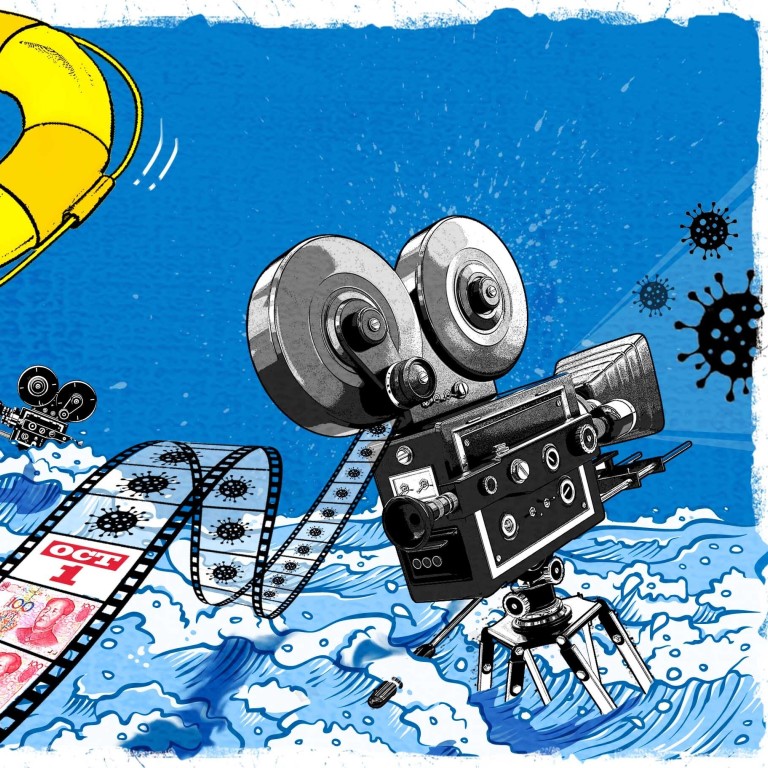

China trots out The Eight Hundred, other patriotism fare to rescue Asia’s largest movie box office as Covid-19 lockdown ends

- ‘The Eight Hundred’ leads box-office takings in an industry interrupted by months of cinema closures due to Covid-19 lockdown

- Film studios look to the Golden Week holiday for respite as China’s movie industry heads for worst year since 2011 in box-office receipts

“It deserves to be the first film I watch in the cinema this year,” said Huang, 27, who took the trouble to go to an unfamiliar theatre in Beijing with wide IMAX screens after work, where she also had her temperature checked and her health code scanned before she was allowed into the screening hall. “The visual effects were great, and there were war scenes that can only be enjoyed on a silver screen in an immersive way.”

The Eight Hundred, pulled from local cinemas at the last minute a year ago and held from distribution without a public explanation, generated 134 million yuan (US$20 million) on its first public screening on August 21. In all, it has raked in 1.5 billion yuan at the box office through Friday, or one-third of the industry.

The takings are a promising sign for China’s US$9 billion movie industry hoping for a reprieve as cinemas reopened in late July after six months of nationwide shutdown. China’s box office of 4.5 billion yuan so far this year could be headed for its worst year since 2011, one analyst estimates, after notching an all-time high of 64.3 billion yuan in 2019.

The upcoming eight-day Golden Week holidays from October 1, in conjunction with China’s National Day, could not have been a better time for movie studios to make up for lost ground. Many potential big-hitters are being lined up for screenings, after the pandemic interrupted their Lunar New Year debuts in February.

“The Eight Hundred achieving such a great result, despite all the restrictions, is beyond our expectations,” said Steven Xiang Shaokun, chief executive of Hong Kong-based film producer Huanxi Media Group, in an interview with the South China Morning Post. “We now have high hopes for the Golden Week. We hope the market can match or even surpass the level achieved last year.”

Investors are already betting on a good outcome. The CSI Media Index, which tracks 50 stocks in the filmmaking and movie distribution industry on Shanghai and Shenzhen exchanges, has risen 18 per cent from this year’s low in April, outpacing the 15 per cent gain in the broader CSI 300 Index.

Huayi Brothers, the main producer of The Eight Hundred, has appreciated 38 per cent so far this year in Shenzhen, while the nation’s largest movie-ticketing company Maoyan Entertainment has risen 9 per cent. Others like Huanxi Media and Alibaba Pictures, are having a mixed year. Their stocks are still trading around the levels at the start of the year.

“Given the virus has been brought under control and the cinema business is reviving, film-related stocks are likely to outperform going forward,” Yang Chunhu, investment director at Guangzhou Jingzhuan Duoying Investment Consulting. “They are a good buying opportunity.”

The Golden Week will feature Leap and My People My Homeland, which count Huanxi Media as an investor. They are two of the seven films to be released during the Golden Week, both playing to patriotic themes.

Leap, postponed from Lunar New Year screening, is based on the true story of China’s world-beating women’s national volleyball team starring Gong Li. My People My Homeland celebrates its “comprehensively well-off society,” of China’s goal of eradicating poverty in 2020.

Beijing Enlight Media, whose animation Nezha was the top-grossing film in China last year with 5 billion yuan, may have another potential winner in the Legend of Deification or Jiang Ziya in Chinese, an ancient mythology about a Taoist noble who overthrew a tyrant king of the Shang dynasty (1600–1046BC).

To reduce the risk of potential infections, cinema operators are only allowed to fill no more than half of the seating capacity in any screening, according to state directives. In some regions, the limit is 30 per cent. It is unclear how long the caps will remain.

Despite the social distancing steps, China’s box office income over the past weekend has exceeded 400 million yuan. That amounted to an encouraging 75 per cent of the collections in the same period last year, according to Alibaba Pictures.

“The film industry is past its worst time,” said Tan Jianfeng, a Shenzhen-based money manager at First Seafront Fund Management, whose fund is invested in film stocks. “We expect the sector’s stock performance to recover along with the companies’ fundamentals.”

“If we continue on this path of recovery, with [all the films in] the pipeline, I don’t see any issue with us getting back to normal before the end of this year, in terms of our weekly average box office, compared to 2019,” said Edwin Tan, chief executive in Shanghai at IMAX China.

China’s box office revenue could reach at least 14.5 billion yuan this year in a worst-case scenario, the least since 2011, according to Zhang Heng, chief media analyst in Shanghai at Guosen Securities. The takings could hit as much as 71.6 billion yuan in 2021 in a bullish scenario, he added.

“We are likely to see a turning point for cinemas’ earnings in the first quarter of 2021,” Zhang said.

How fast China’s film market can recover from the coronavirus is not only a concern for more than two dozen listed Chinese film studios and an estimated one million people employed in the industry. The industry’s well-being also impacts a big chunk of Hollywood income.

American film studios have grown increasingly reliant on the China market as it boomed over the past decade. Before the Covid-19 outbreak, the nation’s film industry was forecast to outgrow the US in box-office takings from 2020.

Marvel Studios’ Avengers: Endgame, the highest-grossing film of all time, earned about a quarter of its US$2.8 billion global box office income from China, according to Box Office Mojo.

It is no surprise, then, that as soon as China allowed cinemas to reopen, Warner Bros has rushed to secure a September 4 release for Tenet. Disney’s live-action Mulan – delayed four times from its original release – is also set to run in mainland cinemas soon.

01:10

Disney's live-action ‘Mulan’ will only hit screens in 2020

The industry has also courted controversies of its own, and is keen to clean up its act. China’s crackdown on tax evasion among entertainers and filmmakers led to 11.7 billion yuan of penalties in the form of back taxes in 2018. That is almost a fifth of the year’s box office income.

The Covid-19 comes as yet another challenge for the industry in a market that appears to be losing its audience to online viewers, as growth slows amid the proliferation of internet streaming sites.

Film studios, on the other hand, have adopted various innovative strategies to survive the trying times.

Alibaba Pictures, for example, ditched the traditional way of promoting films through roadshow releases in major cities. Working with influencer Li Jiaqi, the company sold 260,000 movie tickets in 6.5 seconds in a live-streaming event earlier this month.

04:33

Why live streaming is becoming China’s most-profitable form of electronic media

“After the pandemic, live streaming has become a standard medium” for film promotion and distribution, said Li Jie, chief executive of Alibaba Pictures, in an emailed statement. The company is a main investor and producer of business drama Coffee or Tea? to be released on October 1.

Alibaba Pictures is a unit of e-commerce behemoth Alibaba Group Holding, the owner of the South China Morning Post.

Huanxi Media is setting its sight on online movie streaming. The studio streamed a comedy Lost in Russia for free on its platform huanxi.com during the Lunar New Year as many mainland cities went into lockdowns, making it the first blockbuster to be released entirely online. It also collaborated with ByteDance to stream the film on mobile apps including Douyin, the domestic version of TikTok.

Huanxi’s platform took more than a year to grow its paid subscribers to one million through February, and only three months to double the number, according to Xiang. “We hope our online streaming business will be able to make a meaningful contribution to our revenue in the near future.”

07:11

Coronavirus: March 2020, the month Covid-19 changed the world

“The coming National Day holiday will be an important period to demonstrate the cinema experience remains a unique valuable offering to China’s film-going audience at large,” said Rance Pow, chief executive of cinema industry consulting firm Artisan Gateway.

No matter how filmmakers innovate, one thing they agree is that the industry needs to spend more energy on crafting high-quality content to stay competitive.

The pandemic has popped an investment bubble in the industry, as investors became more rational and cool-headed about their decisions, according to Li of Alibaba Pictures. This made the survivors in the film industry realise that only good content can continue to attract funding, he said.

In the past, any movie in the action or comedy genre with A-listers could easily reap box office success in China, he said. But this recipe no longer worked over the past few years. The supply of films has not caught up with the rise in demand for high quality movies in recent years, he added.

On top of recent winners like Wolf Warrior 2 and Nezha, viewers have also rewarded films in the sci-fi genre, such as The Wandering Earth, or movies about social issues such as Dying to Survive, a black comedy about a leukaemia patient who smuggled generic cancer medicine to China from India.

“The talent and creativity in the whole industry have reached a point where the audience requires higher quality blockbusters, and they can produce,” said Tan of IMAX China, which is stepping up collaboration with more Chinese filmmakers to replicate The Eight Hundred’s cinematography success.

Wang Jianlin-controlled Wanda Film flags first-half loss of up to US$228 million as coronavirus pandemic keeps cinemas shut

On current screening pace, The Eight Hundred could close the year as one of the best films in terms of box-office receipts.

At the very least, it’s a lifesaver for the industry that is likely to have lost 30 billion yuan in lost box-office receipts because of the pandemic, according to an estimate by the National Film Administration. For Wanda Films, China’s biggest chain with 656 cinemas in 230 mainland cities, it was a 1.6 billion yuan hole in the first half this year.

Thus, a successful Golden Week screening this season is all the more crucial to boost confidence and generate some much-needed cash flows. The holiday season has in recent years accounted for 3 to 7 per cent of annual box-office receipts, according to Pow of Artisan Gateway. This year, its share could reach 10 per cent, he added.

“Hopefully, seating restrictions in cinemas will be relaxed, and with the eight-day holiday, the market could surpass that of last year,” said Xiang of Huanxi Media. “I hope our films will all become box-office hits.”