Hong Kong stocks slide to 2-month low as Putin orders Ukraine attack while Alibaba, HKEX earnings disappoint

- Putin orders Russian troops to demilitarise neighbour Ukraine while the US and its allies dish out more sanctions

- Alibaba’s earnings likely dropped 60 per cent in the latest quarter, while city’s bourse operator HKEX trailed market consensus

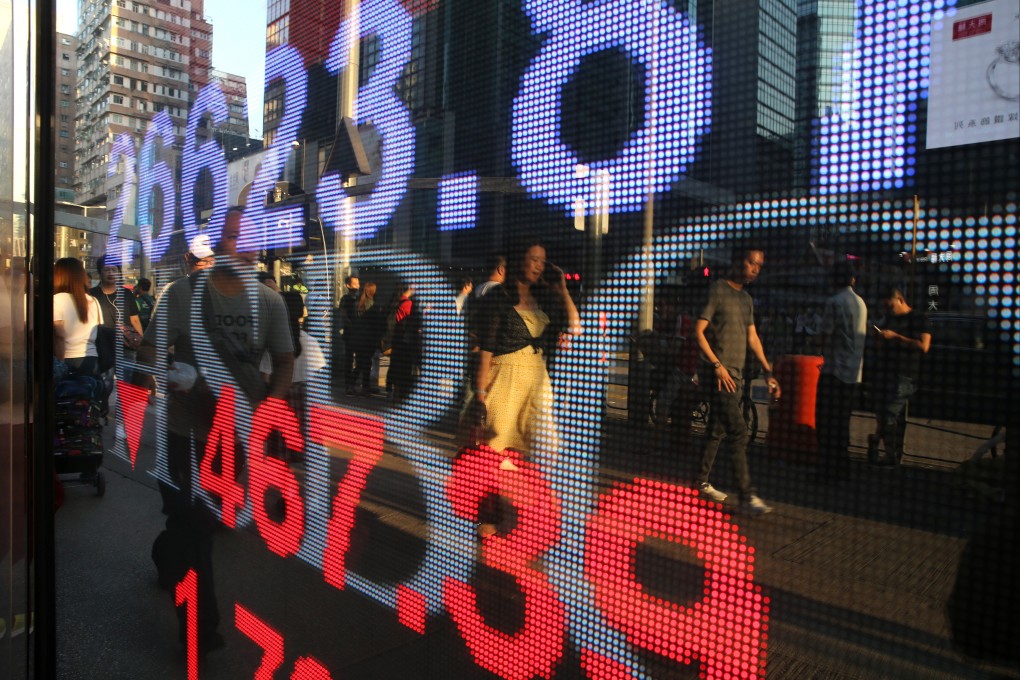

The Hang Seng Index retreated 3.2 per cent to 22,901.56 at the close of Thursday trading, the steepest drop since September. This week’s losses amounted to US$104 billion of market value through Wednesday. The Tech Index sank 4.3 per cent, while the Shanghai Composite Index lost 1.7 per cent.

Oil surged to US$100 for the first time since 2014 on concerns the war in Europe could disrupt supply. Gold approached its record-high of US$2,063.54 set in August 2020. Ten-year Treasury yields fell below 1.90 per cent.

“A period of sustained geopolitical tensions and volatility in financial markets could adversely affect corporate confidence, leading corporates to hold back on capex and hiring decisions, weighing on growth,” Morgan Stanley said in a note on Wednesday.

Alibaba’s earnings probably dropped 60 per cent, its fourth contraction in a row since China foiled the jumbo listing of its associate Ant Group in November 2020 and tightened the screw on internet-platform operators throughout last year.