China National Tobacco, the world’s largest cigarette maker, plans Hong Kong IPO for international unit

- China Tobacco International’s parent accounts for 40 per cent of global cigarette production

- Company derives revenue primarily from a fixed mark-up of 6 per cent on overseas tobacco leaf supplies to domestic cigarette manufacturers

China National Tobacco, a state monopoly that is by far the biggest cigarette maker in the world, plans to list its international unit on the Hong Kong stock exchange even as pressure increases on the government to curb smoking.

The unit, China Tobacco International, is primarily responsible for procuring overseas tobacco leaf from countries like Brazil and Canada for the cigarette giant, which churns out four of every 10 sticks made in the world.

The parent company may clock more profit than either HSBC Holdings or Walmart, according to a rare glimpse of financial data in 2012.

Beijing needs to kick habit of relying on tobacco cash

The international unit accounts for a tiny portion of China Tobacco’s overall business, which has a bigger market share than the next five global tobacco companies combined.

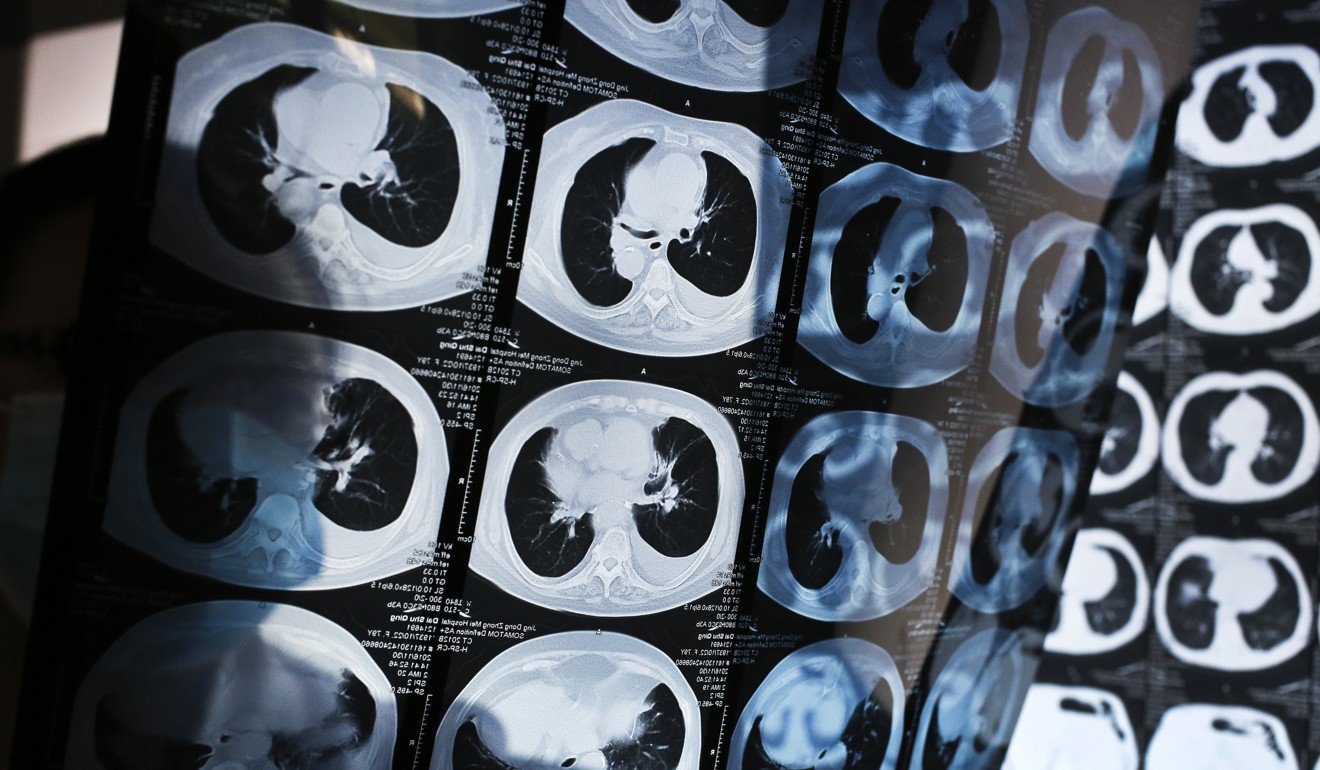

However, the listing represents a rare opening up of the state monopoly that is facing growing domestic concerns over China’s high rates of cancer and smoking-related disease.

China is the largest tobacco-consuming and manufacturing country in the world, and critics contend the government is not doing enough to prevent the spread of smoking because of the tax revenue it derives from the industry.

Last year, lawmakers in China’s National People’s Congress called for higher taxes on cigarettes to deter smoking among the young.

China aims to sell 6 billion cigarettes but tells people to quit smoking. What does it want?

The international business to be floated recorded revenue of HK$5.1 billion (US$651 million) for the nine months ended in September, a 21 per cent drop from the same period last year, according to pre-listing documents issued on Wednesday. It had a gross profit margin of 5.8 per cent, down from 6.5 per cent a year earlier.

The unit derives revenue primarily from a fixed mark-up of 6 per cent it applies to the overseas tobacco leaf supply when selling to domestic cigarette manufacturers. It also has full control of cigarette exports – sold primarily in duty-free locations overseas to Chinese tourists – and domestic-grown tobacco leaf from provinces including Yunnan and Sichuan. In May, it started a business exporting Chinese-made heat-not-burn tobacco devices, the document said.

Hong Kong’s burgeoning e-cigarette industry on the precipice as city mulls total ban

In 2016, the industry contributed profit and tax of 1.1 trillion yuan (US$160 billion), according to China Tobacco’s website.

The monopoly otherwise does not publish financial data voluntarily.

In 2012, a bank that it was buying a stake in released figures that showed the cigarette giant had sales of 770.4 billion yuan and net income of 117.7 billion yuan in 2010.

CICC and China Merchants Securities are joint sponsors of the proposed initial public offering.