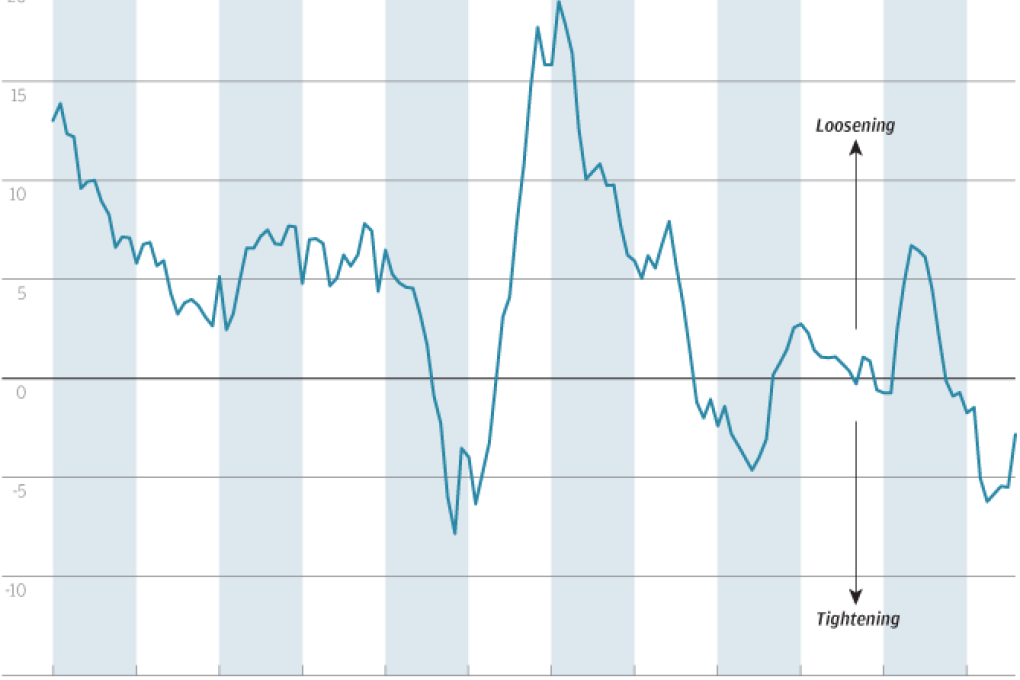

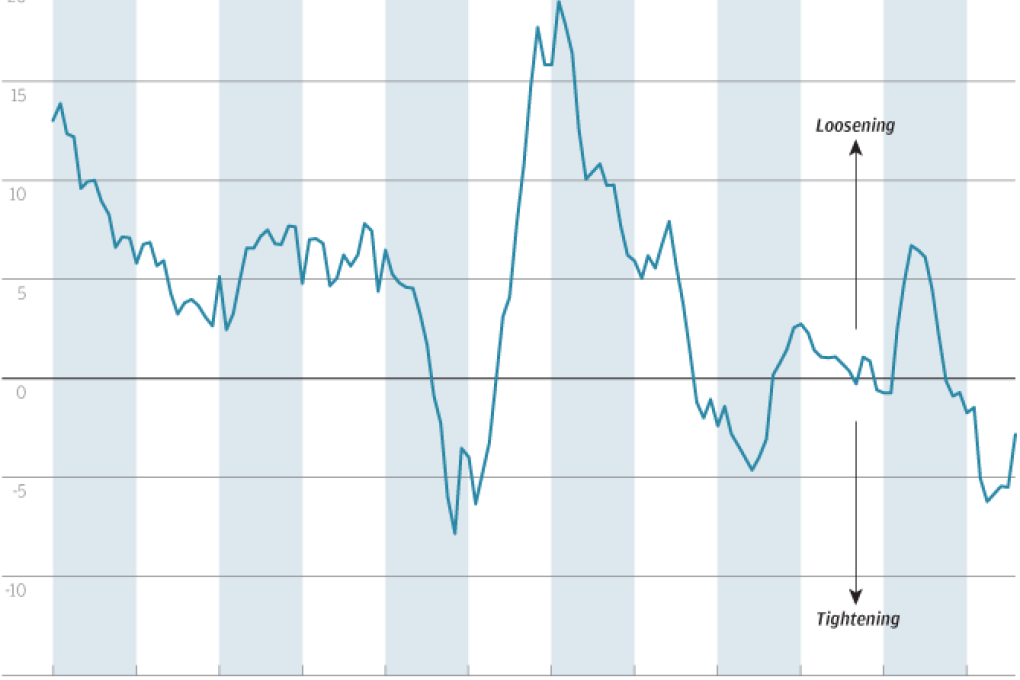

The conflicting signals in China mean growth remains a puzzle, and those watching the country's capital markets wonder why policymakers have been slow in action. As the chart from HSBC shows, monetary conditions in China have been tight throughout the year and arguably still are. Multiple factors are at play in this delayed policy response, but the perceived need to contain the leverage ratio is an important one. In its latest quarterly report on Asian equities, the bank says uncertainty over China's growth will linger for some time to come. Any monetary impulse will take some quarters to work its way through the country's economic system. Given the absence of clear signs of a recovery or stability in growth, HSBC says Chinese equities are unlikely to rally in the near term and volatility is expected to remain high.