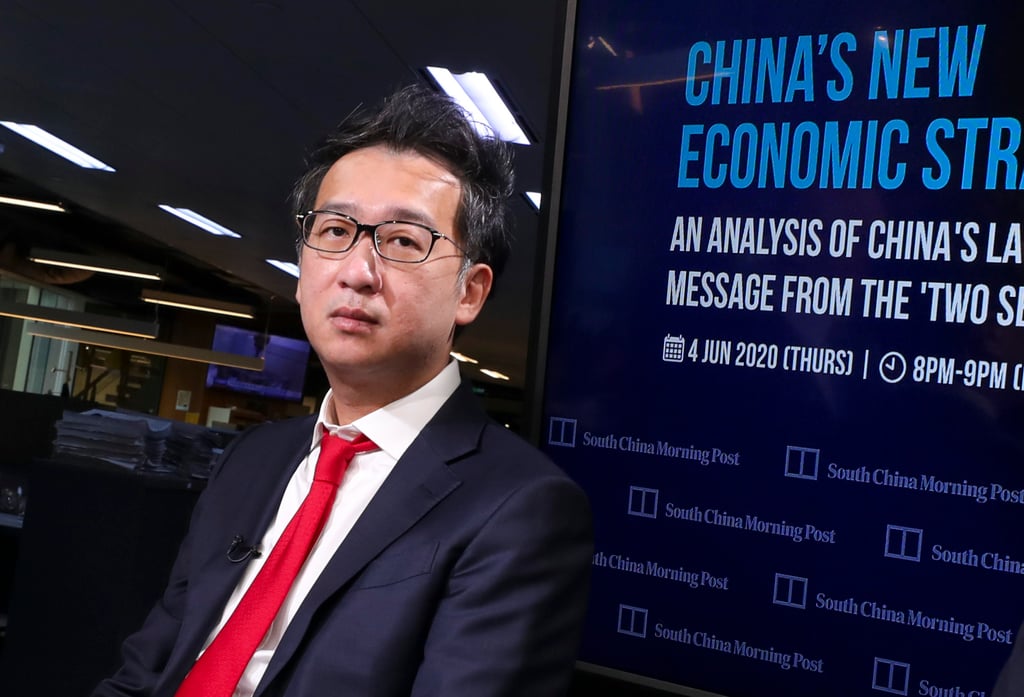

Hong Hao, the Chinese analyst who correctly called the reopening trade, now says stock gains have more room to run

- The chief economist at Grow Investment Group recommended buying Chinese stocks at the end of October just before a 54 per cent surge in the Hang Seng Index

- Hong sees Chinese stocks climbing in the event of a soft landing for the US economy or even if the world’s largest economy slides into a recession

A top strategist who accurately called a market rally before China lifted Covid-19 restrictions has predicted Chinese stocks will resume their upward momentum even with a recession in the US.

The first scenario will take time to materialise, while the second will see stocks decline first before the policy rescue induces a “tearing rally”.

“No matter which scenario eventuates, at today’s vantage point, we need to take a deep breath and hold onto our faith,” said Hong.

Hong recommended buying Chinese stocks at the end of October just before a 54 per cent run-up in the Hang Seng Index. He also correctly predicted the 2015 market meltdown that wiped off US$5 trillion in value. Hong worked for China International Capital Corp and Bocom International Holdings before joining Grow Investment last year.