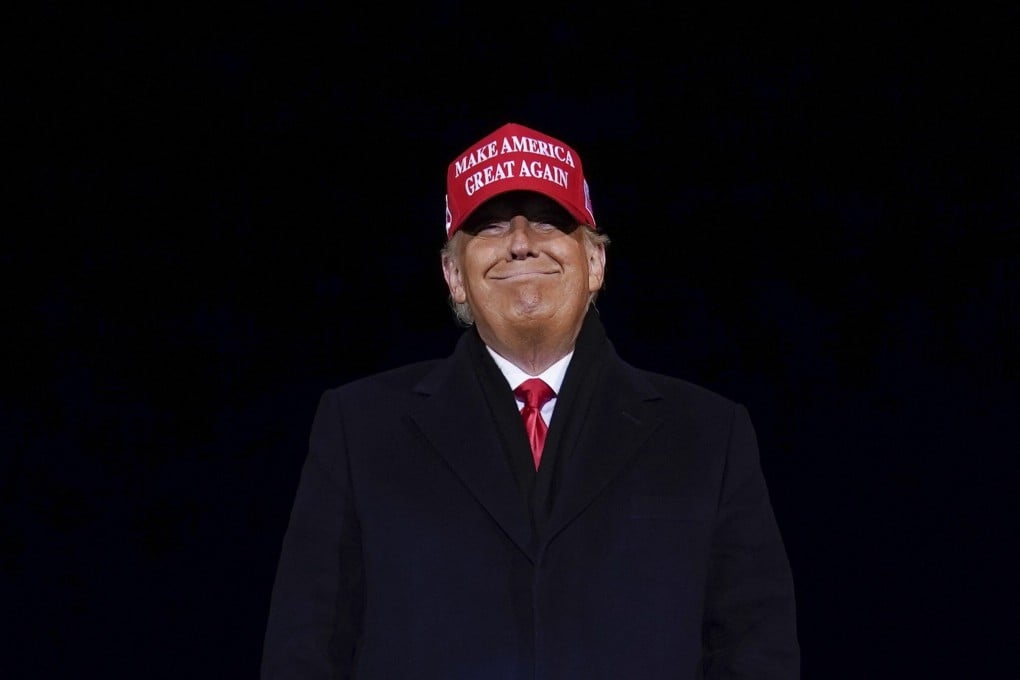

Donald Trump, in the lame duck phase of his presidency, has power to roil global markets with his final 10 weeks in office

- After President-elect Joe Biden’s win is certified, Trump will enter the so-called lame duck phase of his presidency with a formidable capacity for disruption, where any number of executive decisions might leave investors on tenterhooks

- Disputes with China spanning commerce, technology and human rights, the trade spat with Europe, and the upcoming deadline on US government funding in December all offer the potential for market-moving action

Disputes with China spanning commerce, technology and human rights, the trade spat with Europe, and the upcoming deadline on US government funding in December all offer the potential for market-moving action. The current Congress remains in place through the end of the year. Earlier this week, Secretary of State Michael Pompeo said the Trump administration is “not finished yet” with getting tough on China.

“An aggrieved and outgoing President Trump may not be in a very cooperative mood, resulting in a shutdown standoff that could bruise an already ailing US economy burdened with an ongoing pandemic,” wrote Gabrielle Debinski of GZERO Media, a subsidiary of the Eurasia Group political risk consultancy. “The upcoming lame-duck session could be more tumultuous than ever.”

Investors only have to go back to October to see how a barrage of unilateral presidential action can shake markets. US stocks slid and Treasuries surged after Trump tweeted that he had decided to halt stimulus talks.

Pricing in futures markets – where January contracts on the CBOE Volatility Index are trading above both December and February levels – suggests traders are braced for the possibility of a heightened period of turbulence.