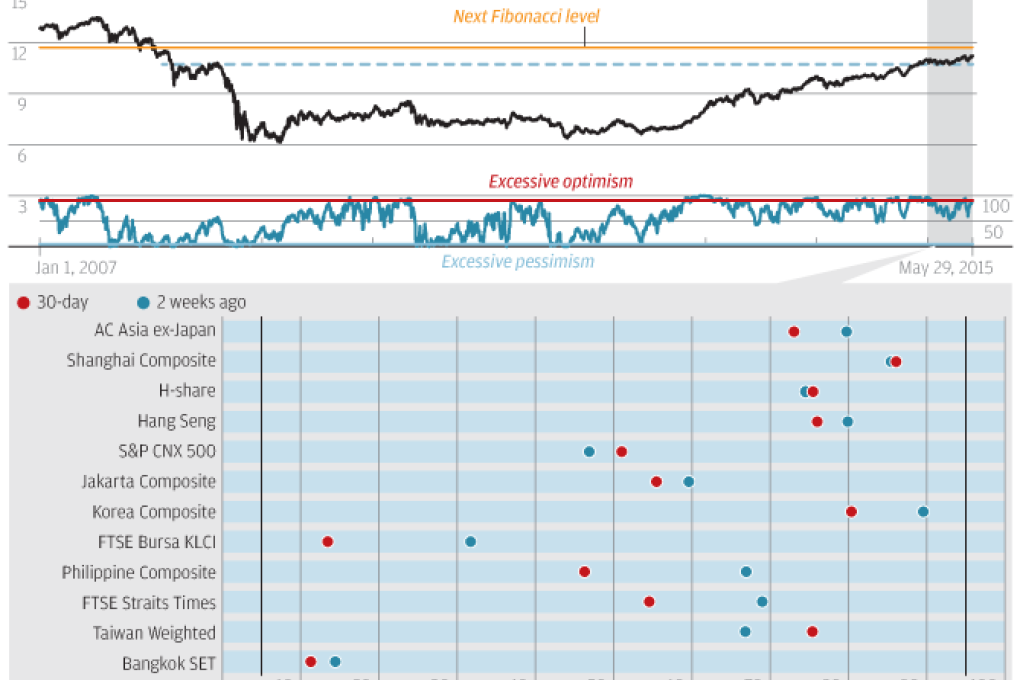

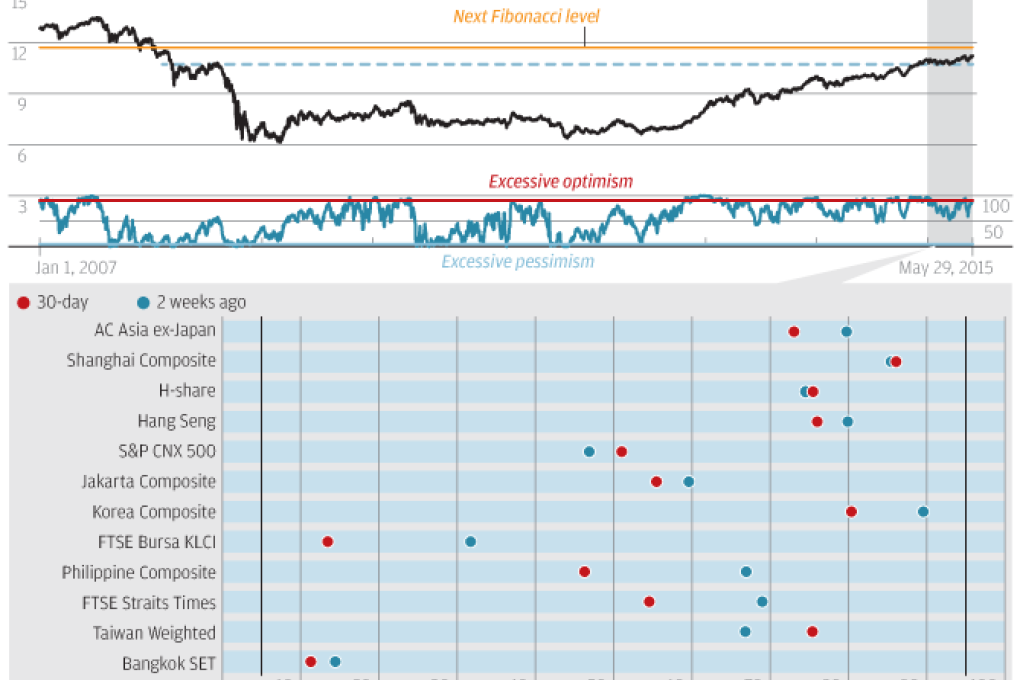

While US dollar strength against the Japanese yen has been centre stage in recent weeks, the breakout in the Korean won-yen pair through key resistance around 11 has marked a step forward in a cross rate that had become entrenched in a rangebound condition. The proprietary sentiment barometer indicator is running at high, but not overstretched, optimism levels on won-yen, suggesting further upside potential before contrarian reversal risk emerges. A move above recent highs around 11.20 would clear the way of technical resistance to the 11.50-11.70 area (a 3 to 5 per cent upside) in the medium term. A move to 11.70 is the next longer-term Fibonacci level.