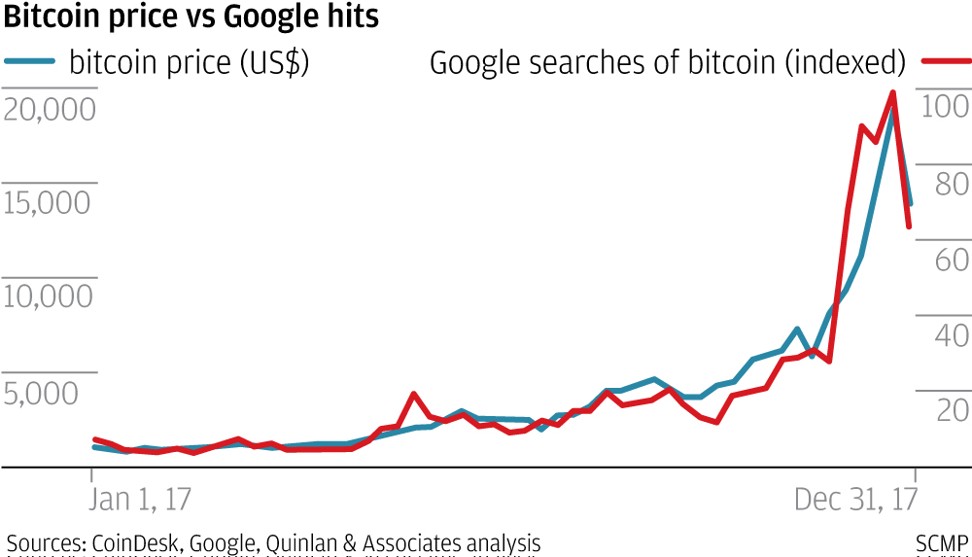

Bitcoin price tracks Google searches for the cryptocurrency as speculators fear missing out

Strong correlation between online searches for the digital currency and its fluctuations show investors’ ‘fear of missing out’ is driving volatility, say analysts

Much of bitcoin’s startling rally was driven by so-called fear of missing out, say analysts, and this explains its recent slump in value.

Last year the digital currency saw its price increase by more than 1,000 per cent. It grew fourfold between October and mid-December when one bitcoin was worth over US$19,000, according to cryptocurrency-data provider CoinDesk. The price then fell back, and on Thursday was trading around US$10 000.

These price movements are closely correlated with the number of Google searches for bitcoin, according to calculations by consultancy Quinlan & Associates, who found that the price spike in late 2017 was preceded by an equivalent spike in searches for “bitcoin”.

The relationship between the rapid rise and fall in bitcoin’s value and online activity has been working both ways; any sharp, sudden fluctuations provide good headlines for journalists, which in turn drive more online interest in the digital currency.

Mike Ryan, chief investment officer for the Americas at UBS Wealth Management, said at the bank’s Wealth Insights Forum in Hong Kong last week that the topic about which he and his colleagues were asked most was bitcoin and cryptocurrencies.

“We have had this question all around the world, but we joke that most of the people asking the questions are journalists,” he said.

If clicks on bitcoin articles drive price moves, and price moves drive headlines and hence clicks, then there is a risk of vicious or virtuous circles developing, exaggerating price fluctuations.

Ryan said there were questions about cryptocurrencies coming from investors too, and while some were driven by headlines, not all of them were.

“The range of people asking questions is pretty broad, but there are differences in the depth of the inquiries.

“The first type are those who are hot with the headlines about cryptocurrencies, don’t understand them, but want to. The second are those who have read about the rise in the price of the currency and don’t want to miss out. The third are those who want to know whether this will fundamentally alter commerce and if businesses will have to engage with it.”