Hong Kong’s Hang Seng Index went from bear to bull in just over three months. What stock investors need to know now

- Excitement is building about the city’s stock market: money is pouring in; 24 companies plan to list this month

- Red hot new economy stocks could be heading for a correction, analysts warn

Well, that was fast. Bulls wrested control from the bears in Hong Kong just three months after the Black Swan coronavirus sent the Hang Seng Index tumbling and unnerved investors.

Fear of missing out has elbowed aside the fear of being in the market. Now what?

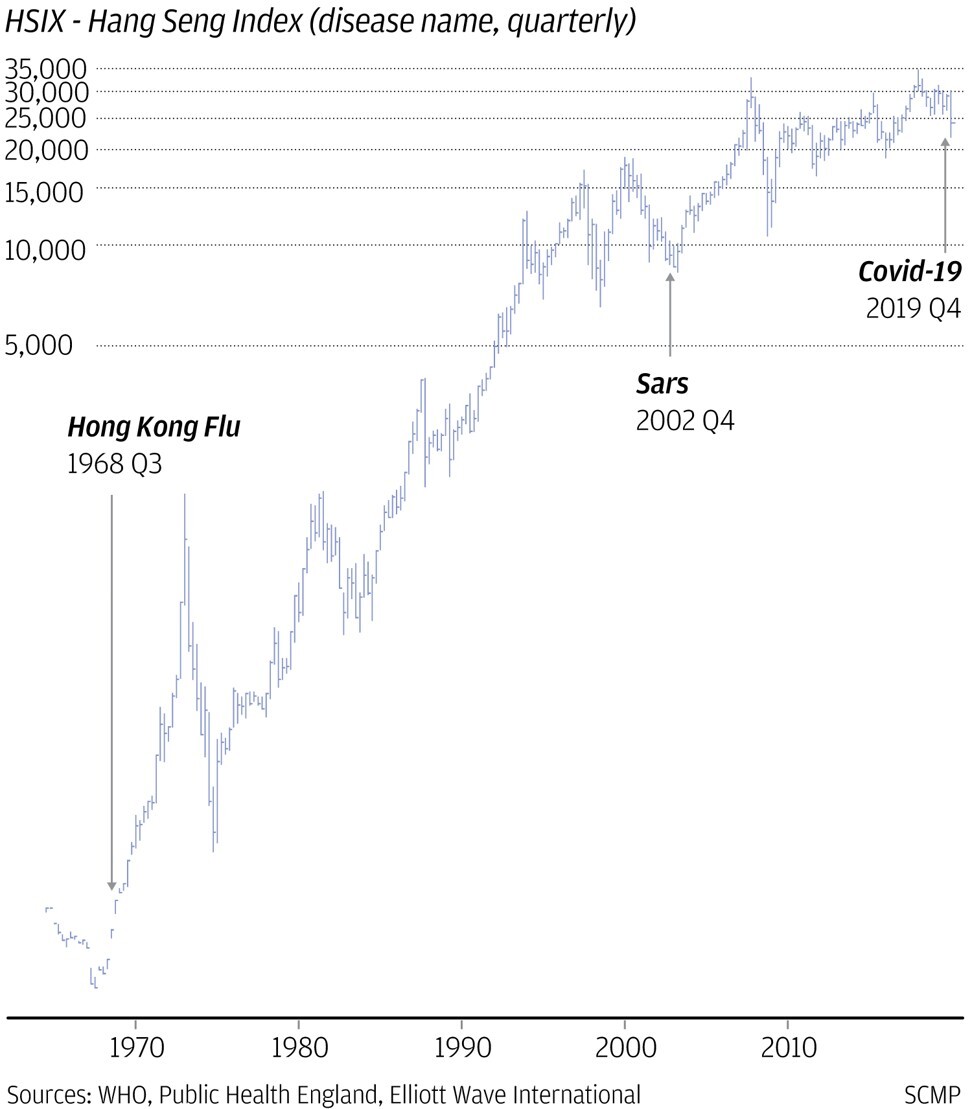

Hong Kong and emerging markets are at the start of a very powerful – and long – bull market, argues Mark Galasiewski, Asian-Pacific financial forecast editor at Elliott Wave, who studies historical charts and other technical tools to predict market movements.

“It will continue to surprise most observers with its persistence and duration because that’s what powerful bull markets do,” he said, contending that this bull market “will continue for many years.”

But Richard Peterson, a behavioural economist and author of Inside the Investor’s Brain, warns investors to watch out for the positive sentiment driving bull markets to shift from rational optimism to the irrational exuberance stage that creates market bubbles – and breaks investors’ hearts.

“Investors who trade now should understand that it is likely to end in tears for most of them,” Peterson says.

So how long will this Hong Kong bull run last?

For now, at least, mainland money is flooding into the Hong Kong stock market. Every trading day from May 29 to Friday, a net inflow of money has poured from the mainland into the city’s stocks through the Stock Connect trading link, according to data collected by AAStocks.com, including a whopping HK$11.19 billion (US$1.44 billion) on July 6 alone

“Money is coming in from the north like lightning,” said Louis Tse, managing director of VC Asset Management.

Meanwhile, investors are signalling lots of optimism.

The Hang Seng Index marked its second straight week of gains on Friday, putting it on track for back-to-back monthly gains. The benchmark has fallen in four of the six full months so far in 2020, and it is down nearly 9 per cent for the year. By one key measurement – the price-to-earnings ratio – the Hang Seng Index is still cheap, at 11.2 compared with 22.5 for the S&P 500 in the US, making the Hang Seng Index very attractive.

But VC Asset’s Tse worries because the pandemic is uncharted territory, making forecasting about the likely length of this bull market especially difficult.

“Covid-19 is so scary because we haven’t seen this before,” Tse said. “Not in our era, and even our ancestors haven’t experienced anything like this. We don’t know what this Covid-19 is, and it’s so difficult to find a vaccine … The market cannot handle all this fear and uncertainty.”

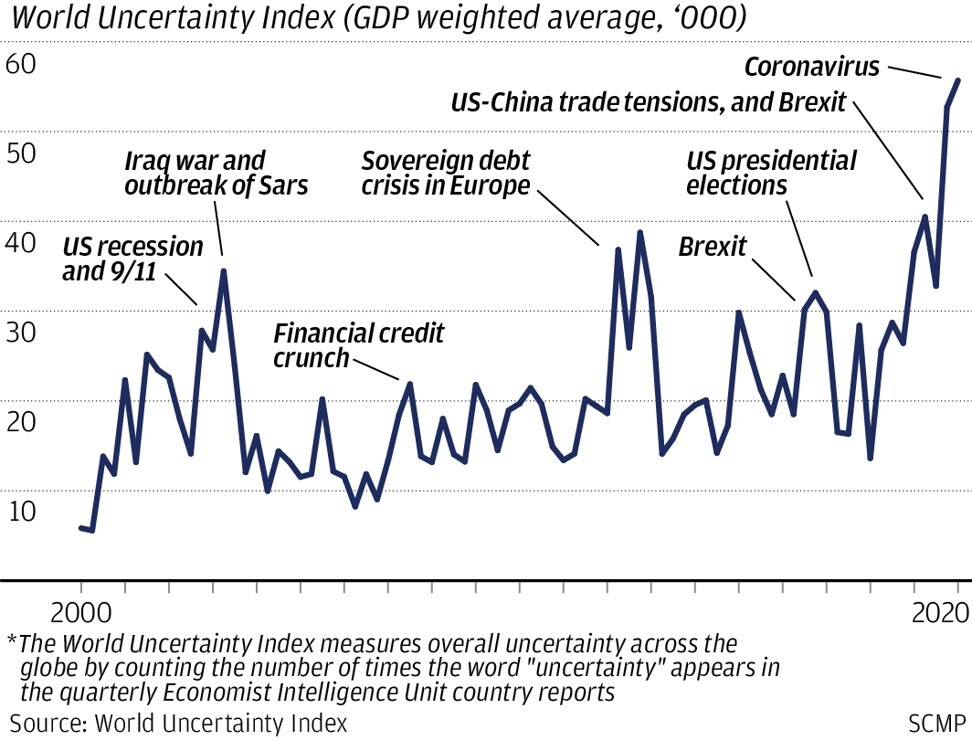

In fact, “uncertainty” in the world, according to a gauge that measures the appearance of the word in writings by economists, is at a two-decade high.

When?

Some notable big stock market runs in Hong Kong include: In February 2016, the Hang Seng fell to a low of 18,319.58 points after the meltdown in mainland China’s markets. From there, it then rose more than 80 per cent over the next two years.

Meanwhile, the Sars epidemic, which killed a comparatively small 700 people worldwide compared to Covid-19, which has killed more than 560,000, was followed by a tremendous bull market in Hong Kong. From the low in April 2003, the market went on a tear, rising nearly more than 65 per cent by February 2004. After falling more than 20 per cent over a few months into May, the benchmark went on to rise more than 180 per cent over the next four and a half years.

Of course, bears are always rested and ready to come out of hibernation when bulls get exhausted.

In the Hong Kong market’s new bull run, new economy stocks are tremendously outperforming old economy stocks, such as Hong Kong property stocks, Alex Wong, director of Ample Capital points out.

Wong and other analysts say investors need to watch out for three big risks: inflation shooting up; rock-bottom interest rates rising; and a sharp correction in new economy stocks, which could be triggered if the market’s mindset changes to the belief the world will normalise back to the pre-pandemic days.

Wong, who has been a big booster of new economy stocks like Tencent and Alibaba, now sounds more cautious, saying that the risk of a correction has risen because new economy stocks have gone up so much and so quickly. Still, he advises having a stake in this sector.

Pharmaceuticals and health care stocks remain good choices, says Gordon Tsui, chairman of the Hong Kong Securities Association, advising investors to skip bank stocks. HSBC, for example, is down 40 per cent year to date.

“Besides new economy stocks, pharmaceuticals and health care stocks will be pursued by the market in hopes that new drugs may be developed to control the virus,” Tsui said.

In contrast, old economy stocks have fallen. The worst hit this year on the Hang Seng Index are Swire Pacific Limited, a real estate-to-aviation-to-industrial conglomerate, down 40 per cent and barely worse than second-place HSBC, with a number of Hong Kong property companies in the top 20 worst performers, Bloomberg data shows.

Stephen Innes, global market strategist at AxiCorp, expects the bull market to have strong legs – at least for the near term.

“This is unlike anything before,” Innes said. “It was not a gradual slowdown. It was, one day the bubble popped, the next day it re-inflated … That is why its so difficult to forecast because it is very much dependent on consumer behaviours. And who knows how long the lingering effects of Covid-19 will weight on the fear factor.”

Although analysts may disagree on how long this newborn bull will run, they agree on one thing: investors need to watch closely to avoid being gored when the bull inevitably changes direction and heads down to bear territory.