How China’s hardline zero-Covid approach is wreaking havoc on its US$9.6 trillion stock market

- The Politburo Standing Committee’s stance indicates that the zero-Covid policy take precedence over economic growth, Saxo Markets strategist Redmond Wong says

- The Shanghai Composite Index has slumped 17 per cent this year, making it the worst performer in Asia

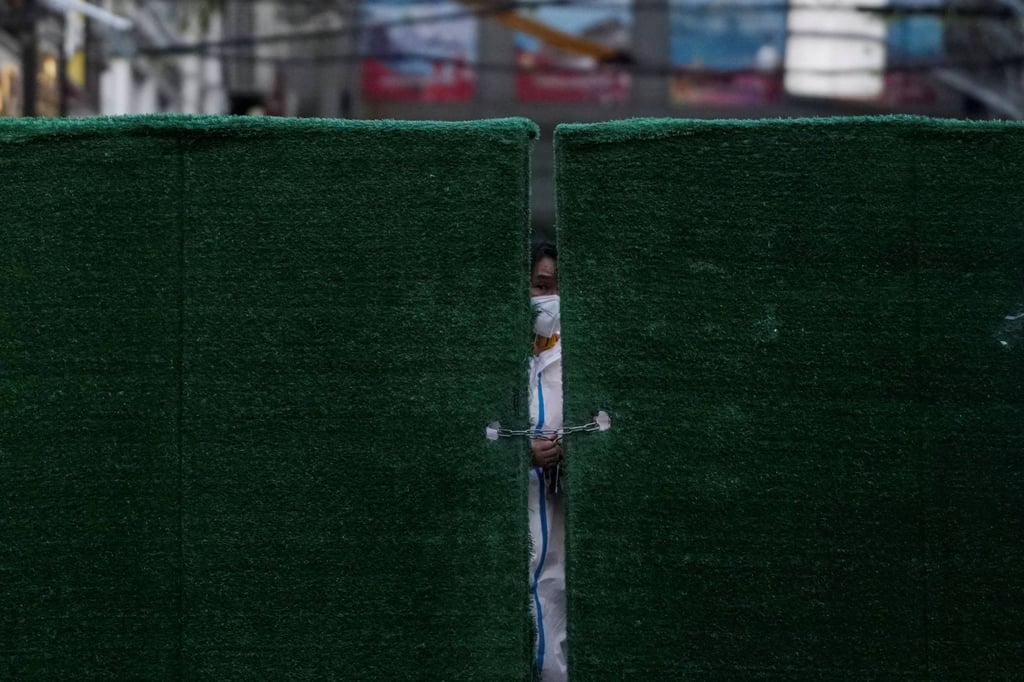

The Politburo Standing Committee, the Chinese leadership’s highest decision-making body, at a meeting on Thursday struck a surprisingly harsh tone to defend the Covid policy, pledging to fight any attempt to “distort, question and dismiss” the approach. The assertion officially put an end to the debate even among government officials on whether Beijing should ease its lockdown measures that have stoked anger among the public, suspended production at factories and paralysed the supply chain.

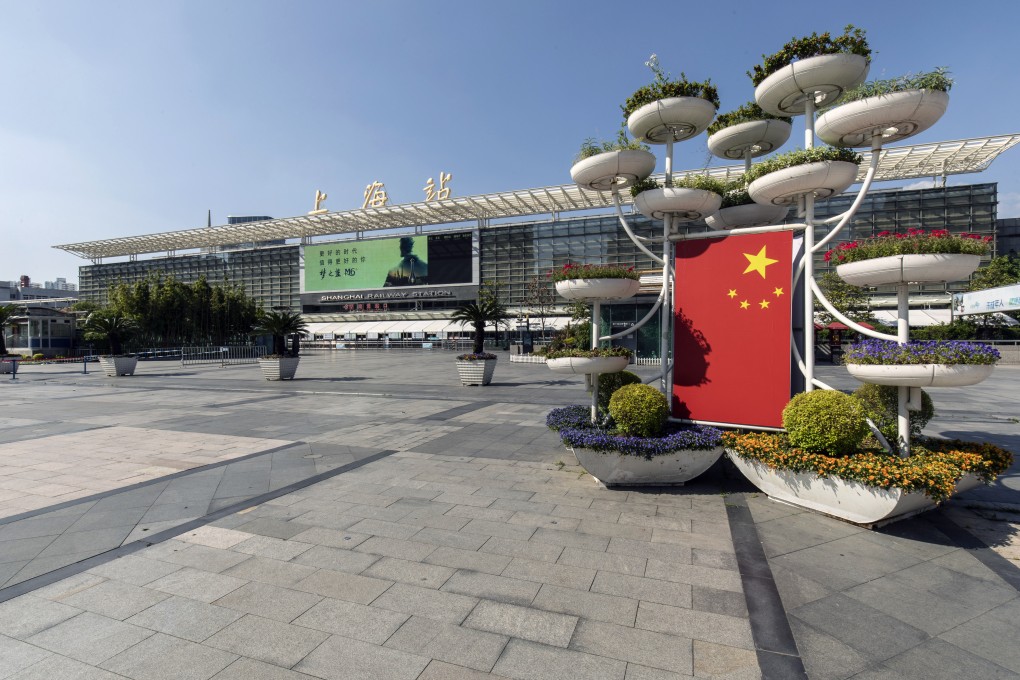

The hardline stance also marks a setback for stock investors who had bet that Beijing would relax the zero-Covid approach to strike a balance between stabilising growth and bringing the pandemic under control. China’s Shanghai Composite Index has slumped 17 per cent this year, making it the worst performer in Asia, as the lockdowns of Shanghai and the nation’s other 40 cities heighten jitters of a deepening slowdown.

The gathering of the seven-member Politburo Standing Committee headed by President Xi Jinping resembled a “wartime mobilisation that called for unity, determination and sacrifice”, signalling that the zero-Covid policy takes precedence over economic growth, according to Redmond Wong, strategist at Saxo Markets.

“Relaxation of dynamic zero-Covid policy is now completely off the table,” he said. “This is going to have enormous negative impact on the economy and the financial markets. The much talked about economic, fiscal and monetary stimulus policy initiatives, even having been rolled out, will be just pushing on a string.”