China’s star manager hopes for redemption as all 4 funds with US$16 billion in assets suffered losses in 2021

- All four funds managed by Zhang Kun at E Fund Management suffered losses ranging from 8.2 per cent to 31 per cent in 2021, ending two years of stellar winnings

- He is responsible for US$16.7 billion in assets, the most cash managed by any portfolio manager in mainland China

But Zhang is not alone in facing headwinds. China’s attempts to rein in so-called “barbaric” growth in private capital and to curb the influence of billionaires have crashed and burned many technology champions, from Alibaba Group Holding to a host of tech-education firms.

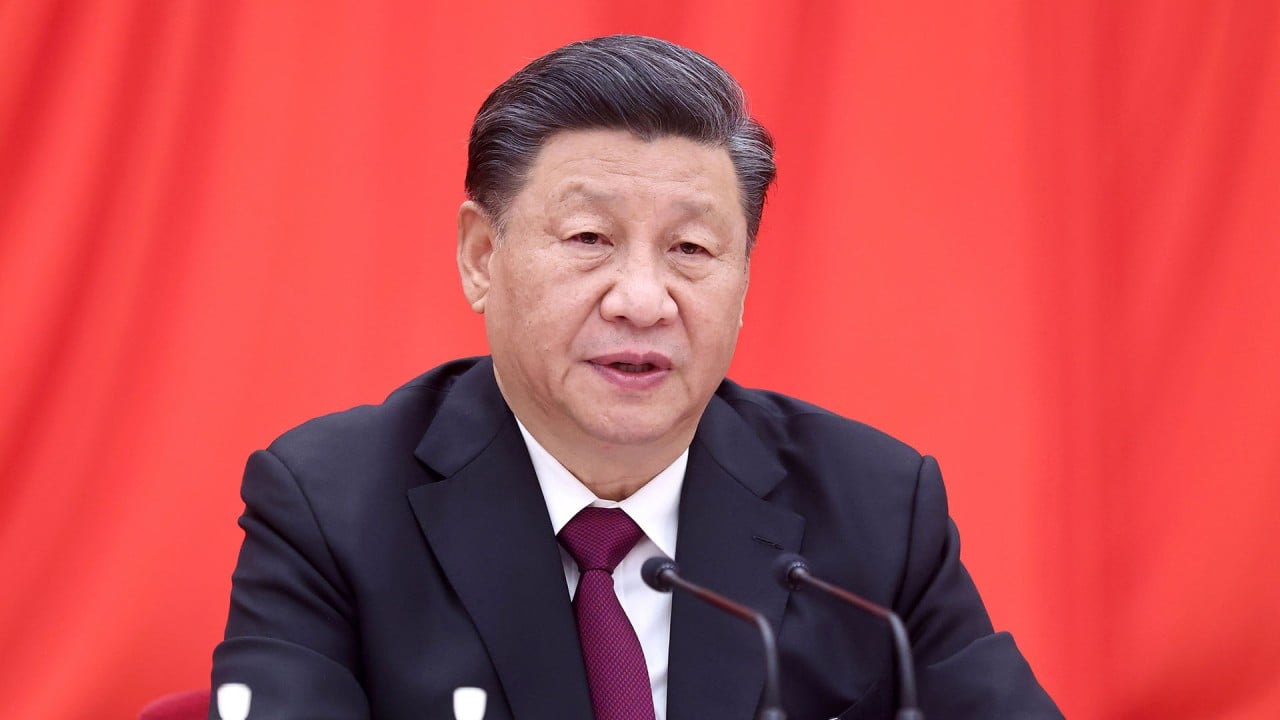

All told, more than US$1 trillion of market value was lost as President Xi Jinping strengthened his grip on the Communist Party in its centennial year.

“Some companies with decent business track records have seen significant declines recently, because of concerns about a slowdown in the economy and corporate earnings, and policy uncertainty,” Zhang said in his most-recent quarterly report to fund investors. “If put into a portfolio, these companies are expected to deliver visible compound growth rates in the next three to five years.”

Zhang, who is based in Guangzhou in China’s southern Guangdong province, managed about US$16.7 billion in assets in the four funds at the end of 2021, according to Bloomberg data. He has about 13 years of experience in the industry, after a stint as an analyst and an assistant to money managers at E Fund Management.

He could not be reached for this story. A phone call to his office went unanswered.

Chinese fund managers trim stock holdings to nine-month low on twin threats

Zhang rose to fame in the local market for his bets on the biggest industry leaders, such as Kweichow Moutai and WeChat operator Tencent Holdings, which hold considerable pricing power in their respective market. His success also caused a frenzy, driving his total assets past the 100 billion yuan (US$15.7 billion) threshold, a first in the local fund history.

As 2022 rolled in, fund managers expect to benefit from policy-easing momentum, picking up tailwinds in the final quarter of last year. China injected massive liquidity into the system last month, while commercial banks trimmed a benchmark cost of money for the first time since April 2020.

With top Chinese leaders prioritising boosting domestic consumption as a tool to counter slowing growth, consumer staple stocks rebounded 8.4 per cent to recoup part of the 13 per cent decline in the third quarter. Zhang’s top bets on liquor distillers Luzhou Laojiao, Kweichow Moutai and Wuliangye Yibin resonated with other fund managers.

“We are relatively optimistic about consumer stocks,” said Luo Di, a portfolio manager at UBS Asset Management in Shanghai. “One of the main reasons is the significant corrections in the first half of 2021. For overseas investors, it’s a long-term story.”

Amperex, ByteDance founders amass wealth in market’s worst year since 2008

There are signs that policy restrictions are easing as the economy faces more headwinds following power shortages, sporadic Covid-19 outbreaks and disruptions caused by indebted lower‑quality property developers, according to Zheng Wenli at T Rowe Price. Beijing has enough policy instruments to engineer a soft landing for the economy.

“We see mispricing opportunities created by the recent regulatory concerns,” Zheng, who manages the China Evolution equity portfolio, said in his 2022 outlook report. “With investors shying away from anything related to the property and health care sectors, we believe there are companies with unique business models that can navigate the environment successfully.”

As a value investor, Zhang has been optimistic about the outlook since the third quarter last year, as a market sell-off created mispricing and buying opportunities. He boosted the allocation to stocks to around 92 per cent from 90.5 per cent in his Blue Chip Selected fund, according to its quarterly report, by adding food and beverage, and banking stocks.

Among the biggest purchases were Wuliangye Yibin, surveillance camera maker Hangzhou Hikvision Digital Technology and Hong Kong-listed food-delivery platform operator Meituan, according to fund filings compiled by Bloomberg.

“Although we don’t know if there will be a trough for stocks, we can be a bit more optimistic about the compound growth rate of these companies in the next three to five years, given that there is no bubble for valuations at the starting point and good-quality equities are always a scarcity,” Zhang said in his latest report.