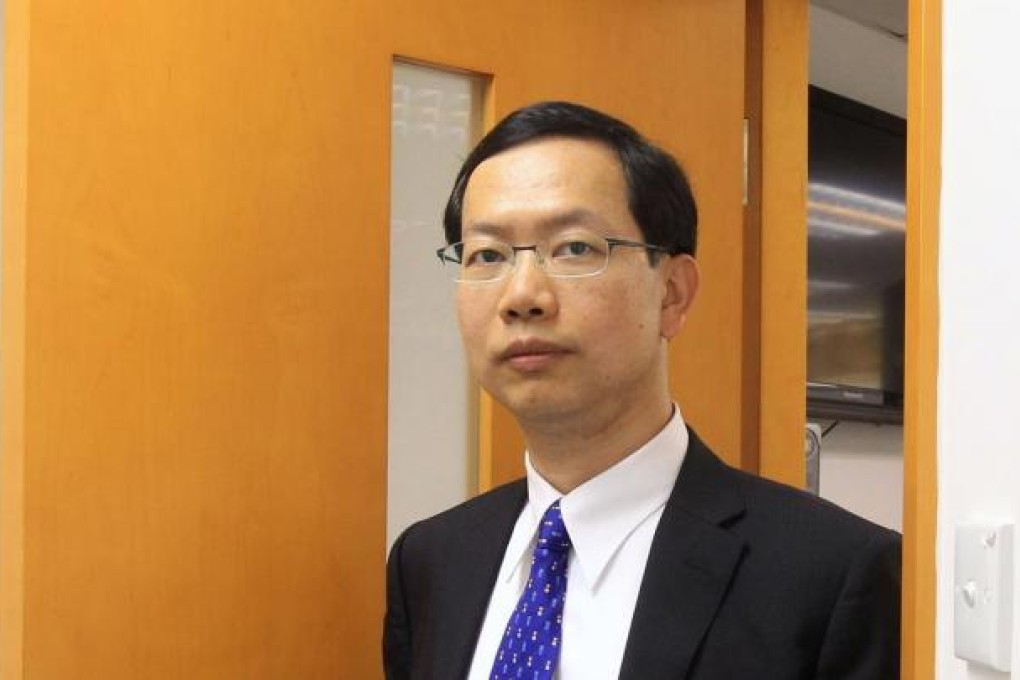

Top stock picker Derek Kwong says 'be boring'

Derek Kwong is recognised as one of the best asset managers in Hong Kong, in large part, he says, because he avoids 'hot' stocks

For Derek Kwong, one of the best-performing China-focused asset managers, it is more important to pick the right stocks than to forecast the upper limit of the stock index.

Kwong, the founder and chief investment officer of Hong Kong-based Basic Asset Management, achieved a 58 per cent investment return for the Golden Bamboo Fund under his management in 2012, leading Bloomberg to rank him the China hedge fund manager of the year for funds under US$100 million.

For comparison, Hong Kong's benchmark Hang Seng index gained 23 per cent last year.

Kwong said his fund has generated an 11 per cent gain in the first two months of this year, against a 1.6 per cent rise in the benchmark index during the same period.

He said that rather than rushing into so-called hot sectors, such as solar power stocks, he preferred buying "boring names": stocks which may have a potential for a re-rating and become highly sought-after.

Kwong said he did not have a preference for a specific sector, either, and investing in Hong Kong's stock market was best done on a case-by-case basis.

This approach led him to accumulate investments in companies with low valuations which jumped later on the back of a change in government policy or earnings improvements.