Bond default in Xinjiang the latest sign of stresses in China’s financial system

A company controlled by a state entity fails to repay a US$73 million note, triggering sell-off of related debt

A company controlled by an economic and paramilitary organisation in China’s Xinjiang region has missed the interest and principal repayment on an onshore debt market note, in the latest sign of the stresses in China’s financial system.

Xinjiang Production Construction 6th Shi State-owned Assets Management confirmed in a Tuesday statement that it had failed to pay a 500 million yuan (US$73 million), 270-day note that was due on Monday. The Shanghai Clearing House, where the note is deposited, had first announced the default on Monday night.

“We have difficulty in raising funds so there are uncertainties over the repayment of another 500 million yuan note due on August 19. We are trying various means to meet payment obligations,” the company said. Besides the defaulted note, there are four notes maturing in the following seven months totalling 2 billion yuan.

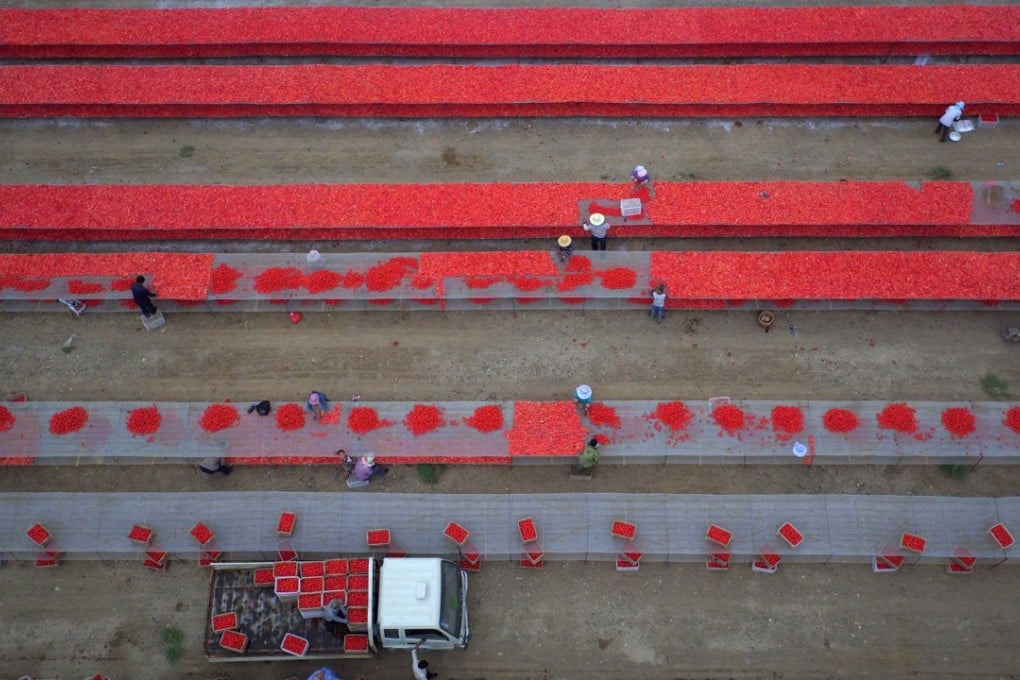

The company is owned by Xinjiang Production and Construction Corps (XPCC), a provincial-level organ set up by the central government in 1954 to farm, settle and help develop the economy of Xinjiang. It is similar to a local government financing vehicle (LGFV) – entities set up by regional authorities in China to raise money for infrastructure projects.

The default triggered a sell-off of Xinjiang and XPCC-related bonds on Monday and early Tuesday as the value of its notes tumbled by half, Bloomberg reported, citing traders. But Su Li, chief bond analyst with Golden Credit Rating International Co, said sentiment had calmed by Tuesday afternoon.

“If XPCC helps the firm repay the debt in the next few days, it would bolster market confidence that even a non-bona fide local government financing vehicle could get a bail out. If there is no repayment, the impact is still limited to Xinjiang-related bonds,” she said.