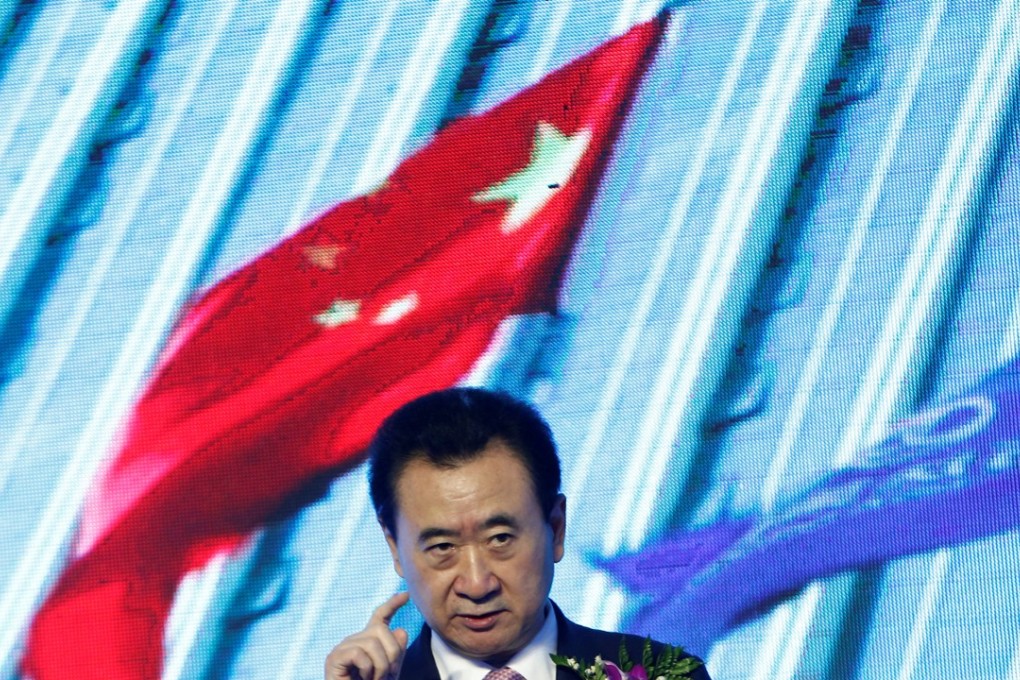

Exclusive | China relaxes leash on Wanda, allowing its unit to issue offshore bond to raise capital

Wanda Group, controlled by billionaire Wang Jianlin, has been granted permission to proceed with an offshore bond issue in Hong Kong, suggesting a thaw in its relations with mainland authorities

China’s government may be showing the first sign of relaxing its tight grip on fundraising by the Wanda Group, five months after putting billionaire Wang Jianlin and his sprawling conglomerate under the regulatory spotlight for its aggressive asset buying spree.

Dalian Wanda Group received a written approval on November 7 to issue an offshore bond by the National Development and Reform Commission (NDRC), the state agency that coordinates industrial policies and oversees debt issues, according to banking sources familiar with the matter. Bloomberg reported on Wednesday that the NDRC had given its approval, citing unidentified people familiar with the matter.

The approval is a relief for Wang, who had to dispose of his portfolio of 77 hotels and 13 theme parks to two rival developers in July at a knockdown price of US$9.3 billion, in the biggest property deal in China’s modern corporate history. The sale came after China’s bank regulator instructed the country’s biggest lenders to put Wanda and other asset buyers including the Anbang Group, the Fosun Group and the HNA Group under scrutiny for their loans exposure.

“Since restrictions were imposed, Wang had taken firm action to deleverage his holdings,” said Brock Silvers, founder and managing director of Kaiyuan Capital, a Shanghai-based investment advisory firm. “An increase in China’s foreign exchange reserves has assuaged concerns regarding currency outflows.”

Wanda rebuffs rumours its chairman Wang Jianlin had been barred from leaving China

Wanda hadn’t been able to raise any offshore funds since June 2016, when its sports subsidiary – Wanda’s sports assets include ownership of the Ironman world triathlon franchise, a Swiss sports marketing company and the Spanish football club Atletico Madrid – Wanda Sports Finance raised US$210 million in a bond sale.

Dalian Wanda Commercial’s credit rating was lowered in late September by Moody’s Investors Service and Standard & Poor’s, citing uncertainties about the group’s business outlook and access to funding. That would trigger mandatory early repayment of nearly US$1 billion of overseas loans by mid-October, Bloomberg reported earlier, citing unnamed sources.