Taking the passive or active route

Passive investing is more diversified, or so they say, because funds may focus too much on one firm. Two analysts push their cases for passive and active funds

Passive investors turn this around. They say forget about trying to outsmart the market, and instead focus on diversification, which is the most cost-effective way to minimise the volatility of one's returns. The passive approach also has a big advantage over active investing: it's cheaper.

An actively managed mutual fund involves a lot of research and support staff. After all, their job is to pick the securities that the rest of the market has overlooked. It's an incredibly difficult job involving a lot of cost. Many actively managed funds underperform the general market they target. An investor might ask why take on this greater risk for additional cost?

Moreover, an active fund may be prone to underperformance in periods of volatility. Active managers are tasked with the difficult job of timing the market. If they get this timing wrong, they may find themselves trying to exit large positions during a big market sell-off, which can easily result in losses.

Passive funds offer a low-cost alternative. If you want exposure to the Hong Kong market, you can buy a fund tracking whichever index you choose. This is a straightforward job that most funds can handle well with minimal expense for investors.

Of course, when most people talk about passive investing these days they are thinking of exchange-traded funds, which are low-cost, democratic instruments that are easily traded on the Hong Kong exchange, as simply as stocks.

An ETF's clearest advantage over a single investment is diversification. Investors can access a multitude of securities within one ETF that tracks the performance of the benchmark, without the costs of an active mutual fund.

These cost implications can be significant. Consider that actively managed mutual funds typically quote their charges in percentage points, while ETFs measure their costs in basis points.

For example, mutual funds involve upfront selling commissions that can be as high as 5 per cent of funds invested. An ETF has no such upfront charge. Investors just pay the same brokerage fee they would to trade stocks.

Why do we say ETFs are democratic? Because they give individual investors low-cost access to a vast array of markets and assets. Previously such investments would only be accessible via a high-cost mutual fund, or perhaps through a private bank, assuming the client had enough money.

But anyone can buy an ETF. They are sold in small denominations, and more than 100 such funds trade on the Hong Kong exchange available to all, offering everyone access to just about everything.

I would argue that's more a case for choosing the right active manager. Opting for a simple passive style won't address all your needs.

If you invest in an index tracker, you tend to get big firms but not necessarily the ones with the best growth. Brazil's education sector, for example, has been experiencing remarkable growth thanks to an expanding middle class. Meanwhile, the MSCI Brazil Index is overwhelmingly weighted towards commodities stocks. In other words, if you bought a Brazil-themed index fund you would get a lot of these commodity stocks but none of the education stocks.

The typical way of investing passively is through exchange-traded funds.

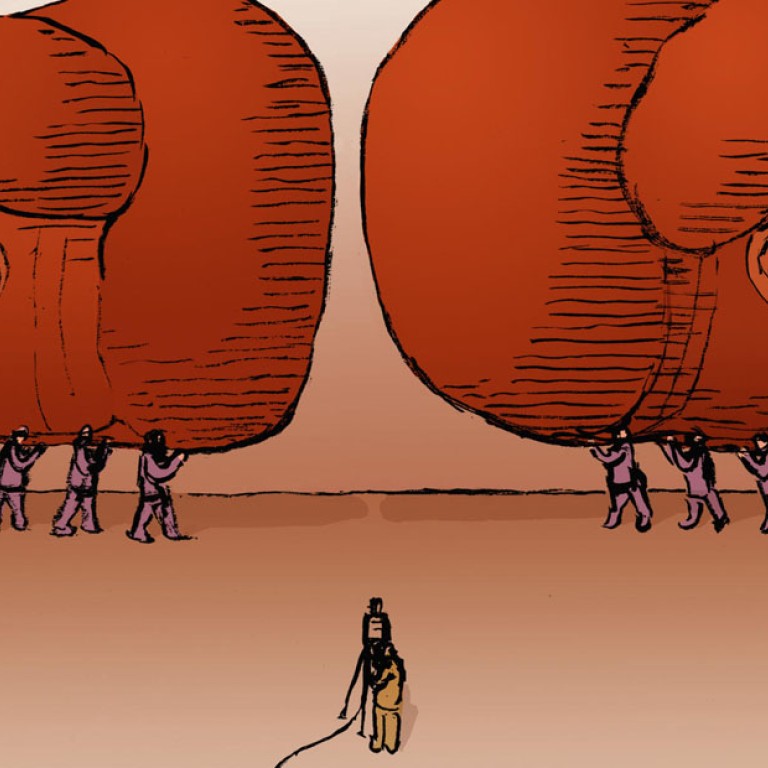

ETFs are designed to mimic indices in the emerging economies in which they invest, and in those markets often a few stocks account for a very large chunk of total market capitalisation and daily index movement.

Investors may believe they are getting significant diversification by heading down the passive route, but they may be buying more of particular names than they expect. For example, if you hold a Korean equities ETF they would be getting an awful lot of Samsung, which takes up a big portion of the market and key indices. There is nothing wrong with Samsung but taking such a concentrated holding clearly works against the objective of diversification.

The passive investing style is completely dictated by market movements. If the share price of a large-cap stock goes up, a passive fund would be compelled to add more of that stock as its weighting in a given index rises with its share price.

If enough passive funds are adding the stock to track an index, the price increase becomes self-fulfilling - it's rising because it's rising. Bear in mind the passive funds would be robotically adding this stock on its way up and selling on the way down. In other words, buying high and selling low.

Moreover, the passive investing style does not adjust for the market outlook. As a given market struggles, passive ETFs for that market typically feel the entire brunt of the downward movement. An entire sector could be on the brink of failure and a passive ETF would stay fully invested in the biggest firms of that industry.

As has often been said, a portfolio cannot beat an index if it looks exactly like it. The reverse is true as well: that same portfolio cannot be protected from the worst of the market's downward movements if it looks exactly like the market. "True" active managers can offer a wider range of potential results, including more upside.