Samsung Everland IPO signals revamp of largest Korean conglomerate

Samsung Everland says it will seek an initial public offering, adding to evidence that the founding family of South Korea's largest conglomerate will restructure the group to retain control.

Samsung Everland says it will seek an initial public offering, adding to evidence that the founding family of South Korea's largest conglomerate will restructure the group to retain control.

Everland, a theme park and zoo operator that is also the de facto centre of Samsung Group's business empire due to a network of cross shareholdings, will seek an IPO by the first quarter of next year, spokesman Kim In-cherl said yesterday.

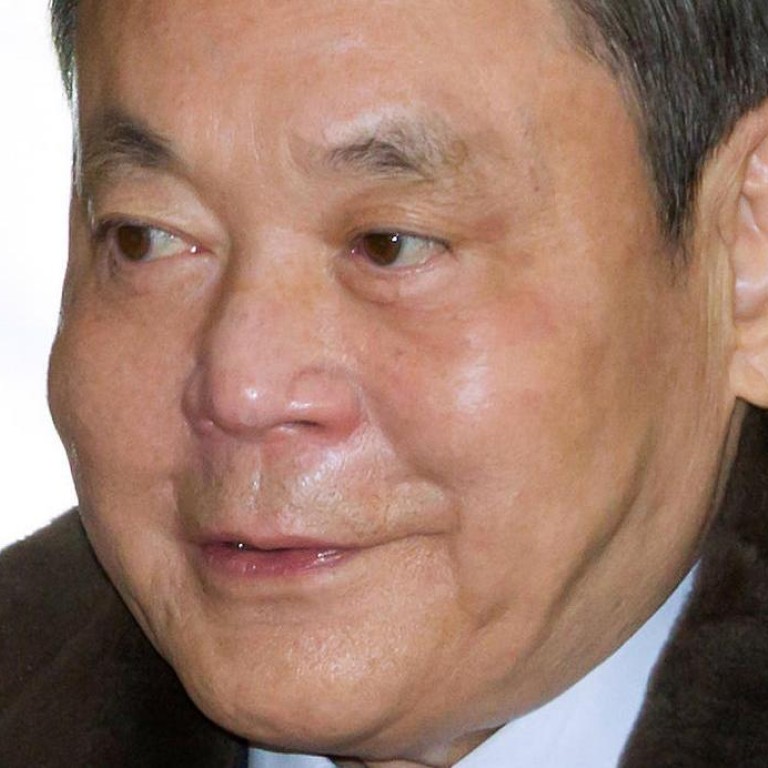

Scrutiny of Samsung's restructuring plans has intensified since Lee Kun-hee, the 72-year-old head of the group that includes Asia's biggest technology company, was admitted to hospital last month following a heart attack.

Samsung Everland would probably play a key role in the group's transition to a holding-company structure, Morgan Stanley said in a report yesterday. Such a shift may boost shares of Samsung Electronics by more than 60 per cent, according to CLSA Asia-Pacific Markets.

"This is part of the revamp that started from the beginning of this year," Midas International Asset Management chief executive Heo Pil-seok said in Seoul. "The circular ownership structure is unwinding in a positive way. The value of stakes held by the Lee family will be realised, and that could be used as a funding source for other projects."

KCC, the second-biggest shareholder of Samsung Everland, rose 11 per cent to the highest level since 2007 by the close of trading in Seoul yesterday. Samsung Electronics climbed to a six-month high, while Samsung Card gained 4.8 per cent. The benchmark Kospi index rose 0.3 per cent.

Lee is the chairman of Samsung Electronics, the world's largest maker of smartphones. His presumed heir, Lee Jae-yong, is vice-chairman of Samsung Electronics and is the biggest shareholder of Samsung Everland with 25.1 per cent as of the end of March, the company said last month.

Lee Kun-hee held 3.72 per cent of Samsung Everland, while two daughters each held 8.37 per cent. Samsung Card has valued its 125,000 Everland shares, or 5 per cent stake, at about 261.2 billion won (HK$1.97 billion).

Everland is pivotal to controlling Samsung due to the system of cross shareholdings that has allowed the founders of Korea's family-run chaebol to control their groups despite holding only small stakes. The Lee family controls 49.7 per cent of Samsung Group's 74 companies while holding a combined 1.53 per cent stake, the Korea Fair Trade Commission said last year.

Everland has a 19.3 per cent stake in Samsung Life Insurance, which is the third-biggest shareholder of group flagship Samsung Electronics. Everland's corporate value was estimated to be about 8.26 trillion won.