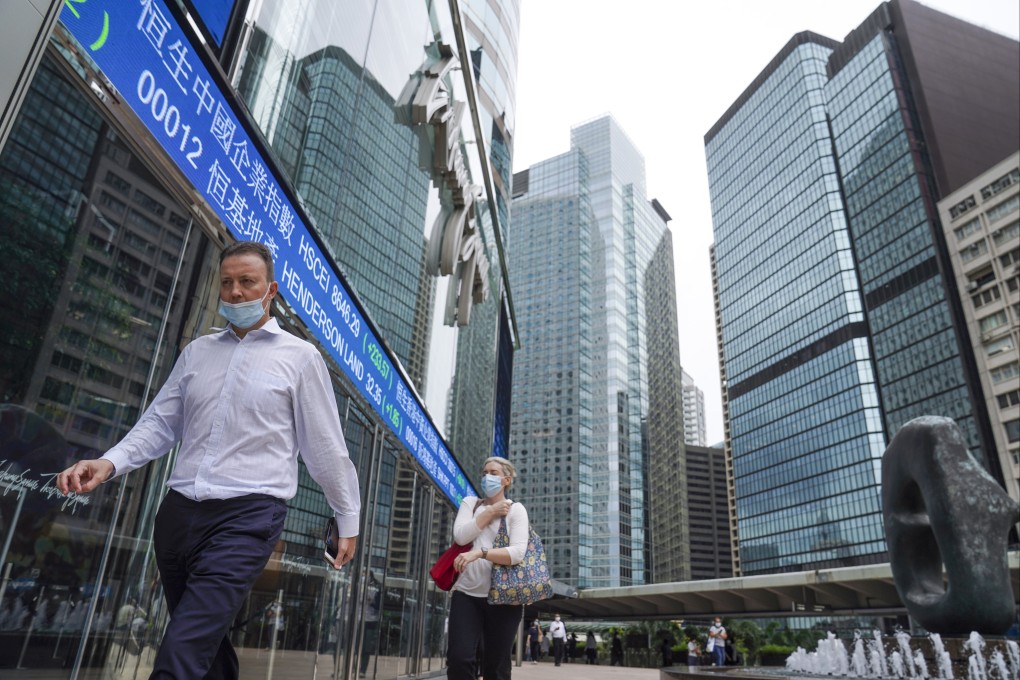

Hong Kong stocks end four-day slide as developers rally on China rate-cut hopes, tech recovers from record low

- Hang Seng Tech Index rebounded from the lowest since its July 2020 inception as WuXi Biologics unveiled a US$500 million stock buy-back plan

- Chinese developers rallied on speculation authorities will ease funding access to alleviate a liquidity crunch and counter a slide in home prices

The Hang Seng Index rose 0.2 per cent to 23,475.50 at the close of Thursday trading, reversing an earlier loss of as much as 1.2 per cent. The Tech Index gained 0.5 per cent, recovering from a dip to an all-time low. The Shanghai Composite Index rose 0.8 per cent.

“In our view, what started as an idiosyncratic risk has now become a systemic one,” Lombard Odier Investment Managers said in a note to clients on December 14. “We expect the authorities to institute new policies that should reduce stress for real estate developers in order for them to obtain funding at reasonable and sustainable yields.”

Mainland Chinese media fanned speculation with reports citing analysts that commercial banks could lower the loan prime rate for the first time since April 2020. The rate, seen as a benchmark in local markets, is set every 2oth of the month.