Advertisement

Hong Kong stocks slump as Shanghai pandemic fallout slams Alibaba, Tencent amid lack of China policy stimulus

- Alibaba, Tencent, Haidilao among benchmark index’s top losers, each tumbling by more than 4 per cent

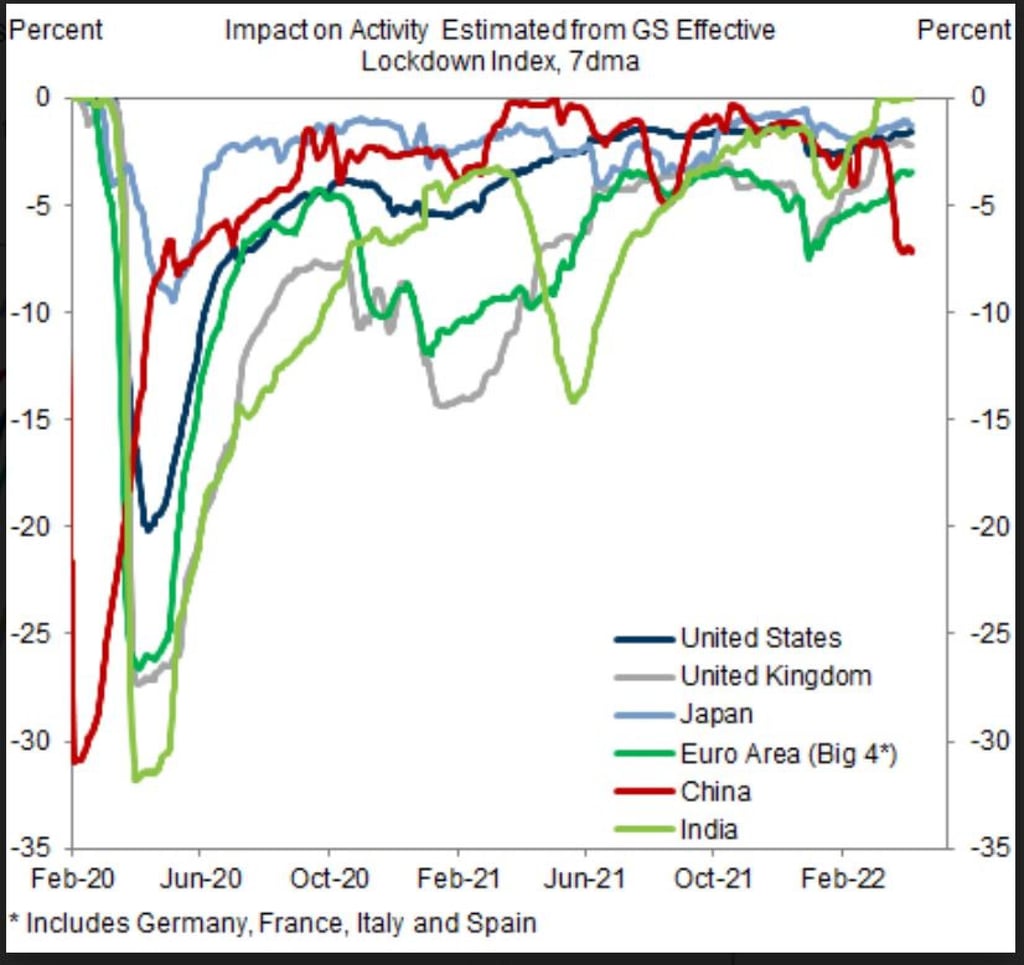

- Lockdowns in Shanghai and other mainland Chinese cities are taking a heavy toll on manufacturing activity, according to Goldman’s tracking index

Reading Time:2 minutes

Why you can trust SCMP

1

Hong Kong stocks fell to near a four-week low on concerns an extended lockdown in Shanghai and other mainland cities will hit manufacturing and derail economic growth while policymakers held back policy stimulus.

The Hang Seng Index slumped 3 per cent to 21,208.30 at the close, set for the lowest level since March 16. The Hang Seng Tech Index sank 5.2 per cent while the Shanghai Composite Index weakened 2.6 per cent.

Among the Hang Seng Index’s worst performers, Alibaba Group Holding lost 5.1 per cent to HK$98.50 and Tencent Holdings retreated 4.3 per cent to HK$353.60. Haidilao sank 9.6 per cent to HK$12.76 and Country Garden Services tumbled 9.1 per cent to HK$36.45.

China is struggling to contain the most severe Covid-19 outbreak in two years, with Beijing sticking to its zero-tolerance policy. Daily confirmed cases in Shanghai surged above 25,000 on Sunday, a record since the March 28 citywide lockdown. New infections have also emerged in Guangzhou, leading to a partial lockdown in the capital of southern Guangdong province.

Advertisement

“It’s illogical to be long on stocks now and an upward trend on the market is unlikely,” said Yan Kaiwen, an analyst at Huaxin Securities. “There’s still a chance that stocks will test a new low.”

The stringent containment measures are hurting industries. Nio, the Shanghai-based maker of electric vehicles, halted production because of a parts shortage. Factories at Contemporary Amperex Technology (CATL), which supplies EV battery packs to Tesla, were also affected, Shanghai Securities News reported.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x