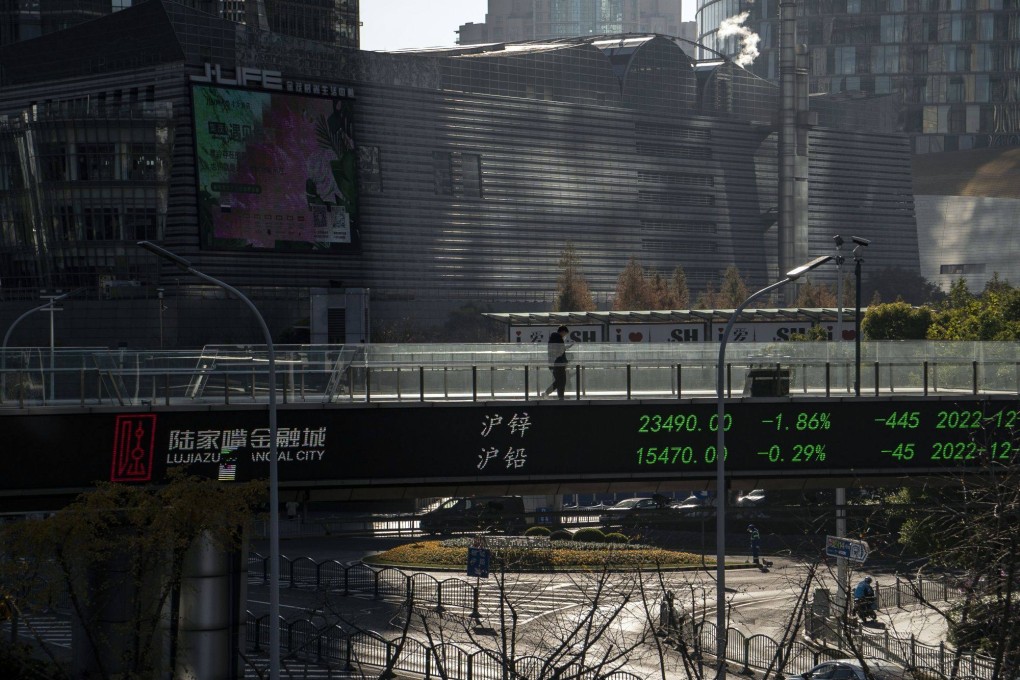

China stocks rise as top brokerages Citic, CSC and Everbright predict swift economic recovery from Covid impact

- With markets in Hong Kong and Japan closed for the Christmas break, China’s onshore stocks led gains in Asia

- Crowds thronged malls, restaurants and cinemas in Beijing over the weekend to celebrate Christmas as many people have recovered from Covid-19, reports said

Chinese stocks rose as bullish calls by major brokerages bolstered expectations that the impact of surging infections on the economy would be short-lived. Onshore stocks led gains in Asia where most markets were closed for the Christmas break.

The Shanghai Composite Index closed 0.7 per cent higher at 3,065.56, rebounding from a weekly loss. The CSI 300 Index added 0.4 per cent, while the tech-dominated Shenzhen Component Index advanced 1.2 per cent.

While Asian markets such as Hong Kong and Japan were closed, those open on Monday were mixed. South Korea’s Kospi rose 0.1 per cent and Taiwan’s Taiex index lost 0.1 per cent.

Citic Securities, the nation’s biggest publicly traded brokerage, CSC Financial and Everbright Securities, all issued reports saying that 2023 would be brighter for Chinese stocks, citing economic recovery, attractive valuations and an uptick in risk appetite.

The calls are likely to reinforce expectations among investors that the damage from recent surge in Covid cases, which are ravaging megacities from Beijing to Shanghai, will be largely one-off.

Some of the people who have recovered from Covid-19 returned to major shopping malls in Beijing to celebrate Christmas over the weekend, queuing outside restaurants and cinemas, according to local media.

“In the short term, the market may still remain volatile,” said Liao Jingchi, an analyst at Guotai Junan Securities. “But in the long run, the current level offers a good buying opportunity and investors can buy into financial and consumer names that are set to benefit from the economic recovery.”