Advertisement

MSCI’s chief dismisses concern that Chinese stocks are ‘uninvestable,’ citing instances of market’s rebound from slump

- Stock benchmarks in Hong Kong and China are among the world’s worst-performing major equity gauges this year

- Hong Kong’s Hang Seng index briefly slump into bear market territory last week

Reading Time:2 minutes

Why you can trust SCMP

MSCI, the world’s biggest index provider, shook off concerns about the “investability” of Chinese stocks following recent Beijing’s regulatory crackdown, citing previous instances where markets rebounded in the aftermath.

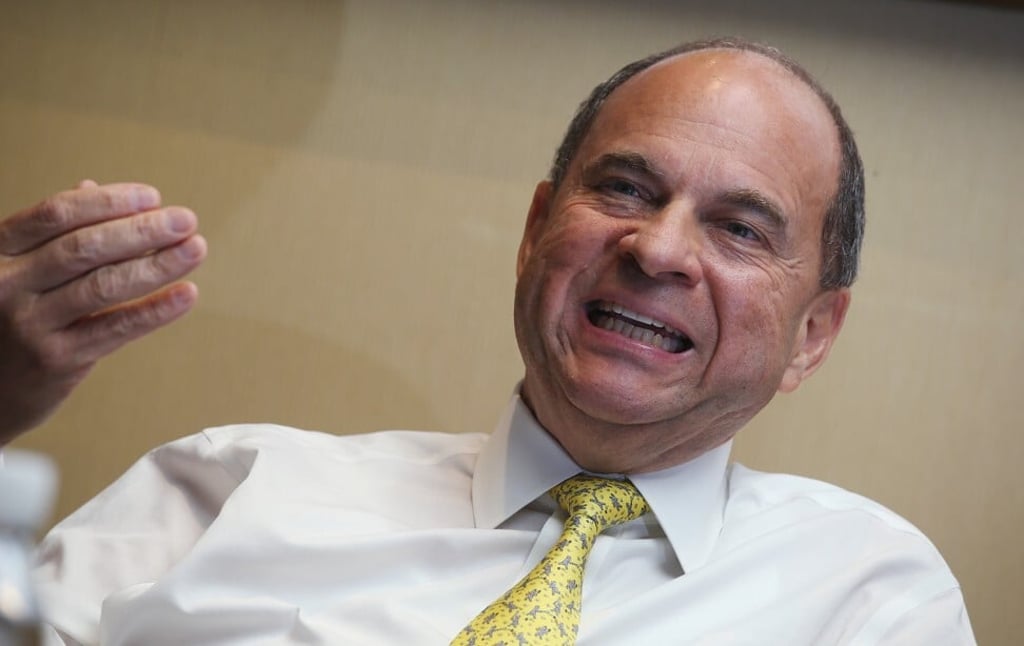

Regulatory compliance has weighed on China “every three, four, five years and obviously the markets have sold off at the time. But very quickly afterwards, the markets have recovered and gone through to new heights,” MSCI’s chairman and chief executive officer Henry Fernandez told Bloomberg Television’s Haidi Lun and Shery Ahn in an interview.

MSCI’s optimism on China stands in contrast to some investors who have called the nation’s stock market “uninvestable.” Regulatory uncertainty wiped off about US$1 trillion from the market value of local stocks listed globally last month, with sharp declines in sectors including online gaming, live streaming and liquor.

Advertisement

Every emerging market in the world has faced such criticism, Fernandez said, adding there were times markets in India and Mexico were also deemed uninvestable because of actions by their governments.

“We have to look at this process that the Chinese regulators are going through in the prism of the last 10 years and also across other markets in the world,” he said.

Advertisement

Stock benchmarks in Hong Kong and on the mainland are among the world’s worst-performing major equity gauges this year, at a time when US benchmarks have been setting record highs. The Hang Seng Index dropped into a bear market last week.

Advertisement

Select Voice

Select Speed

1.00x