Hong Kong’s monetary authority sells US dollars to prop up local currency, the first intervention since August 2018 as rate gap widened

- The Hong Kong Monetary Authority said it sold US dollars equivalent to HK$1.5 billion to keep the local exchange rate at above HK$7.8500 per dollar

- More interventions are likely if carry trade continues to take advantage of an interest rate gap between the local currency and US dollars, the HKMA said

Hong Kong’s monetary authority has sold HK$1.5 billion (US$191 million) of US dollars in the foreign-exchange market to prop up the local currency’s value against the greenback, the first intervention by the city’s de facto cental bank since August 2018.

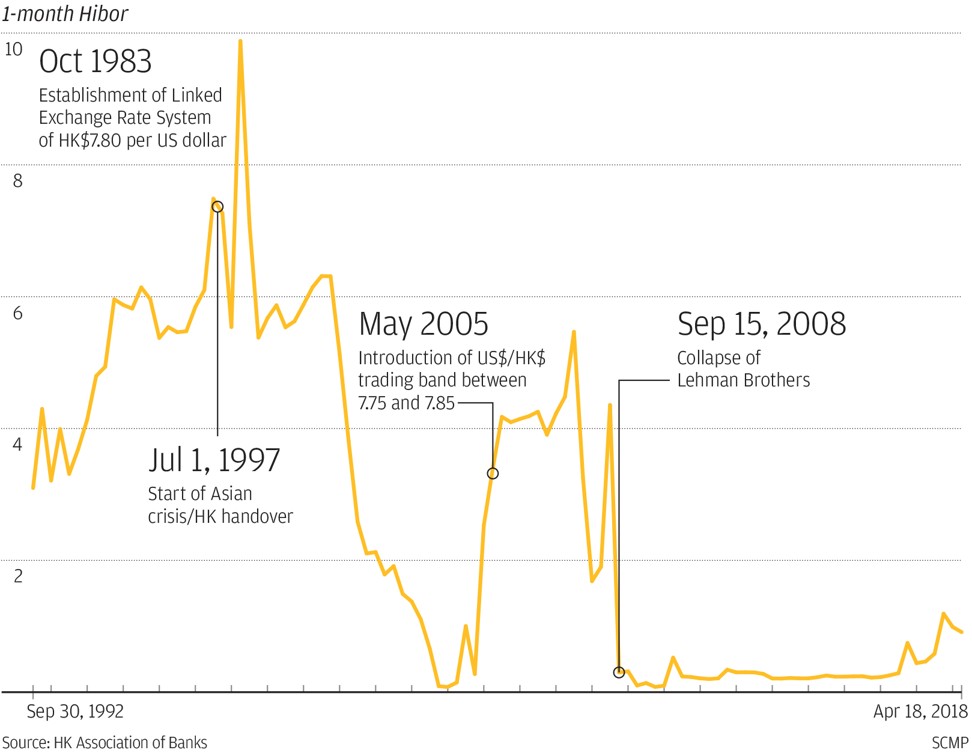

The local currency weakened to touch the lower limit of the trading band because a decline in banks’ funding demand had led to a drop in interbank rates for Hong Kong dollars, which widened the gap between local-currency and US dollar deposit rates. The gap in overnight rates was between 150 and 200 basis points, while the difference in 1-month rates was at about 150 basis points.

“The wide interest rate gap attracted carry trade activities that sold HKD for USD, pushing the HKD towards the weak side,” said HKMA’s deuty chief executive Howard Lee.

Hong Kong’s monetary policy is run in lockstep with the US Federal Reserve to maintain the local currency’s peg against the US dollar. That means every interest rate move by the US central bank is matched in equal measure in Hong Kong.

The low-interest policy by the US monetary authority - matched in Hong Kong - has left the city’s financial system flushed with cheap funds, adding fuel to a bull run in the city’s property market that had only begun to falter as interest rates picked up.

The local currency has been pegged at 7.8 per dollar since October 1983. A trading band of between 7.7500 and 7.8500 per dollar was introduced in 2005 to give the local currency moving room. The monetary authority would buy or sell US dollars to keep the local currency within the trading band.

The HKMA last sold US dollars in August last year, when it intervened to fight back traders who were betting on the deterioration of the Hong Kong dollar, the 13th-most traded among global currencies. Over a four-month period ending in August, the HKMA would spend HK$103.4 billion to defend the local currency.