More currency reform expected from Beijing, 10 years after yuan peg removed

Bankers and traders expect Beijing will carry out more currency reforms to boost the international status of the yuan and further liberalise capital controls, 10 years after its landmark move to break the mainland currency’s peg to the US dollar.

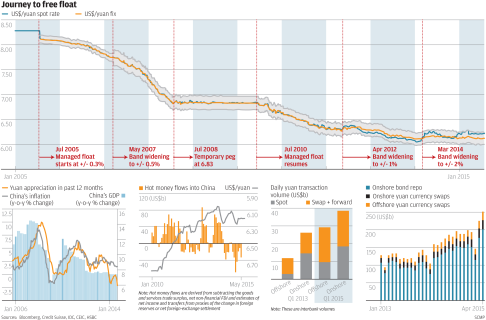

“After 10 years of ‘managed float’ for the onshore yuan, the journey to free float has only just begun,” Credit Suisse senior currency strategist Heng Koon-how said.

On July 21, 2005, the People’s Bank of China freed the yuan from its 8.28 peg to the US dollar and allowed the currency to appreciate by 2.1 per cent.

The daily fixing should cease tracking the USD, be more transparent, market-determined, and less influenced by the People’s Bank of China

The removal of the peg did not see the yuan become a free float currency, instead entering into what Heng describes as a ‘managed float’ against the US dollar. The People’s Bank of China announces a mid-price for the yuan at 9.15am each trading day, with traders able to trade up or down in a set band. The range was originally set at 0.3 per cent either side of the mid-price, before being widened to 0.5 per cent in May 2007, 1 per cent in April 2012 and 2 per cent in March last year.

In the past 10 years the yuan has appreciated 25 per cent from 8.28 to 6.20 to the US dollar, a level Heng said it was likely to maintain in the near term.

“The International Monetary Fund (IMF) has now finally suggested that the onshore yuan may be near its neutral valuation,” he said. “However, the US Treasury continues to reiterate its long running view that the onshore yuan needs to appreciate further.”