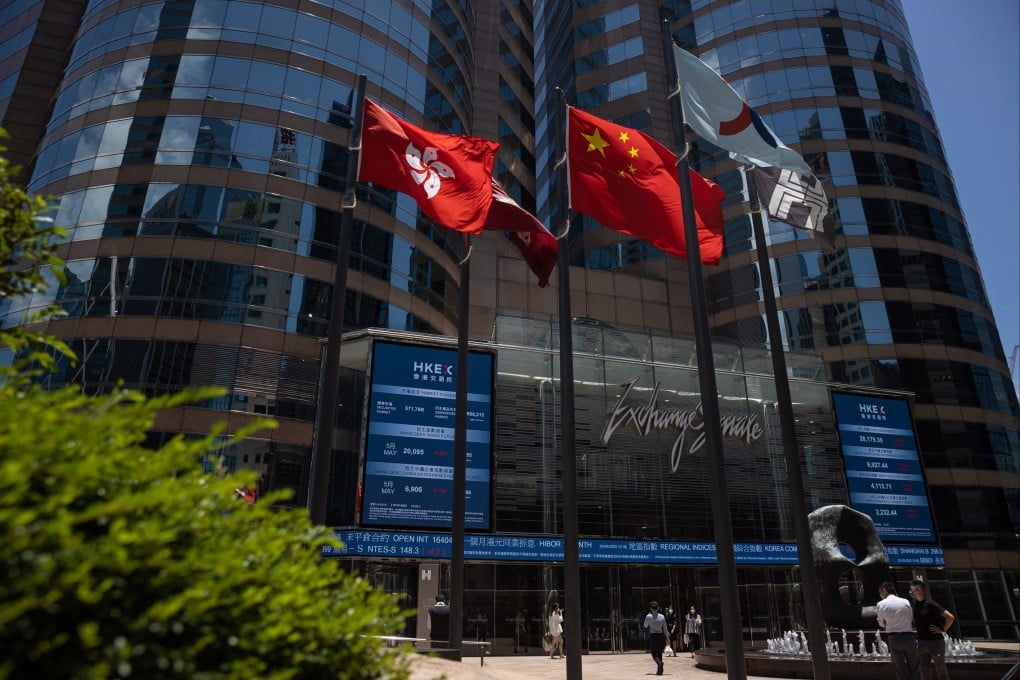

Hong Kong stocks retreat as China counts economic pain amid stimulus calls while Alibaba slips before earnings

- Premier Li Keqiang said the Chinese economy in some aspects is in worse shape than when the pandemic first hit the nation in 2020

- Alibaba weakened before reporting its latest quarterly results as the tech sector failed to sustain a rebound from Wednesday

The Hang Seng Index dropped 0.3 per cent to 20,116.20 at the close of Thursday trading. The Tech Index lost 0.2 per cent while the Shanghai Composite Index added 0.5 per cent. Benchmarks in South Korea, Japan and Australia fell by 0.2 to 0.7 per cent.

“The government is clearly panicking and has been stepping up policy easing [measures] with increasing urgency,” Xiaocen Wang, an analyst at Alpine Macro wrote in a report on May 26. “Their efficacy and impact are constrained by the rolling lockdowns that have paralysed activity.”

Economic indicators have deteriorated significantly, Beijing officials said on Wednesday, and “the current situations in some areas to a certain extent are worse than when the pandemic hit the nation in 2020,” Li said in a speech during a multi-agency teleconference on Wednesday.