Alibaba Health, JD Health pull Chinese healthcare stocks lower amid fears of a crackdown on online pharma platforms

- Alibaba Health fell by 13.8 per cent for its worst decline in 11 months, while JD Health slumped 14.8 per cent

- Mainland Chinese media reported that Beijing is mulling a ban on sales of medicines on third-party e-commerce platforms

Chinese healthcare-related stocks tumbled in Hong Kong on speculation authorities are turning to online pharmaceutical platforms as the next focus of regulatory crackdown, erasing HK$40 billion (US$5 billion) of market value on Wednesday.

Alibaba Health Information sank 13.8 per cent to HK$4.79 at the close of Wednesday trading, the most in 11 months, while JD Health tumbled 14.8 per cent to HK$53.40, its worst drop in two months. A healthcare sub-gauge within the Hang Seng Composite Index retreated 3.1 per cent, the most in nearly two weeks, as 62 of its 75 members slid.

China is mulling a ban on third-party platforms from selling medicines online, the 21st Century Business Herald reported on Tuesday, citing people it did not identify. Regulators might clarify the boundaries between self-operated and third-party platforms when engaging in online drug sales, the mainland media reported.

The media report has sparked worries in the market, reviving concerns that regulations could be implemented, said Sunny Chen, analyst at UOB Kay Hian. The sell-off, however, could be one-off, she added.

The report fanned jitters in a market, just when fund managers are beginning to believe that Beijing is stepping away from tightening the regulatory noose on the tech sector after a trillion-dollar market rout.

Months of clampdown last year on internet platform operators crippled for-profit private tutoring firms overnight, forcing some to switch to live-streaming shopping, among others.

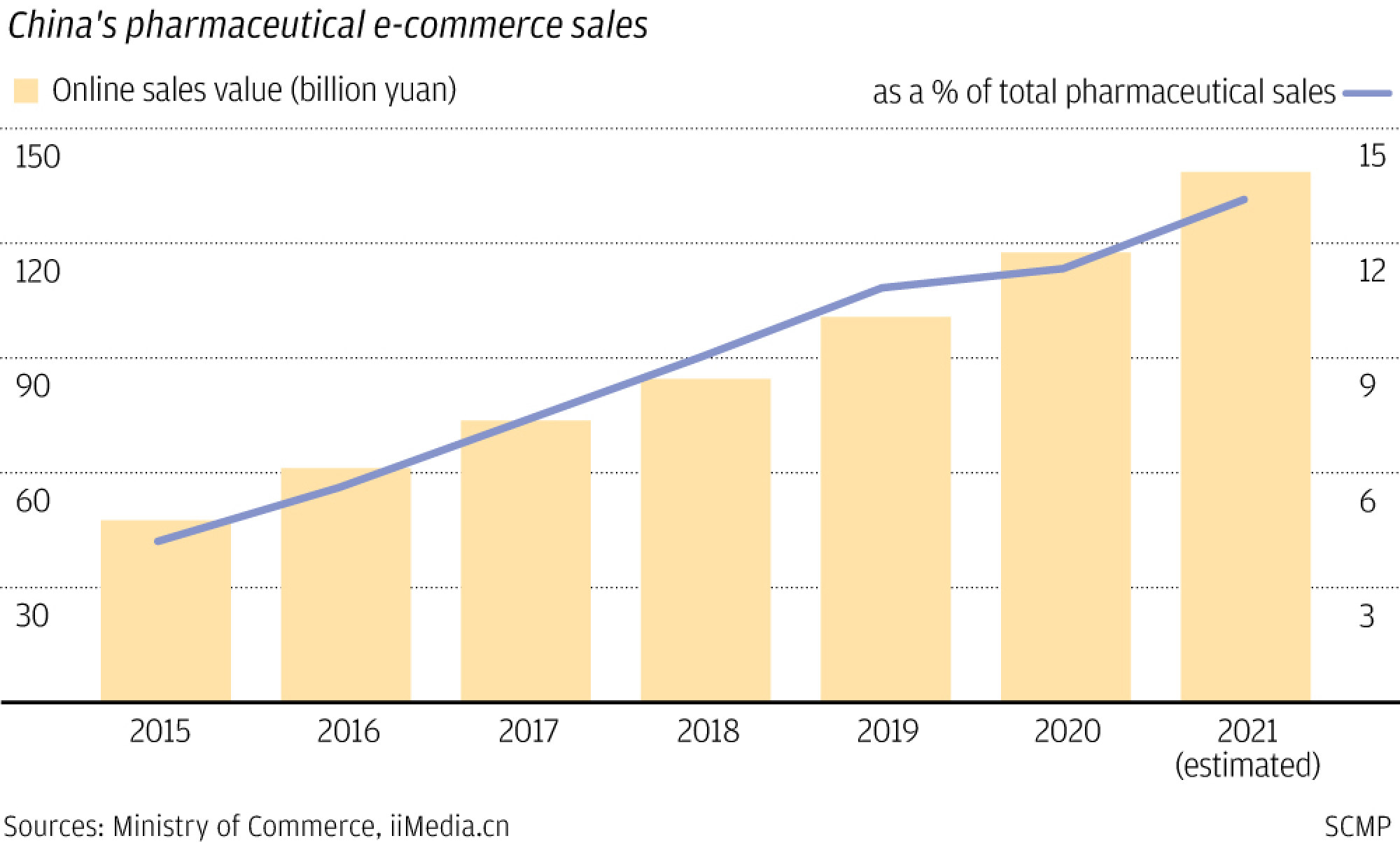

China’s pharmaceutical e-commerce sales were forecast to grow to around 177 billion yuan (US$26.3 billion) by 2028 and account for almost a third of total pharmaceutical retail sales, up from 2 per cent in 2018, according to a report by Deloitte.