CNOOC, Chinese banks power Hong Kong stock rebound before earnings season as confidence recovers

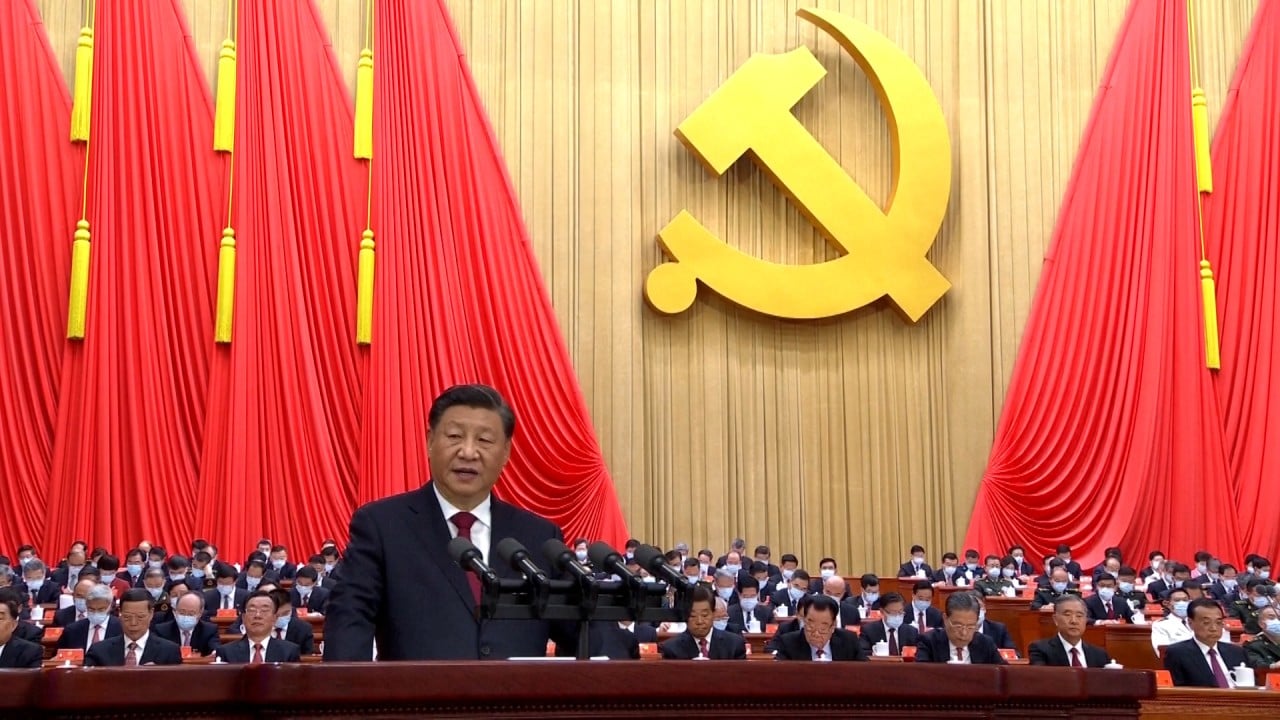

- Xi Jinping opened the Communist Party’s congress on Sunday touting its zero-Covid policy and warned of ‘dangerous storms’ amid challenges from the US

- CNOOC advanced after saying earnings for the nine months to September likely doubled on the back of higher oil prices

The Hang Seng Index rose 0.2 per cent to 16,612.90 at the closing of Monday trading, after sliding as much as 1.7 per cent. The Tech index retreated 0.2 per cent, trimming a more than 3 per cent slump. The Shanghai composite index advanced 0.4 per cent to overturn a 0.6 per cent setback.

Market confidence is now “neutral to contrarianly positive” with a better monetary environment, Hong Hao, market strategist and chief economist at Grow Investment Group, said in a research note on Sunday.

The Chinese leader placed a “similar level of emphasis on growth and somewhat less on market and reform,” versus his speech five years ago, Goldman economists said in a report. “Will there be a material shift towards more growth-oriented policies following the Congress? We are likely to have to wait longer for clarity.”

Alibaba Group weakened 0.1 per cent to HK$73.20, Tencent lost 0.8 per cent to HK$247.20, while JD.com tumbled 1.7 per cent to HK$171.90. Electric-car makers fell, with Xpeng and Nio and Li Auto sliding about 4 per cent to 5.1 per cent. Top apparel maker Li Ning crashed 4.3 per cent to HK$55.55. All narrowed their declines.

The Hang Seng Index slipped 6.5 per cent last week in the market’s biggest setback since mid-July. The index has tumbled about 28 per cent this year through last week, erasing HK$6.3 trillion (US$802.5 billion) of market capitalisation.

Elsewhere, China’s central bank kept the interest rate unchanged at 2.75 per cent on 500 billion yuan (US$69.55 billion) worth of one-year medium-term lending facility (MLF) loans to simulate the faltering economy, today’s operations showed.

A government report later this week may add to worries about China’s economic slowdown. The nation’s exports probably grew 4 per cent in September, slowing from a 7.1 per cent pace in August, according to consensus among economists tracked by Bloomberg.

Rego Interactive, a marketing service provider, surged 103 per cent to HK$1.30 per share on its first trading day in Hong Kong. Benchmarks in Japan and Australia both slipped more than 1 per cent, while the Kospi index in South Korea added 0.3 per cent.