Macroscope | Will China’s consumer market become the next credit bubble?

In a broad sense, economies globally are undergoing a rolling process of deflating their credit excesses. During this process in almost every major economy, bubbles tend to form and spill over from one segment to another, in an attempt to keep growth percolating. We believe China will be no different.

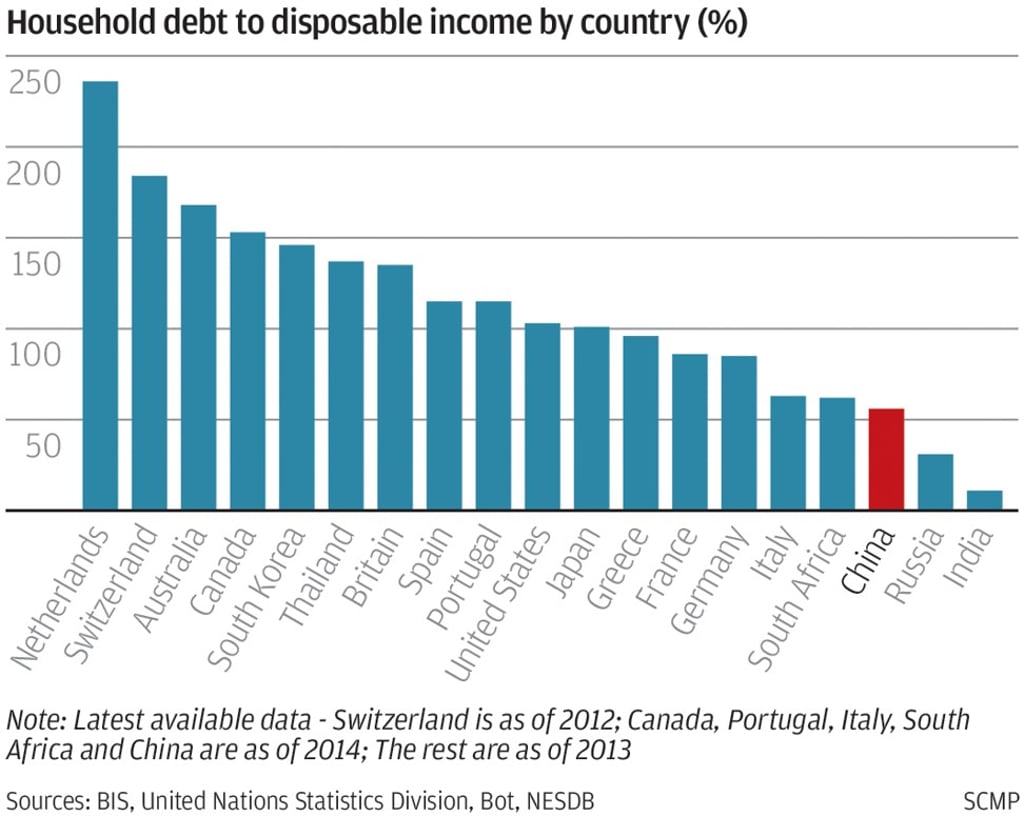

About 45 per cent of China’s gross domestic product (GDP) is in the industrial economy, which after a credit-fueled growth, is now suffering from debt-laden excess capacity. This is the current focus of deleveraging, and is the primary source of increasing non-performing loans, about which we have been writing in past columns. But 39 per cent of GDP is private household consumption, which has very little leverage. That’s about to change.

To offset the negative impacts on economic growth from deflating the industrial economy, we fully expect China to adopt the approach of letting bubbles spill from one segment to another, which most other major global economies have employed. This will quicken the rebalancing of the economy to a more domestic, consumption-driven growth model.

While the positive medium-term, global implications of turbo-charging the Chinese consumer are enormous, they come with a health warning.

Just as in many other economies which have leveraged-up their consumers, it would not surprise us if in the next three-to-five years from now, we are grappling with a Chinese consumer credit predicament. But we have quite a way to go before that develops, so for now, let’s consider how this process is likely to unfold.