These five super-trends will shape the future of investment

Credit Suisse has identified five super-trends as long-term themes that are expected to dominate in the coming years and provide investment opportunities

As investors wonder how to best handle high valuations of many assets, they automatically turn to thematic investments that can benefit from long-term societal trends.

The expectation is that such investments do not depend as much on the daily ups and downs of the financial markets, but seek to profit from the predictability and sustainability of multi-year trends. Demographics, transformational socioeconomic and political developments as well as technological and scientific progress are at their core.

● Angry societies – Multipolar world

Rising inequalities within Western countries and frustration over perceived or real failures of the political establishment to deal with current societal challenges are leading disenchanted middle-class voters to demand change. This brings to power governments with strong mandates for a policy more oriented to support the domestic economy, create jobs at home and address some of the pain points of the Western middle class.

The years of hyper-globalisation helped reduce inequalities across countries but raised inequalities within countries, leading to the social disenchantment that is now driving political change in many Western countries. Looking ahead, we expect a period characterised by economic policy that seeks to support domestic consumers and redistribute growth to sectors with high domestic employment. This will likely shift the spotlight to national champions and brands, defence and security and emerging-market consumers, areas we consider multi-year investment themes.

● Infrastructure – Closing the gap

A global wave of new infrastructure programmes has captured the attention of investors. From India to the United States, governments have turned to infrastructure spending as a means to stimulate domestic economic growth. We review the opportunities for investors as infrastructure spending programmes develop and gradually move our focus from transport infrastructure, which has been the first priority of many governments, to water, energy and affordable housing.

The need for infrastructure spending is clear, as is the political will to invest in infrastructure projects. Investors also appear ready to allocate capital to infrastructure spending. However, it is challenging for investors to find ways to benefit from such opportunities. We continue to maintain a list of equities related to infrastructure spending, but as the first direct beneficiaries of transport infrastructure spending have seen equity values price in heady expectations for future earnings growth, we turn our attention to housing and energy infrastructure as the next beneficiaries. Investors can consider direct participation in infrastructure projects or investments in infrastructure funds.

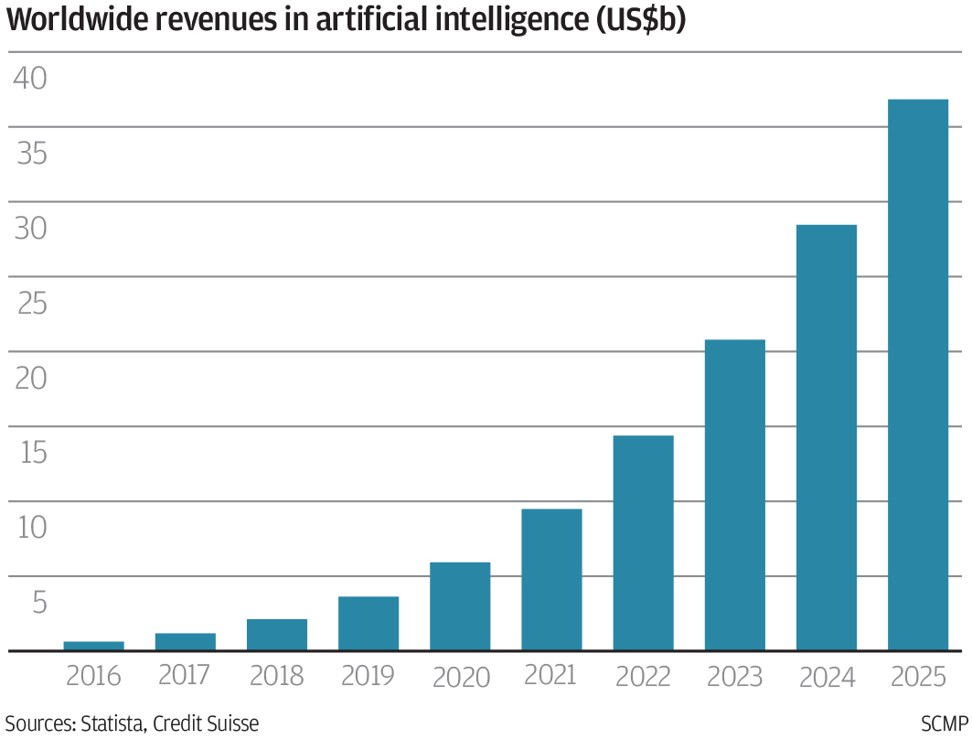

● Technology at the service of humans

In recent years, technology has increasingly been regarded as a threat, with cheap robots, algorithms and programmes seen as eliminating jobs and making humans redundant. As initial thoughts about potential regulation or taxation are floated, technology and innovation that make workplaces safer, increase productivity and provide better products and services for people are in focus.

Technology at the service of humans is set to remain a key topic in the years to come. Digitalisation paves the way for innovation, with internet platform companies and firms offering virtual-reality and augmented-reality technologies among the main beneficiaries. The sheer amount of data that continues to grow will result in opportunities for cybersecurity and data waste management. The fourth revolution of the industry will continue to mostly benefit vendors of semiconductors and robots. Healthtech, the internet and the human genome project offer fields for investing in the future of the health-care industry.

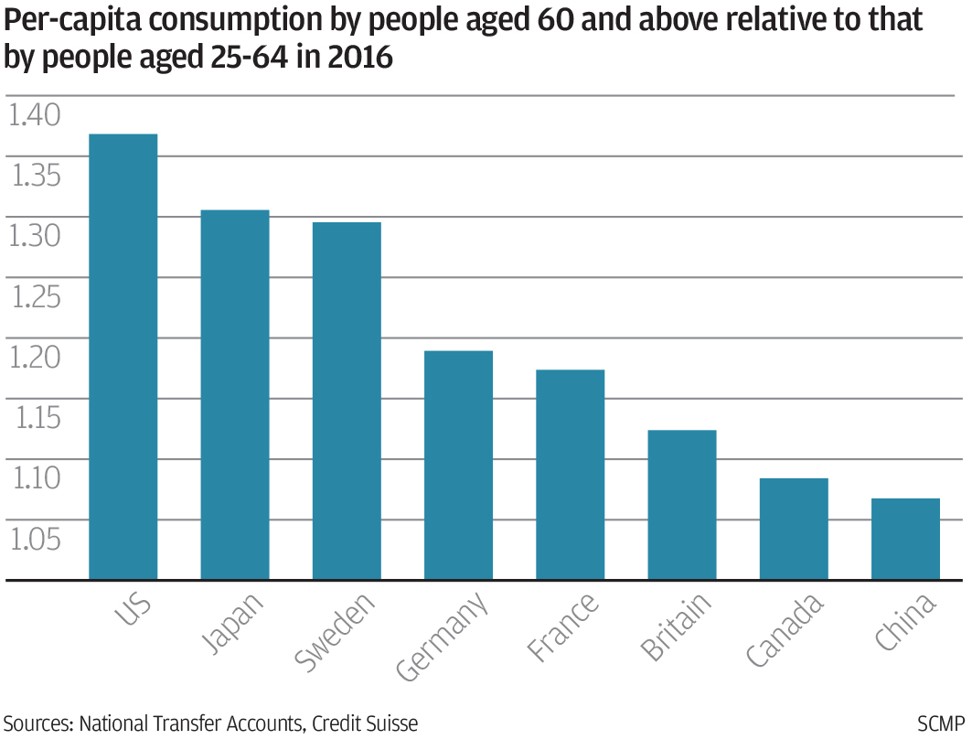

● Silver economy – Investing for population ageing

Although there is a general agreement on the trends related to ageing, we are ill-equipped to grasp their magnitude in terms of the shift in societal composition. We expect the addition of more than a billion senior citizens by 2050 and an associated drop in the dependency ratio to pose immense challenges, but also present opportunities. In our view, investors positioned along the continuum of senior wants and needs such as senior-centric consumer goods, health-care services, senior housing as well as wealth management and pension solutions should see attractive returns.

We expect the unrelenting and seismic shift in the age composition of populations to have an impact on consumer goods, health-care, real estate and financial services markets. Besides some inevitable challenges, there will also be great opportunities for companies catering to a senior population that we expect to grow to more than 2 billion by 2050.

● Millennials’ values

About 50 per cent of the world’s population – we refer to them as millennials – is under the age of 30, and the values of this generation are set to become the norm. As a connected and truly global generation, they feel a collectively responsibility, they care and show they do through their actions. Digital natives with a different mindset and priorities from previous generations, they also value a conscious but experience- and fun-oriented lifestyle.

Millennials are the largest generation in history and soon coming to full maturity as investors. Sustainability, clean energy and investing matter to the millennials and will gain in importance in the coming years. As digital natives, millennials are disrupting the traditional models and redefining consumption, with millennial brands emerging. Micro apartments are developing as an attractive type of housing for millennials and investors.

John Woods is chief investment officer for Asia-Pacific at Credit Suisse