Why is Europe’s deep pool of funds attractive for Chinese green bond issuers?

Drawn by increasing need to fund green projects spurred by China’s Belt and Road Initiative, several leading Chinese banks have tapped euro funding by getting their climate-aligned bonds certified

Ten years after the world’s first green bond, Chinese issuers – the largest globally – have stepped up efforts to tap the fast growing European funding pool. Their increasing use of international climate bonds standard to raise offshore funding underlines their early success in dissipating doubts about their bonds being not-so-green.

The green bond market’s rapid growth is set to continue into next year, deal arrangers and fund managers say, as more investors have embraced the idea that protecting the environment and making a positive social impact will not compromise – and as some argue, even enhance – returns because of issuers’ better risk management and growth opportunities from green businesses.

Chinese issuers are poised to tap into such growth. Just this quarter three banks – Industrial and Commercial Bank of China (ICBC), China Development Bank (CDB), and Bank of China (BOC) – have raised a combined €2.8 billion (US$3.3 billion). Although all these transactions also comprise tranches of other currencies (predominately US dollar), all three issuances are listed on at least one European exchange where secondary market trading take place.

These banks also share a similar marketing pitch – all deals were certified with Climate Bonds Standard, a globally accepted benchmark. With the exception of BOC the proceeds were all raised to support projects related with China’s Belt and Road Initiative.

“Certifications and second party opinions are giving international investors more comfort towards Chinese issuers’ green bonds,” said Dominique Duval, head of sustainable banking for Credit Agricole CIB based in Hong Kong. “By getting certified, Chinese issuers are showing potential investors their internal green bond framework adhere to the best international standards.”

Chinese issuance of offshore euro-denominated green bonds has jumped 263 per cent year on year to US$2 billion up to November 9 this year. This accounts for roughly a tenth of the volume of yuan green bonds issued in the domestic market.

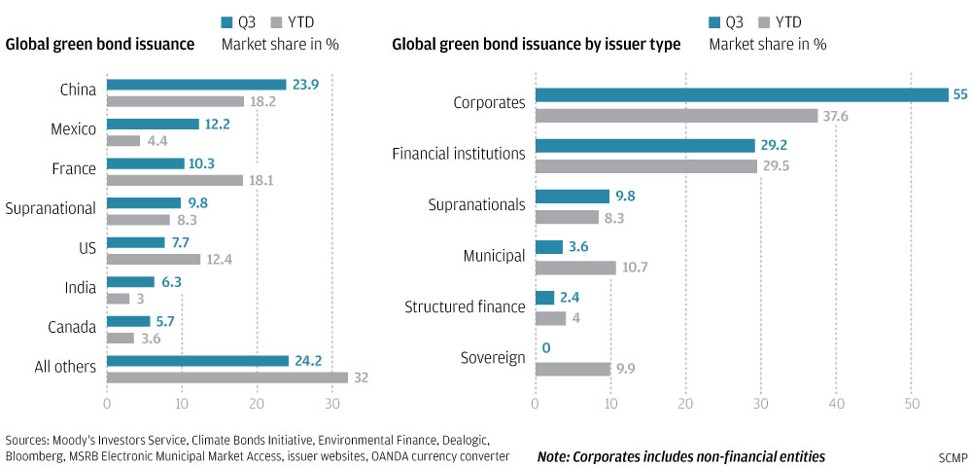

Still, globally, China continued to be the biggest issuer with a 22.6 per cent share of the global market this year to November 9, although down from 37.2 per cent in the year-earlier period as issuance volume dropped 10 per cent, Dealogic’s data showed.

The decline was largely caused by issuers that raised large sums last year – such as Shanghai Pudong Development Bank and BOC – that have yet to use up the proceeds from previous issuances to fund green projects.

But offshore currency issuance is likely to continue to grow, particularly now that green bonds seem to have hit a sweet spot for Chinese issuers looking to finance projects under the Belt and Road Initiative. For example, CDB plans to use the green bond proceeds of its recent four-year €1 billion, and five-year US$500 million deal placed in November on projects in renewable energy, clean transport and water resources management in some of the countries covered by Belt and Road Initiative, which span over 60 nations.

During the early days of the market development, differences between onshore China definitions and international standards had caused some money managers with environment, social and governance (ESG) mandate to shun Chinese green bonds. For example, green bonds issued in Europe do not allow proceeds to fund “cleaner” coal utilisation projects and large hydro power plants which tend to cause ecological, heritage destruction and raise mass village resettlement concerns.

Hence, to address this, the green bonds issued by ICBC, CDB and China Three Gorges Corp this year all came with green certifications, with some even openly stating their use of proceeds would avoid investment into these areas.

“The certification ticks a lot of boxes [for attracting European investors],” said Laurent Morel, Asia-Pacific head of debt capital markets and advisory at Société Générale. “The benefit for Chinese issuers is that it allows them to diversify their investor base, which is extremely important for frequent issuers.”

From the issuers’ point of view, cost of issuing green bond is no longer a concern, according to bankers.

Globally, issuance of green bonds has jumped 48 per cent year on year to US$97.6 billion up to November 9 after more than doubling last year

“We have reached a point where the financing cost of a green bond is generally in line with those of conventional bonds and in some instances, can be slightly lower due to the rarity value of the issuer coming to market,” said Devesh Ashra, co-head of Asia-Pacific debt solutions at Bank of America Merrill Lynch.

He added that the extra compliance cost of issuing green bond rarely comes up as a concern in discussions with issuers. Instead, they were usually more focused on making a statement to their stakeholders around ESG-related issues.

Globally, issuance of green bonds has jumped 48 per cent year on year to US$97.6 billion up to November 9 after more than doubling last year, according to data compiled by Dealogic.

For China, Morel said it was too early to say whether the full year issuance volume would fall short of last year’s, since “at least two state owned enterprises” under the administration of the central government might offer green papers before year-end.

What holds true globally for the green bond market is that greater breadth and depth of the market means greater liquidity – the ease of finding a buyer or seller – and increased investor friendliness for going green.

“As the number of green bond issuers and the volume of green bond issuance grow, investors will naturally seek out this increased pool of liquidity,” said Ashra.

He noted the bank was seeing an increasing number of institutional asset managers put every individual investment or position through an ESG review.

“For fund managers, a green bond element within their portfolio is an attractive calling card for their customers who are increasingly socially aware. Some fund houses are launching green ESG dedicated funds to meet this trend,” said Ashra.

Institutional investors are increasingly proactive in requesting us to invest more in green bonds

For the whole of this year, Société Générale is projecting €115 billion of global green bond issuance, which would be 63.5 per cent higher than last year.

Given the green bond market amounts to only around 5 per cent of the entire global bond market, Morel believes further significant growth is likely in the years ahead.

“It would not be surprising to see 20 to 25 per cent growth for next year’s global issuance, driven mainly by sovereign, supranational and corporate issuers,” he said.

For 2018, HSBC expects growth of up to 44 per cent based on their 2017 full year forecast of US$125 billion.

The bank this week said it has launched the world’s first private sector sustainable bond based on the United Nations’ sustainable development goals, raising US$1 billion to fund projects including hospitals, schools, small-scale renewable power plants and public railway systems.

This year’s green bond issuance growth is led by Europe-based issuers, whose combined volume is projected to grow 65 per cent this year from last year, partly driven by a jumbo €7 billion, 22-year sovereign bond by the French government to fund renewable energy tax credit and grants, according to Morel.

Several more European sovereign issuances were expected next year, while Asian sovereigns were also looking to print their first green papers, Morel said.

Ken Hu Ka-lam, chief investment officer of Asia-Pacific fixed income at Atlanta-based Invesco, said a “healthy cycle of greater demand and more supply” has begun.

“Institutional investors, especially insurance firms and endowment funds in Europe, are increasingly proactive in requesting us to invest more in green bonds, and into bond issuers that perform well on the ESG fronts,” said Hu, whose firm manages over US$850 billion of assets globally.

While a diverse set of investors in Europe has for years been buying green bonds and ESG investment products, in Asia, Hu expects large insurers to lead the trend, followed by wealthy family investment offices.

“Insurers have economic incentives to fund projects that mitigate climate change, partly because global warming has negative consequences that lead to higher insurance claims,” he said.

Since investors have different green and ESG investment criteria, fund managers have to do extra research on bond issuers and their projects, besides carrying out additional management procedures to ensure their clients’ goals were met and their own fiduciary duties fulfilled, he added.

“Before, we only focused on financial parameters like the issuers’ cash flows, debt and profitability, but now we have to also look at a whole host of additional factors.

“For example, we have clients who asked us to exclude firms that burn coal, while others have set caps on investees’ carbon dioxide emission per dollar of revenue.”

However, given the lack of dedicated demand for green bonds, analysts at fund houses’ credit research team do not believe green bond will trade at a premium, or tighter spreads and higher price, compared to vanilla bonds.

Henry Loh, research analyst for Aberdeen Standard Investments’ Asian fixed income team in Singapore, said he has not seen a commensurate increase in demand for green bonds in Asia, despite the increase in supply.

Asian investors do not differentiate between a green and a standard bond and there has yet to be any discernible premium for green issuance in the Asian credit markets. This is probably explained by the lack of socially responsible investing-dedicated bond funds in the region.

“We’ve treated green bonds just like any other bond we invest in for the simple reason that there has yet to be any overarching regulation over what can be labelled as a green bond, though we have seen modest progress on this front,” said Loh, referring to efforts by Chinese authorities and industry bodies to consolidate the two domestic green bond standards that exist onshore. These standards are the People Bank of China’s “green bonds endorsed catalogue”; and the “guidance on green bond issuance” published by the National Development and Reform Commission.