Bank of China pips HSBC in arranging Hong Kong bond deals as IPO bankers stare at Sars-era collapse

- Local currency bond offerings jumped 38 per cent in the first half as Bank of China pipped HSBC for the first time since 2015

- IPO bankers struggled at the same time as new stock offerings slumped to a level last seen in 2003 when Sars struck the city

Bank of China (Hong Kong) was credited with roles in 110 deals worth HK$49.4 billion (US$6.3 billion) in the first half of 2023 including self-led deals, according to Bloomberg’s ranking.

Bond bankers at the lender, one of the three currency note-issuers in Hong Kong, helped arrange Hong Kong Mortgage Corp’s HK$800 million issue and China Construction Bank’s HK$900 million certificate of deposits last quarter.

BOCHK’s ranking was boosted by its prolific second-quarter performance, when it surpassed HSBC for the first since the final quarter of 2015, according to Bloomberg data.

“Hong Kong is a major international financial centre with a highly liquid and active bond market, making it very attractive to bond issuers in the Asia-Pacific region and global investors,” BOCHK said in a statement to the Post. It expects the issuance methods for Hong Kong-dollar bonds to become more diverse in the second half.

Excluding self-arranged deals, HSBC topped BOCHK this year as all its business came from such transactions, versus the Chinese lenders’ HK$32.9 billion from 86 deals, according to Bloomberg data. The UK-based lender remained the leading arrangers in both quarters on that basis.

“There was a notable rise in self-led bank issuances in the first half of the year,” said Daniel Kim, Asia-Pacific co-head of debt capital markets at HSBC. “Excluding these, HSBC retains its market leading position and we remain committed to supporting our clients with their Hong Kong dollar financing needs.”

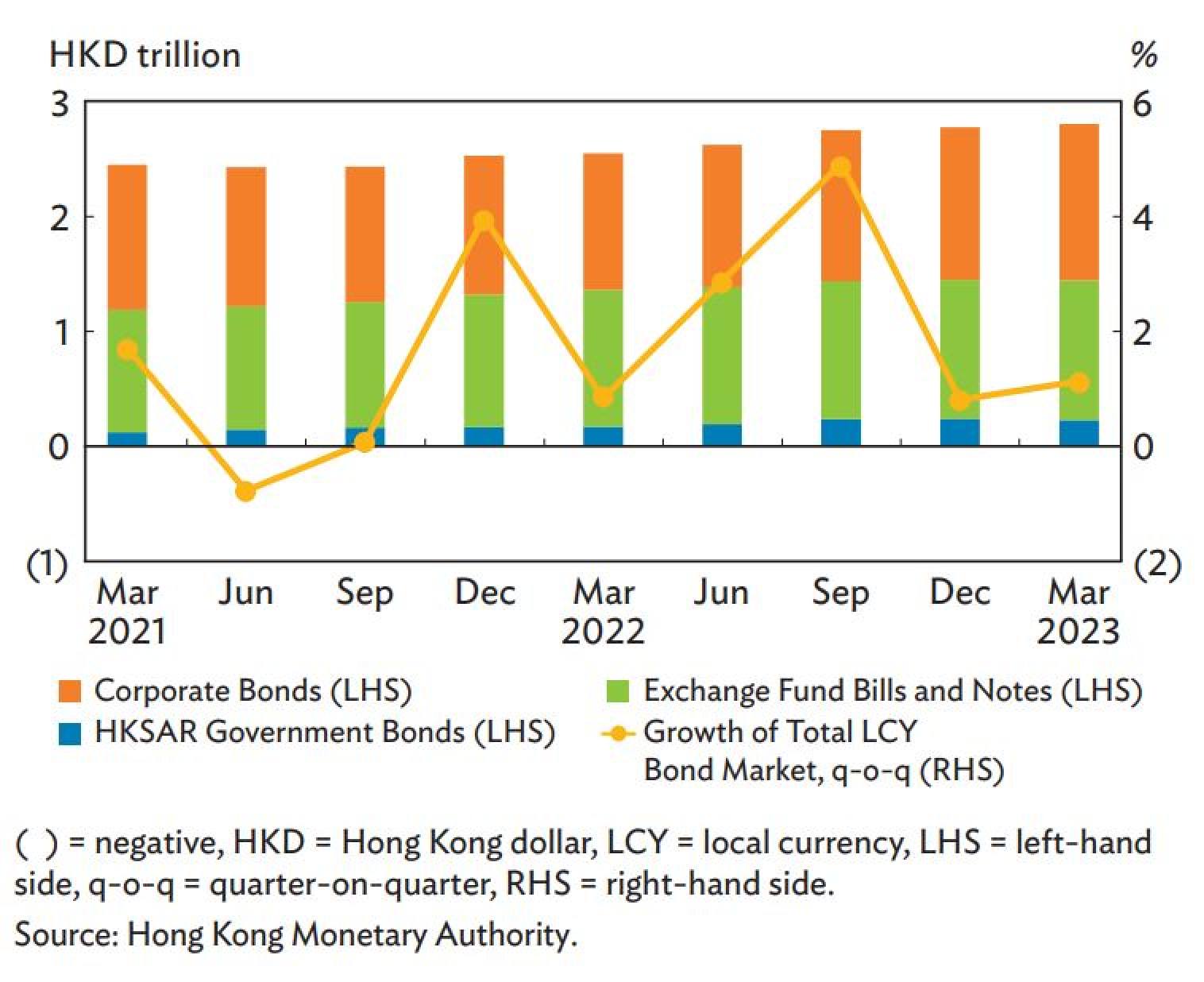

Local-currency bond sales in the city rose 38 per cent to HK$243 billion this year, as companies and government turned to fixed-income investors for more capital. A slump in stock prices, marked by the Hang Seng Index’s 4.2 per cent retreat, sent new offerings crashing to US$2.2 billion, the least since Sars (severe acute respiratory syndrome) struck the city in 2003.

The growth of the local-currency bond market underscores the city government’s push to deepen and enrich the liquidity of the capital market.

Chinese lender Bank of Communications sold HK$2.7 billion of two-year notes in February, the biggest local issue so far, according to Bloomberg data. BOCHK and HSBC helped arrange the deal with 11 others. Standard Chartered’s self-arranged HK$1.9 billion of three-year notes in April was the next largest.

Corporate bonds dominate Hong Kong’s bond market, according to the Asian Development Bank. There were HK$1.4 trillion of such notes outstanding on March 31, or almost half of the market. Exchange Fund bills and notes, the city’s main liquidity management tools, accounted for 43 per cent, while government bonds made up the rest.