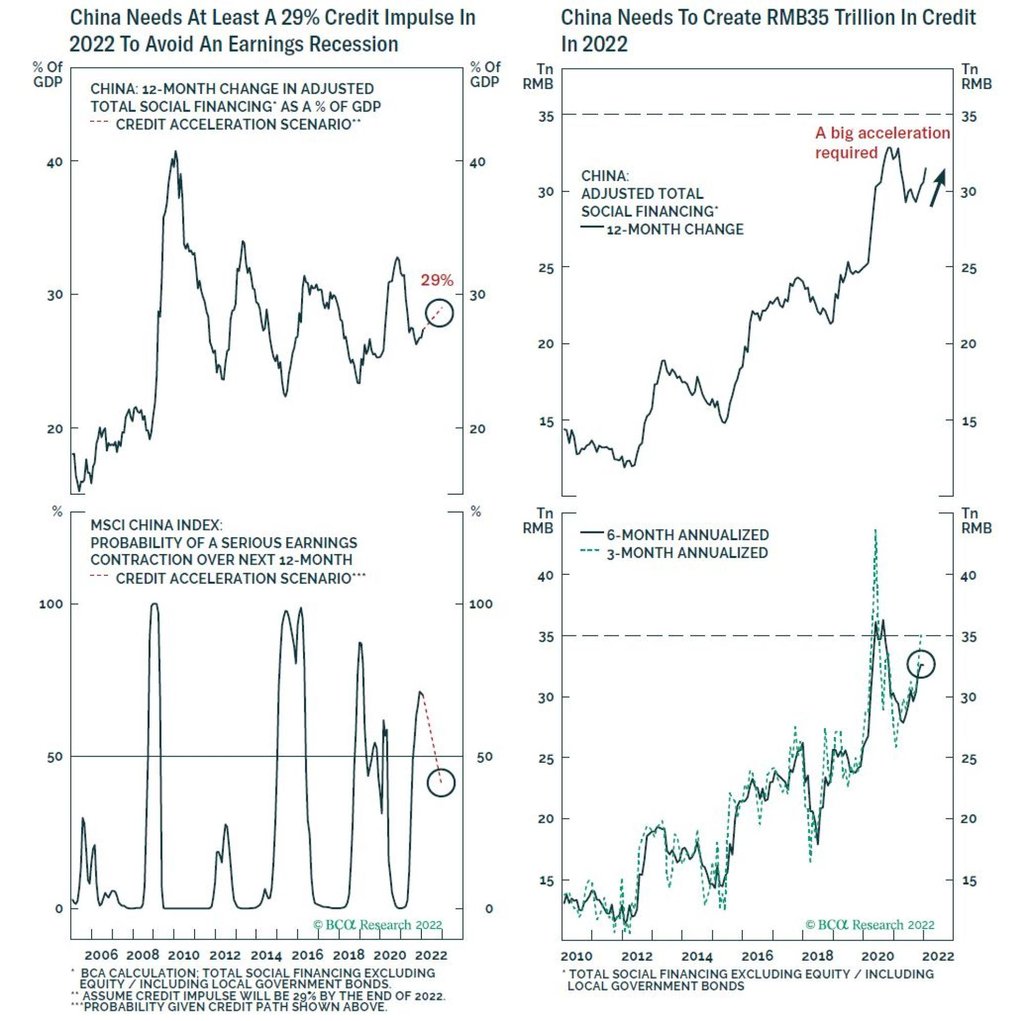

What does it take to go overweight on Chinese stocks? US$5.5 trillion of credit expansion, BCA estimates

- Hold off from going overweight on Chinese stocks as strong January financing data obscures below-par trend against past easing cycles, BCA says

- Stocks have weakened 0.5 to 1 per cent despite encouraging January data, underscoring caution among investors

The sum would be needed to revive sagging domestic demand and anything short of that target would mean investors should bide their time in upgrading the market to overweight within a global portfolio, strategist Sima Jing said in a report on February 16.

BCA arrived at its 35 trillion yuan estimate based on the flow of TSF as a share of GDP. That ratio needs to hit at least 28.5 per cent to reduce the odds of a major earnings contraction to below 50 per cent. It assumes an 8 per cent growth in China’s nominal GDP in 2022.

Aggregate total social financing (TSF) more than doubled in January from December. Yet, the year-on-year increase was slower than the pace seen in China’s previous easing cycles, such as in 2013, 2016 and 2019, according to the Montreal-based research firm.