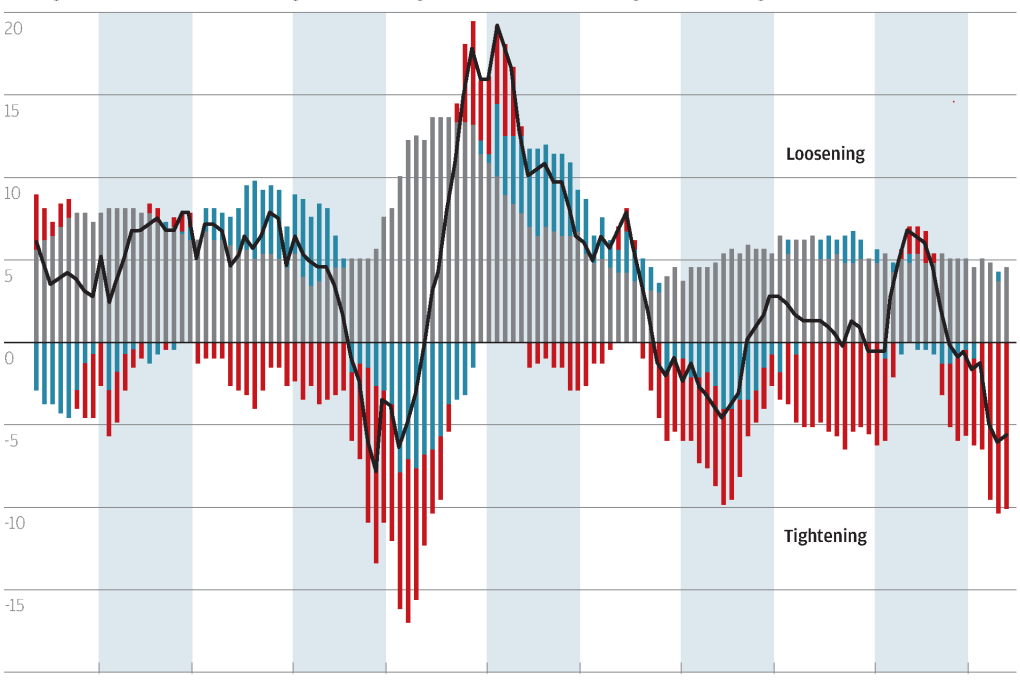

The clamour for monetary easing on the mainland has intensified in the wake of last week's stock market falls in Shanghai and Shenzhen. The latest HSBC China Monetary Conditions Indicator shows a marginal improvement in absolute terms compared with April, aided by a slight weakening of the real effective exchange rate and an improvement in the growth of money supply. "This is the first sign that monetary conditions may be bottoming out," HSBC economists write in a note to clients. But "more policy easing will still be needed to sustain the improvement". HSBC is calling for reserve requirement cuts of 250 basis points and interest rate cuts of 50 basis points for the rest of this year.