Delisting of Focus Media just the start

More Chinese firms are expected to shun US stock markets as they sense hostility and believe investors don't understand mainland business models

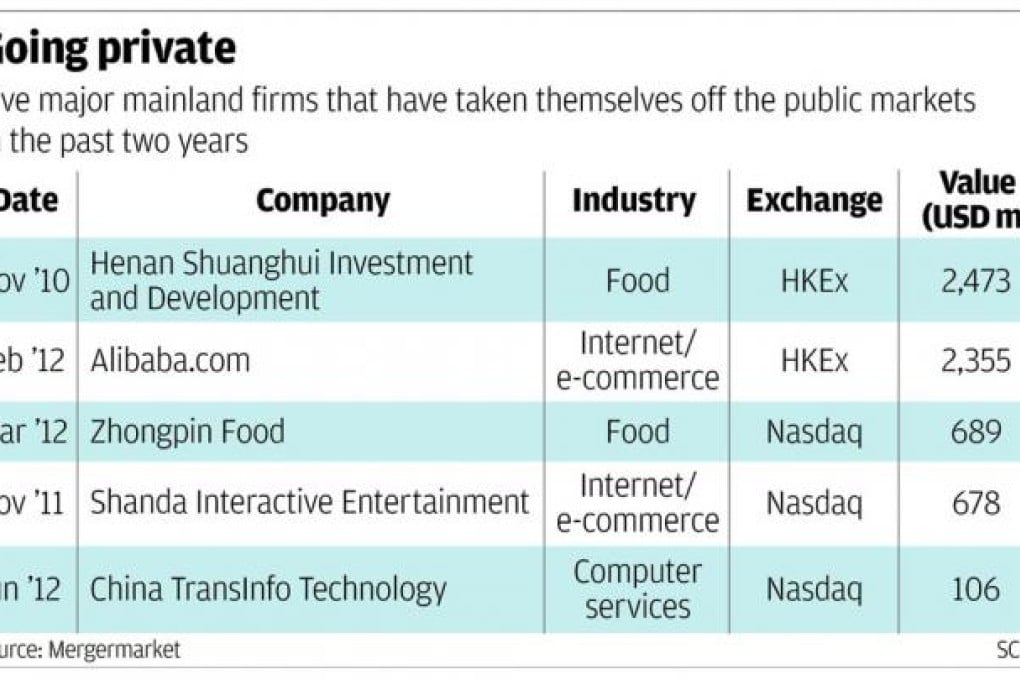

Focus Media's proposed delisting from the Nasdaq stock market in the United States is set to be a template for other Chinese companies that are growingly uncomfortable with the US market environment.

About seven years after the Shanghai-based display-advertising company went public in the early wave of Chinese firms' venturing onto Western capital markets, Focus Media this week surprised shareholders with a US$3.5 billion plan to take the company private, backed by management and several private-equity funds.

If successful, the deal would make it the largest Chinese company to delist itself on a US stock exchange, signalling an important change in sentiment towards the American market among Chinese entrepreneurs.

The delisting plan started as a reaction to an attack on Focus Media by short-seller Muddy Waters, which accused the company of fraudulently overstating by about 50 per cent the number of screens in its digital display advertising network across the mainland.

Focus Media chief executive, Shanghai-born Jason Nanchun Jiang, "was very angry. At one point, he was seriously thinking of suing Muddy Waters", said a person close to Jiang. But he gave up on that idea, figuring the chances of winning were slim, and embraced a buyout.

Jiang's idea to privatise the company quickly won support from mainland private-equity firms including Citic Capital and FountainVest Partners, investment company China Everbright and the US buyout giant Carlyle Group, which all agreed to help Jiang finance his deal.