Looking for trade war-proof stock ideas? China’s large pharma firms might be good medicine for investors’ portfolios, analysts say

- Chinese Big Pharma firms benefiting from policies speeding up drug approvals, incentivising discovery of new medicines

- Sector primarily driven by domestic consumption, which can help it weather the trade war

China’s pharmaceutical sector – a growth industry primarily driven by domestic consumption, policy support and reform – is a smart bet for investors at a time when other sectors are being pounded by the protracted US-China trade war and China’s economic slowdown, experts say.

Some investors are reluctant to take big risks by putting their money in biotechnology firms that were allowed to list in Hong Kong without any profit or even revenue. Those firms’ drugs can take a decade to get to market at a cost of more than US$1 billion.

So large generic drug producers in China that are also developing new drugs are a good alternative, analysts said.

“While biotech stocks are getting greater interest, the research and time costs are too high for retail investors … whereas the big pharmaceutical firms can offer steady growth from their existing business with potential upside from new drugs development.”

Citi’s top picks include Sino Biopharmaceutical, the nation’s second largest drug maker by sales with a 2.3 per cent market share, third-ranked Jiangsu Hengrui Medicine and eighth-ranked Jiangsu Hansoh Pharmaceutical.

Zhongtai Securities has “buy” ratings on Hengrui and Shanghai-based Fosun Pharma, while Huatai Securities likes Sino and Hengrui.

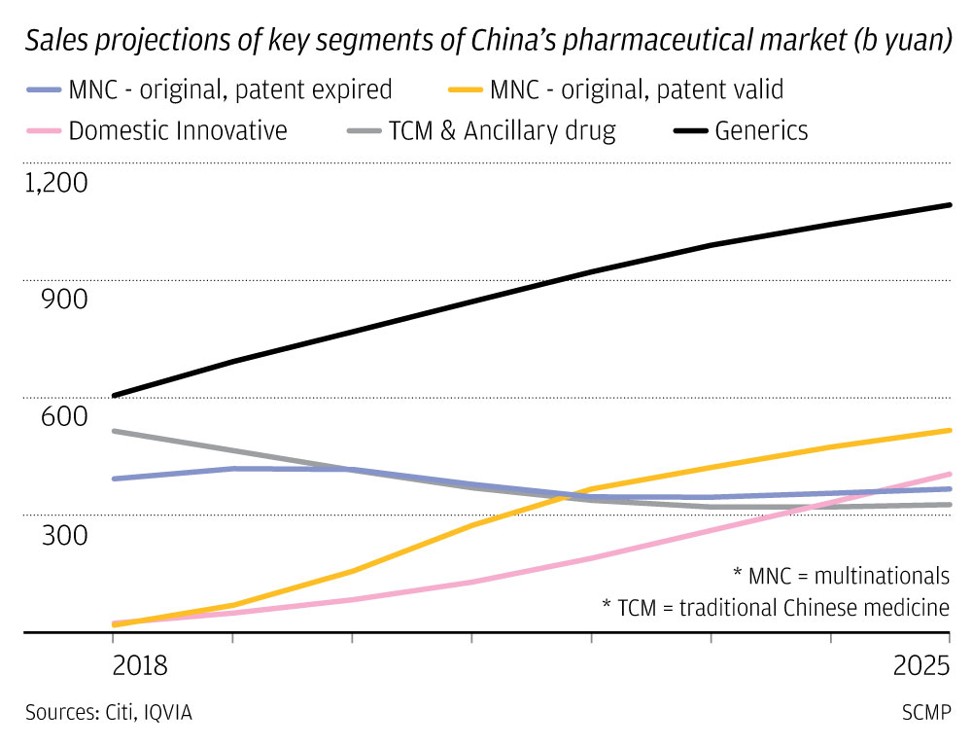

China’s pharmaceutical market, the world’s second largest after the United States, is projected to grow to US$393 billion in 2025 from US$226 billion in 2017, at an average annual rate of 9.7 per cent, according to Citi’s forecast.

The nation’s fast-ageing population and rising incomes have prompted Beijing to take action to address an inadequate health care system. Health care is one of China’s three social services “big mountains,” with the other two being a shortage of quality education and housing.

A quarter of the population is projected by the government to be aged over 60 by 2030, compared to 17.3 per cent at the end of 2017. That means a greater need for medicines for cancers and chronic diseases like diabetes and hypertension.

With limited financial resources, Beijing took measures to lift generic drug supply volumes while cutting costs and improving quality.

It forced drug firms to obtain efficacy and safety certification by conducting clinical trials and bidding for supply contracts with public hospitals.

Generic drugs are those whose patent protection periods have expired, allowing multiple companies to produce them and compete on price.

The first round of pilot tendering in 11 cities saw the average price of 25 drugs fall by 52 per cent on average.

Pharma stocks took a tumble in December over concerns that winners of the drug contracts might not be able to offset sharp price cuts – as much as 96 per cent in the most extreme case – through higher sales volumes. It led to a 20 per cent fall of the FTSE China A600 Pharmaceuticals & Biotechnology index, which has since regained all the lost ground.

Yung said some investors have overreacted to the price cut concerns, saying he expects the pricing reform to lead to the number of drug makers in China shrinking from around 4,000 to less than 1,000 in five years.

“There are so many inferior products in China’s generic drug market … which also was the case in Japan and the US market many decades ago … many small unlisted players will be eliminated due to cost and quality reasons.

“So for the leading [Chinese] pharmaceutical firms, even if their generic product prices are slashed by half, they will still be better off as the industry consolidators … on top of that, they have new growth drivers in innovative drugs.”

Still, more pricing pressure is looming and some analysts are concerned.

The National Healthcare Security Administration recently announced a nationwide roll-out of last year’s pilot. The roll-out will start early next year on 25 drugs.

“The new policy was slightly more negative than our expectation, especially from a longer term view,” said Credit Suisse analysts Serena Shao and Zheng Fei in a recent note. “Nationwide expansion and continuous price cut are inevitable.”

The Credit Suisse analysts, who previously expected mandatory hospital bulk generic drugs procurement to take place in 80 per cent of China by the end of next year, have a “neutral” view on the sector.

Before the reform, drug prices were arrived through negotiations. Multiple layers of distributors were blamed for corruption and high prices.

With mandatory tendering, costs are reduced as the middle people are cut out, while less marketing effort is required.

In return, winners are awarded most of the volume of the tender, which follows a lowest-price-wins principle.

Shanghai Securities’ analyst Jin Xin pointed out that cost savings generated from the reform will translate into greater spending on innovative drugs, which are expensive as China relies heavily on foreign firms for supply.

This is positive for Chinese Big Pharma firms investing in new drugs development. They are also benefiting from Beijing policies that sped up approval of new drugs and incentivise discovery of new drugs.

The overall valuation of Chinese pharmaceutical stocks, trading on average at 30 times their earnings per share, remains attractive compared to their historical average multiple of 37, according to Zhongtai Securities analysts Jiang Qi and Zhao Lei.

Yung agreed.

“Admittedly, Chinese pharmaceutical stocks have risen a lot year-to-date, but current valuations have not yet fully reflect their new drugs development pipelines’ value,” Yung said.

“As more execution rules will come out later this year on the nationwide roll-out of hospital drugs bulk procurement, they may trigger some correction or stock re-rating and give rise to buying opportunities.”