Hong Kong stocks slump as China’s rate cuts underwhelm market bulls while Alibaba slips on management reshuffle

- Chinese lenders cut loan prime rates for the first time since August amid deepening struggle in housing market

- Alibaba Group slips from a two-month high; Daniel Zhang Yong to step down as chairman and CEO to oversee cloud-computing unit

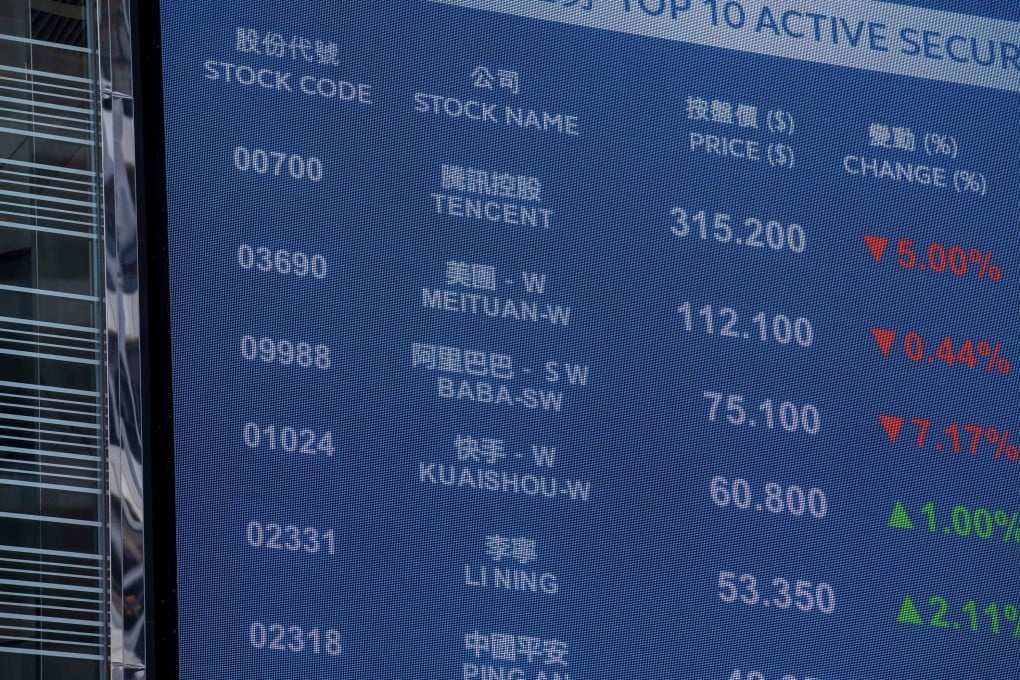

The Hang Seng Index slumped 1.5 per cent to 19,607.08 at the close of Tuesday trading, the most since May 31. The Tech Index sank 2.5 per cent while the Shanghai Composite Index declined 0.5 per cent.

Alibaba Group tumbled 1.5 per cent to HK$88.35, while e-commerce rival JD.com weakened 3 per cent to HK$149.70 and food delivery platform Meituan declined 3.4 per cent to HK$132.30. Developer Country Garden lost 6.8 per cent to HK$1.65, and peer Longfor slumped 5 per cent to HK$19.44.

“Markets should curb their expectations for a fast and cure-all [stimulus] package,” Nomura economists including Ting Lu said in a note on Tuesday. There could be more monetary easing following but they will only have a limited impact, they added.

Consumer sentiment weakened further this month as income growth slowed and confidence among Chinese homebuyers waned, a Bank of America survey showed. Only 35 per cent of the respondents said they plan to spend more over the next six months, versus 43 per cent in its April survey.