Hong Kong’s Mandatory Provident Fund beats inflation in 17-year history to record 4.8pc returns

MPF benefited from a strong 2017 and reported a net gain of 22.3 per cent last year

Hong Kong’s Mandatory Provident Fund has reported a 4.8 per cent annualised net return in the 17 years since its launch, beating the 1.8 per cent inflation during this period of time, the city’s pension regulator said on Thursday. The MPF is worth HK$843.5 billion (US$108 billion).

The returns have benefited from a strong 2017, which reported a net gain of 22.3 per cent, the fund’s second highest since 2010, thanks to a strong stock market. The Hang Seng Index rose by 36 per cent last year.

On average, each member had HK$200,000 in their MPF account at the end of last year, up from HK$13,000 in 2001, its first year.

David Wong Yau-kar, chairman of the Mandatory Provident Fund Schemes Authority, said employees should carefully choose investments for their MPF, as this would affect their returns and how much money they have when they retire.

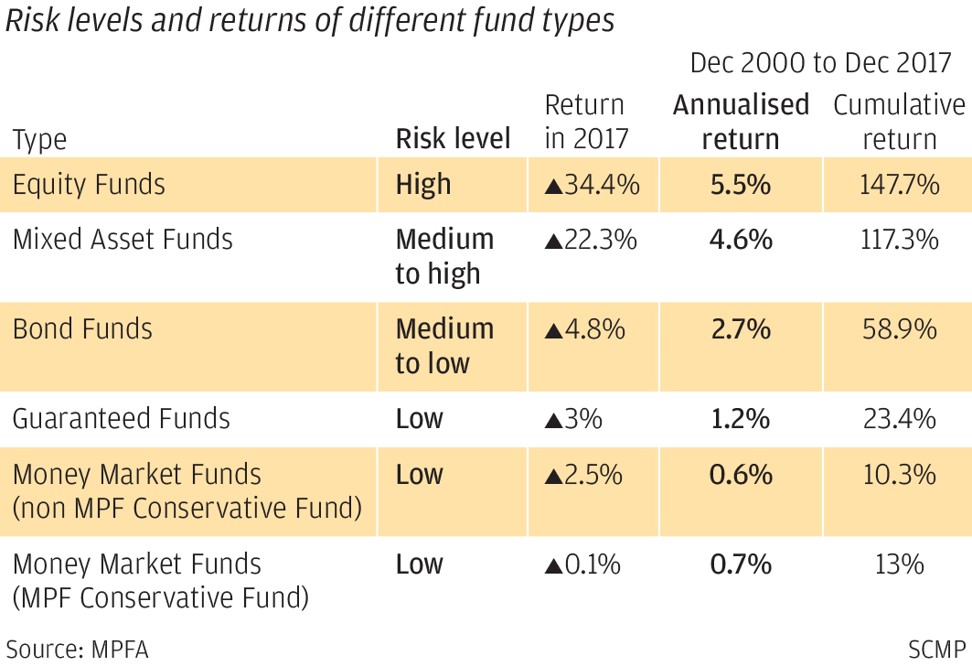

“Different MPFs have different rates of return and risk levels. A member’s return hinges on their investment decisions. Members’ collective investment choices, in turn, affect the overall performance of the MPF system,” Wong said during a media briefing held on Thursday to review the 17-year performance of the MPF.

“Since 69 per cent of MPF assets are invested in equities, the upturn in global stock markets in 2017 led the MPF to a strong performance last year,” he said.

Wong refused to give a market forecast but said “2017 was a spectacular year, which would be hard to repeat in 2018”.

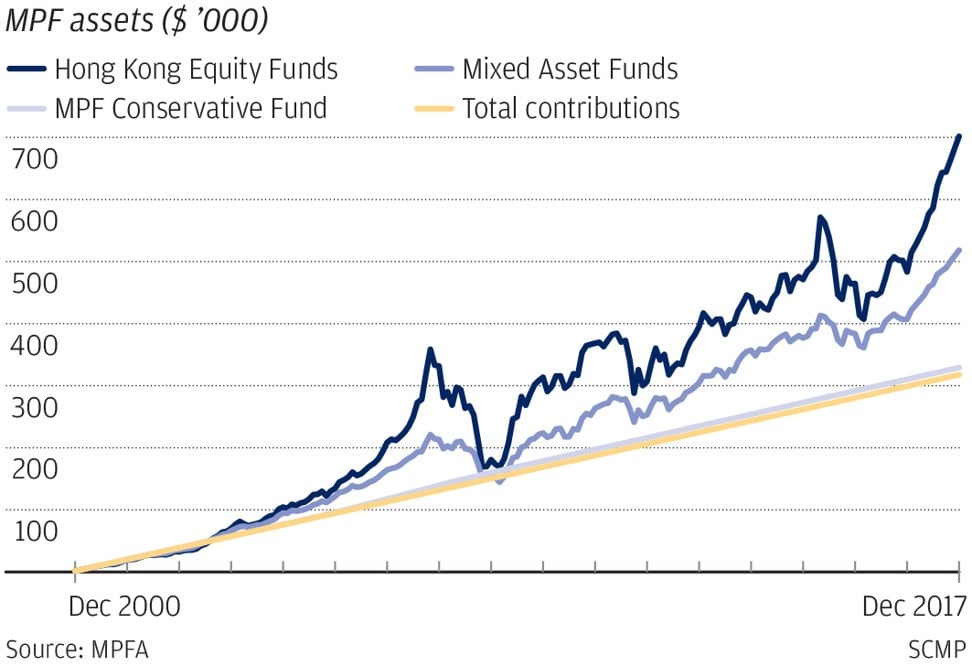

The strong returns have helped to boost total MPF assets to HK$843.5 billion, with investment returns forming a third of these assets.

Choice of investment will make a big difference to what a MPF member makes: Asian equity funds ranked highest with an annualised return of 7.6 per cent; next are Hong Kong equity funds, with returns of 7.4 per cent; mixed asset funds that invest in bonds and equities, had annualised returns of 4.6 per cent. Money market funds were the worst performers, with an annualised return of 0.6 per cent.

Alice Law Shing-mui, the Mandatory Provident Fund Schemes Authority’s chief operating officer and executive director, gave the example of three employees who have all contributed HK$318,000 over the past 17 years. The employee who invested in Hong Kong equity funds, could receive a total investment return of HK$384,000, compared with HK$200,000 for the employee who chose mixed asset funds, while the one who opted for the conservative fund will only receive a return of HK$11,000.

“All members should decide on how to invest their MPF, not just by the return but also by the risk level they can afford. They should not try to time the market as only very professional investors can get it right,” said Law.

The authority yesterday launched a fund comparison platform to help the public check their fund managers’ performance, with the hope to encourage all 2.8 million employees to make smarter investment choices, and to force fund managers to do a better job.

The MPF, launched in 2000, provides pension cover for 2.8 million of Hong Kong’s employees and self-employed residents. Employers and employees each contribute 5 per cent of an employee’s salary to a plan run by one of 14 providers, while employees can choose how to allocate their contribution into different investment funds.

Stewart Aldcroft, the managing director of Citi markets and securities services, welcomed the launch of the fund platform. “I hope that the introduction of the MPF fund performance platform will not lead to greater switching between funds, as MPF members should understand their MPF is for long-term savings and not short-term speculation.

Since 69 per cent of MPF assets are invested in equities, the upturn in global stock markets in 2017 led the MPF to a strong performance last year

“What the platform should achieve is better selection, of the MPF fund that best suits the member, according to their profile and retirement needs,” said Aldcroft.

“One of the bigger problems faced in the MPF business has been younger MPF members selecting low risk or guaranteed funds, and older members selecting funds that offer too higher a level of risk for the time they have left before retirement. Through using the fund performance platform, it is to be hoped that MPF members will make better fund selections, with younger members being more willing to use funds with a higher proportion invested in equities, giving themselves a better chance to achieve higher long-term returns,” he said.

Cheng Yan-chee, the authority’s executive director, said the authority would also like to see the MPF management fee continue to go down to 1 per cent for the long term, from about 1.56 per cent now.