Advertisement

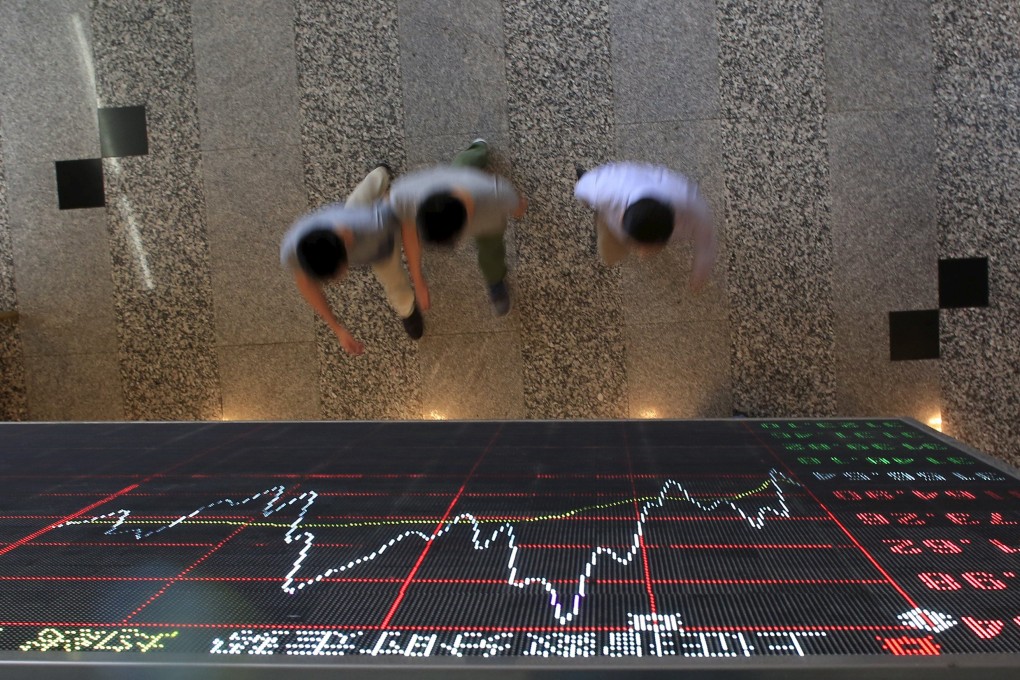

Are Chinese stocks regaining favour? More fund managers predict better returns ahead as economy mends, US-China tensions ease

- Matthews International Capital Management says stocks are more likely to get better in the coming quarters as data, US-China ties improve

- ‘The economy is doing better than it gets credit for,’ fund manager Rothman says. ‘The biggest challenge for the economy now is just confidence.’

Reading Time:3 minutes

Why you can trust SCMP

7

Chinese stocks are more likely to get better in the coming quarters as new data indicated the economy is stabilising while efforts are made to ease geopolitical tensions between Beijing and Washington, a US fund manager said.

Improvements on both fronts, plus attractive valuations against historical yardsticks, are paving the way for better returns in mainland China and Hong Kong markets, said Andy Rothman, a strategist at Matthews International Capital Management, which manages about US$12 billion of assets.

“From the macro perspective, we are at the bottom and probably coming out of that,” he said in an interview. “The economy is doing better than it gets credit for. The biggest challenge for the economy now is just confidence.”

Advertisement

Government reports in the past two weeks showed the slowdown in China’s economic activity is ending. Exports have stabilised while headline inflation accelerated while manufacturing expanded in September. Wall Street banks including Goldman Sachs and Morgan Stanley raised their growth forecasts for China after several rounds of cuts, betting that more policy stimulus this year will strengthen the rebound.

US President Joe Biden signalled on Friday that a one-on-one meeting with his Chinese counterpart Xi Jinping was possible next month, when leaders of the Asia-Pacific Economic Cooperation forum gather in San Francisco. Beijing has yet to confirm whether Xi will attend.

Advertisement

Rothman added to a chorus of bullish views after the MSCI China Index, which tracks 717 Chinese companies listed at home and abroad, suffered a five-week beating to hit an 11-month low. More than US$358 billion has been erased from markets in Hong Kong and mainland China in that losing streak, battering confidence among some of the world’s biggest money managers including BlackRock.

Advertisement

Select Voice

Select Speed

1.00x