Alibaba overtakes Facebook as world’s sixth-most valuable company after shares soar by 10 per cent in Hong Kong

- Alibaba’s shares rose 10 per cent in Hong Kong to a record HK$261.60, after advancing 9 per cent in New York overnight to US$257.68

- That gives the Hangzhou-based technology company nearly HK$5.614 trillion (US$720 billion) in market value, more than Facebook’s US$694.53 billion in capitalisation

Alibaba Group Holding’s market capitalisation ballooned after its shares soared on the New York and Hong Kong markets, helping it vault past Facebook to become the world’s sixth-most valuable company.

Shares of the e-commerce and cloud computing giant – also the owner of South China Morning Post – rose 10 per cent in a soaring Hong Kong market to close at a record HK$261.60, after advancing 9 per cent in New York overnight to US$257.68.

That gave the Hangzhou-based company nearly HK$5.614 trillion (US$720 billion) in market capitalisation, more than Facebook’s US$694.53 billion. Tencent Holdings, the only other Chinese stock among the world’s top 10 companies, is capitalised at HK$5.38 trillion based on its latest closing price of HK$563 per share.

Investors are rushing into Alibaba for “fear of missing out” on its strong earnings, according to Jefferies, which recommends its clients “buy” the stock with a target price of HK$307 per share.

“[Alibaba] shows strong execution with multiple business models, and is at the sweet spot of a recovery story backed by strong technological strengths,” Jefferies analysts led by Thomas Chong wrote in a note. “In the June quarter, we expect it to deliver solid results with core marketplace as a strong cash cow and customer management revenue offering high [return on investment] to merchants. We expect a strong recovery in the June quarter.”

The world’s largest company remains Saudi Arabian Oil, better known as Saudi Aramco. The oil exploration company, which went public in December 2019 in the biggest initial public offering (IPO) in global finance, has a market value of US$1.77 trillion.

The world’s trillion-dollar club has five members: Aramco, Apple, Microsoft, Amazon.com and Alphabet, as the parent of Google is called. After Alibaba, Facebook and Tencent, the remaining two slots of the 10 biggest companies are rounded out by Warren Buffett’s Berkshire Hathaway with US$440 billion in capitalisation, and Visa’s US$379 billion in value.

Alibaba has 21 “buys” and no “hold” or “sell” recommendations among analysts tracked by Bloomberg, with a consensus target price of HK$263.39. It was the first of a growing number of Chinese companies listed in the US to do a secondary listing in Hong Kong. It debuted in Hong Kong on November 26.

Tencent’s founder Pony Ma Huateng remains China’s richest person and the 18th richest in the world, with his wealth estimated at US$54.4 billion. Alibaba’s co-founder Jack Ma is the second-richest person in China and the 19th richest worldwide, with US$52 billion. Alibaba’s Ma’s wealth rose US$2.7 billion on Thursday, while Tencent’s Ma’s wealth climbed US$2.5 billion, according to Bloomberg’s data.

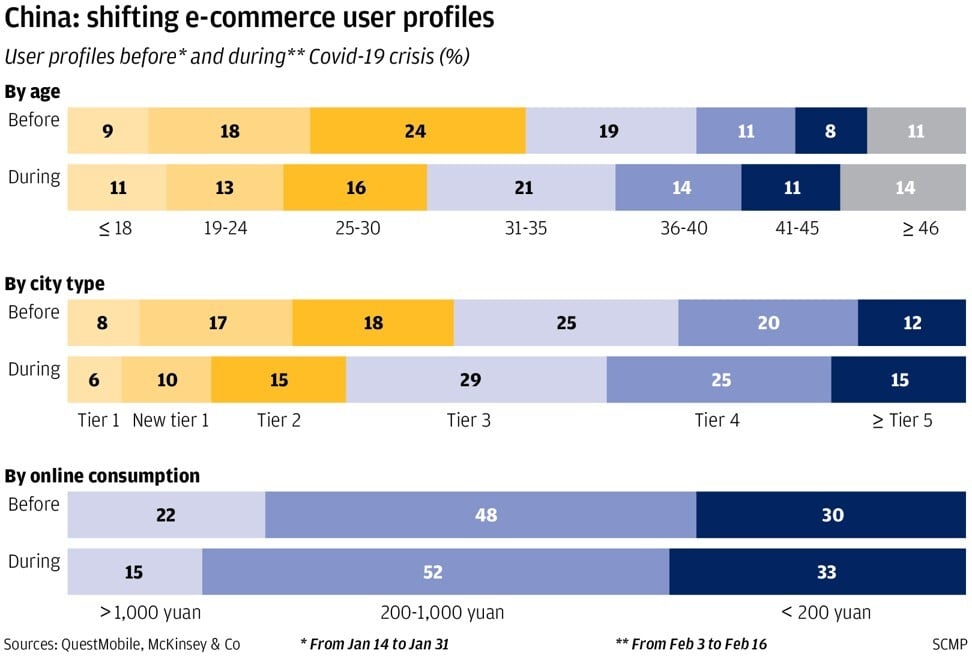

Interest in Alibaba’s shares may have been sparked by investors chasing the e-commerce industry, seen as one of the biggest winners out of the global coronavirus pandemic, as the disease forced more consumers to switch to online shopping, analysts said.

“The [interest in the] e-commerce sector is led by Pinduoduo in recent days” in the US market, said Atta Capital’s portfolio manager Alan Li. “When Pinduoduo’s shares fell on Monday, investors switched to laggards like JD.com and Alibaba.”

Shares of Pinduoduo, a Shanghai-based company that promotes what it calls social e-commerce and team purchase, rose 1.4 per cent overnight to US$92.31 in New York.

JD.com, one of China’s largest online market places, jumped 7.4 per cent to HK$266 in Hong Kong and advanced 6 per cent in New York to US$65.38, giving the Beijing-based company US$101 billion in market value.

The share gains “won’t go too far for Alibaba,” said Li. “Hot money will go back to Pinduoduo after a short-term adjustment.”

Everbright Sun Hung Kai’s wealth management strategist Kenny Wen disagreed, putting a “buy” recommendation on the stock. The company is trading at 31 times estimated 2021 earnings.

“The market sentiment and liquidity are both good in Hong Kong,” Wen said. “Investors like these new-economy stocks which have been lagging the broader market. Also, positive comments from the brokerage firms are driving the stock up. In terms of valuations, the current level is not too demanding. I think Alibaba can go up higher.”