China-focused funds reload Alibaba, JD.com stocks to defy ‘uninvestable’ tag as Goldman’s worst-is-over view gains traction

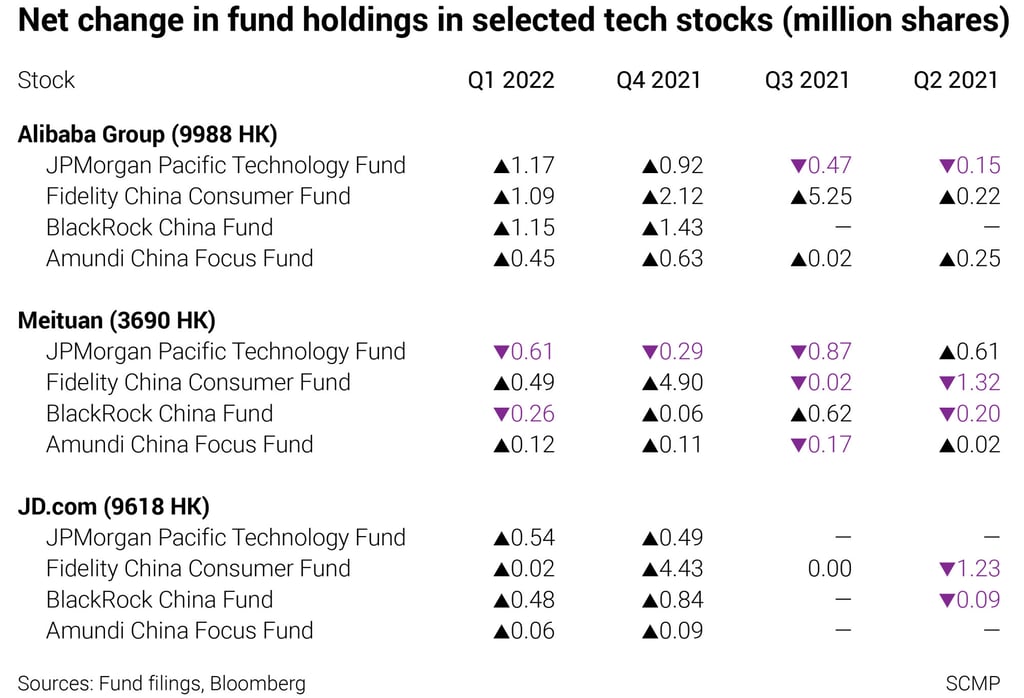

- Funds managed by Fidelity, Amundi and BlackRock have been picking up Chinese tech stocks before and during the March storm

- Stock selection is a dominant driver for performance for the rest of the year and performance is likely to be earnings-led, Fidelity says

Funds run by the world’s biggest money managers including BlackRock, Amundi SA, JPMorgan and Fidelity have profited by picking up tech stocks in Hong Kong during the March storm and riding the rebound from there, according to fund data. Goldman Sachs said the March low likely marked the market bottom, given historical precedents.

The Hang Seng Tech Index has risen 34 per cent from a multi-year low on March 15, adding back US$397 billion of market value and helping these funds trim their year-to-date losses. Investors should be looking at the brighter side ahead, according to Citigroup, which turned overweight on Chinese stocks on June 10.

“Much regulatory risk has already crystallised” with the digital economy being endorsed by policymakers, Pierre Lau, the US bank’s China equity strategist in Hong Kong, said on June 17. “Markets seem to be able to forecast their earnings, we have high predictability and a better idea of their intrinsic value.”

Fidelity’s US$4.3 billion China Consumer Fund added 1 million Alibaba shares in the first quarter, adding to purchases in the preceding three quarters. Managed by Hyomi Jie, the fund made Alibaba the second-largest bet with 7.6 per cent of net assets, according to its May 31 fund fact sheet.