Why analysts pick on BYD

Warren Buffett has a 10 per cent stake in the company, its shares are flying, its green energy technologies are attracting big government subsidies, and yet analysts constantly complain that BYD is 'too rich'

BYD is a curiosity. The firm gets few breaks in brokerage reports: of the analysts who track the company, 15 have "sell" ratings, six are "neutral", while two are a "buy". Meanwhile, the firm's share price is up by a third in the year to date.

Let's begin with what BYD is. The Shenzhen-based firm makes rechargeable batteries, mobile phone components and solar panels. It is best known as a manufacturer of electric cars and buses, and it broadly identifies itself as a green energy firm.

In 2010 the firm launched the e6, a plug-in electric car that is already part of Shenzhen's taxi fleet. After a 10-month delay, a fleet of 45 BYD electric taxis is scheduled to roll out in Hong Kong on Wednesday. The company, in other words, is a growth stock for the next stage of the development of the mainland economy, which will be more technology-based and more value-added, and one that will help address the mainland's epic pollution problems.

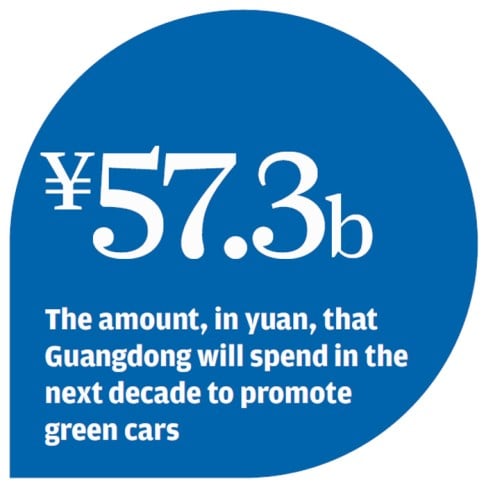

New energy technology is also an irresistible target for policymakers looking to hand out subsidies. The Guangdong government plans to spend 57.3 billion yuan (HK$70.82 billion) over the next decade to encourage the production of new-energy vehicles, and BYD is a consistent beneficiary of such aid.

Nomura analyst Leping Huang says the central government is looking to increase an electric-vehicle subsidy programme, to introduce 500,000 pollution-free vehicles by 2015.