A toast to 20 years of H-share listings

It is two decades this month since the beer flowed in celebration as Tsingtao Brewery became the first H-share listing in Hong Kong

Tsingtao Brewery, the 110-year-old mainland brewer, entered the history books 20 years ago when it became Hong Kong's first H-share listing.

At its listing ceremony on July 15, 1993, then stock exchange chairman Charles Lee Yeh-kwong and other executives used beer instead of champagne for a toast.

Lee and other members of the Stock Exchange of Hong Kong spent more than a year lobbying then premier Zhu Rongji to let mainland firms list in the city.

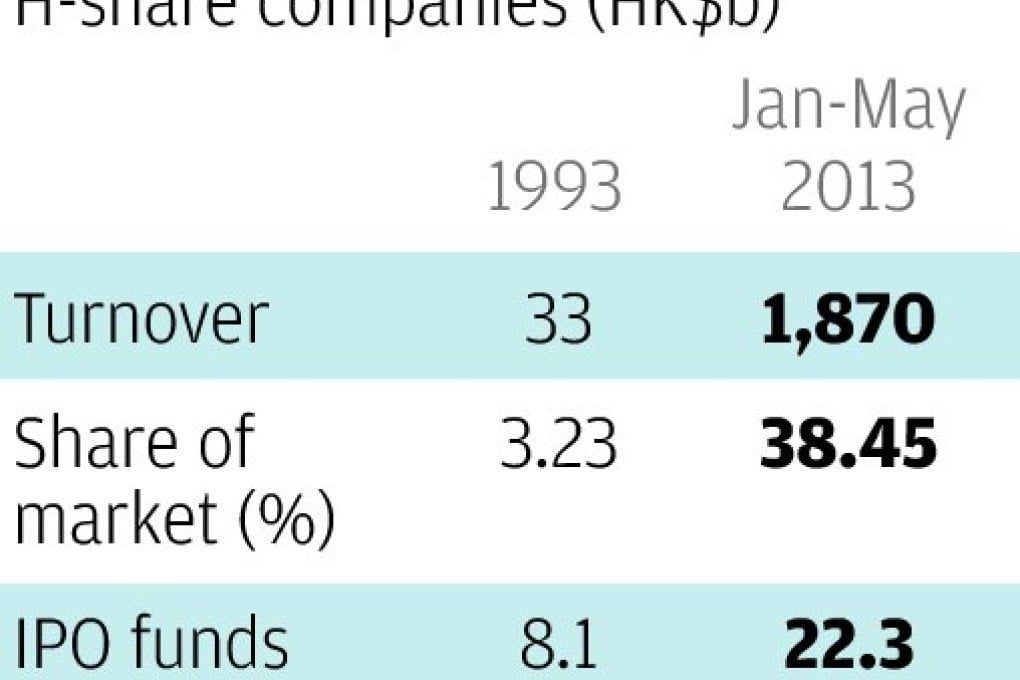

H shares have since come a long way, turning into a major part of the local market. There are now 176 H shares listed in the city, representing a fifth of the local market capitalisation and nearly two-fifths of turnover. When all types of mainland concerns are counted - H shares, red chips and privately owned firms - they represent more than half of market capitalisation and nearly three-quarters of turnover.

H shares are those state-owned firms listed in Hong Kong, while red chips are overseas incorporated companies with mainland-backed parents.