State-backed developer China South City warns of default on deadline day for dollar bond restructuring

- State-backed China South City warned of default after struggling to reach requisite consents for bond restructuring proposal

- Stocks slipped 4.7 per cent in Hong Kong, bringing the losses this year to 46 per cent

China South City Holdings said it would not have enough cash to pay interest on its foreign-currency debt this month, as the property developer struggles to win the necessary support from creditors to restructure five bonds totalling US$1.35 billion maturing in 2024.

The state-backed developer said holders of 69.8 per cent of the bonds on aggregate have voted in favour of its proposals to extend the bond maturities and halve their coupon rates, according to a stock exchange filing on Monday. Consent for one of the five bonds has surpassed the 75 per cent threshold, it added, refuting a media report.

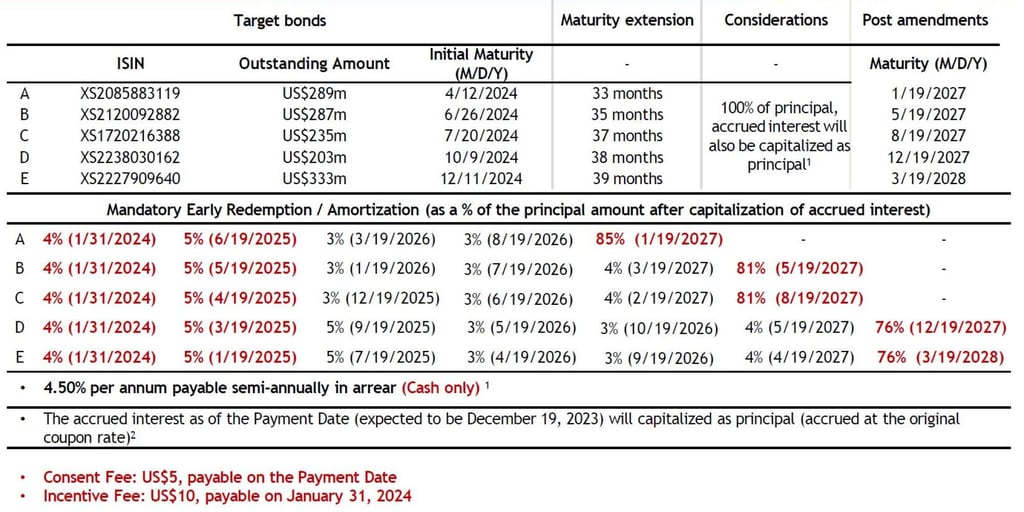

The five dollar bonds each mature in April, June, July, October and December next year. China South City started its consent process on December 4, asking bondholders to extend the maturities by 33 to 39 months, and halve the annual coupon rate to 4.5 per cent, according to its proposals.

“We have not made an interest payment due on November 20 with respect to the July 2024 notes, which would lead to an event of default on December 20 [after the 30-day grace period],” it said in the filing. “As such, if the requisite consents are not received by December 20, it may trigger an event of default under other indebtedness.”

The stock fell tumbled 4.7 per cent to HK$0.30 on Monday, extending the loss this year to 46 per cent. A gauge tracking mainland Chinese developers listed in Hong Kong lost 2.5 per cent.

The warning came before a Monday deadline for creditors to approve its proposals. The developer has extended the closing date twice, the latest to 4pm London time on December 18, while also increasing the incentive fee for bondholders to accept the revised bond terms.

Haitong International and China Citic Bank International are helping the developer as consent solicitation agents.