Support builds for SFC's dark pool rules restricting retail investors

Brokers and operators back regulator's move to bar retail investors from trading platform while providing level playing field for all participants

Brokers and dark pool operators support a Securities and Futures Commission proposal to restrict trading in such pools to institutional investors, but some warn it could be a difficult rule to implement.

The SFC proposal, unveiled in a consultation paper on Thursday, would require so-called dark pool operators to ensure only institutional investors, such as pension funds, insurance companies and fund managers, are trading on their platforms and to exclude retail trading.

Dark pools allow investors to match orders through an electronic platform with no requirement to disclose their identity or trading volume.

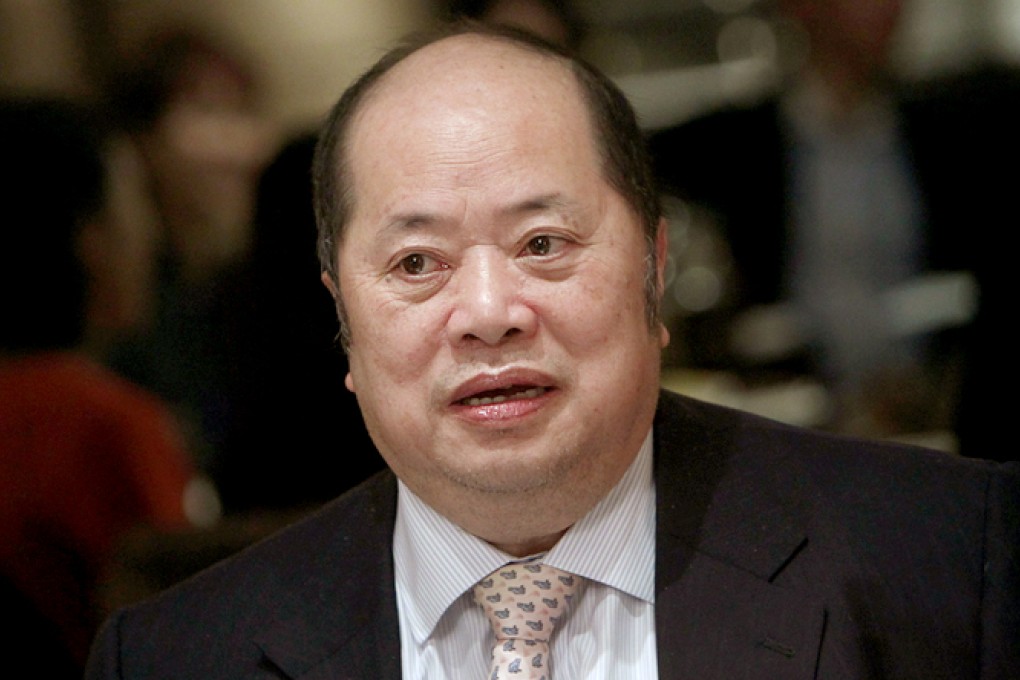

Christopher Cheung Wah-fung, the legislator representing the financial services sector, said he would welcome a ban on dark pool operators providing services for retail investors.

"However, I wonder how the SFC would implement such a rule," Cheung said. "The SFC may need to introduce more detailed guidelines on how it would make sure all dark pool operators would not serve retail investors as some operators might let institutional investors trade on behalf of retail investors.

"The SFC is doing the right thing to ban retail trading on dark pools. Such electronic trading systems are complicated and retail investors may not understand all the risks involved."