Luxury e-commerce in China has loads of room to grow, thanks to the country’s tech-savvy, cash-rich millennials

Luxe brands ramp up their e-commerce game in China as they try to create buzz with digitally-driven Chinese millennials – the key growth-driver of the fast-paced and booming market.

The battle for wealthy Chinese is moving online, with luxury brands especially hungry to win over millennials through offers on everything from limited edition fashions to white-glove delivery services.

Moncler, Christian Dior, Hermes and Tiffany & Co. are among those in the online stampede to grab a share of China’s US$73 billion annual luxury market. It is composed of 50 million people and growing – the largest number of wealthy people of any country in the world. And they tend to be younger – and more tech savvy – than their global counterparts.

The experiments to woo over this wealthy cohort are truly in their early stages. And with only a small fraction of Chinese at this point buying their luxury goods online, the battling can only get more fierce.

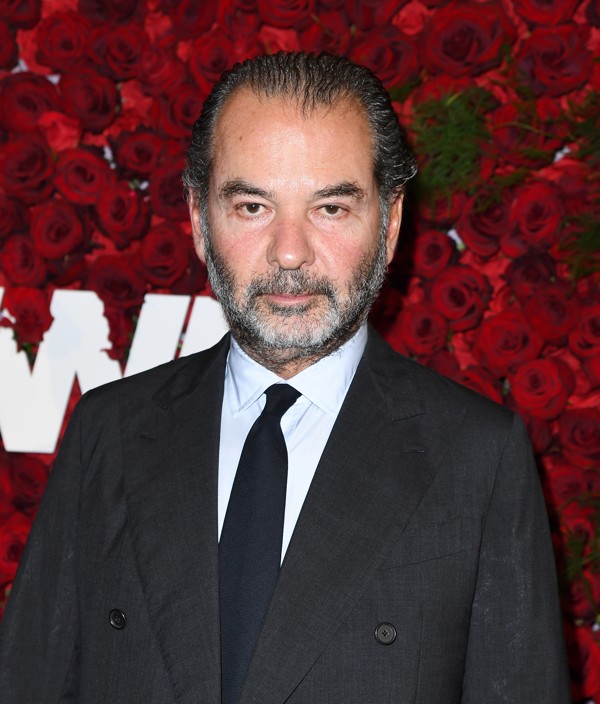

“Among international customers, Chinese ones are more digitally driven today,”said Remo Ruffini, the chairman and CEO of Moncler. “Technology related to consumption in China has made giant steps in recent years. Our challenge is of course to have a leading role with all these technological changes to create a new digital e-commerce experience.”

Moncler set up a virtual store last year on WeChat, the ubiquitous social media platform in mainland China, where customers could order the brand’s signature down jackets and other luxury items whose eye-popping price tags are in fact part of their appeal.

It’s also setting up a “pop up” store on Tmall, the e-commerce site of online giant Alibaba Group,

where from October 4 to October 14 it will spotlight several of its latest collections. (Alibaba is the owner of the South China Morning Post. )

Data explain the online push, which aims to complement, rather than replace physical luxury stores. Moncler, for example, now has 34 stores in mainland China, seven in Hong Kong, two in Macau and three in Taipei and Taichung.

Pascal Martin, partner at OC&C Strategy Consultants, says that most of the growth in the China luxury market comes from online sales.

“The share of online sales in the overall China luxury market is growing fast, at a pace close to 20%, while the total luxury market for fashion and accessories is only growing at 3-4% per annum,” he said.

Luxury consumers are comparatively younger in China than their European and US counterparts, according to a report by Martin Roll, which means they tend to be online junkies.

More than 80 per cent of mainland Chinese luxury consumers are between the ages of 25 and 44 – and they love to travel and buy abroad, where prices tend to be much lower and counterfeit goods less a problem than back home.

Half of Chinese consumers aged 20-49 have done online luxury shopping, according to London-based market researcher Mintel Group.

“Generation Y, those aged between 20 and 29, are consumers who are most positive about online luxury shopping,” said Jaslien Chen, a Mintel research analyst. “Of these consumers, those between the ages of 25-29 with a mid-level household income are more open when it comes to purchasing online.”

Christian Dior and Hermes have run online pop-up store campaigns on WeChat. They have always been with limited offerings – often exclusive to the campaign – during a short time frame and aimed at creating a buzz among younger customers, according to OC&C Strategy Consultants.

Luxury brands also rolled out digital marketing campaigns to cash in on the gift-giving demand during popular Chinese festivals, such as Qixi, China’s Valentine’s Day, Alibaba’s Singles’ Day, which smashed all records when it took in US$25.4 billion last year, and Women’s Day.

On a daily basis, 35 per cent of Chinese consumers generate online content. But only 7 per cent of Chinese luxury sales are online, according to a report by McKinsey in 2017.

Euromonitor data and OC&C analysis came up with similar results.

Nearly 29 per cent of general apparel and footwear sales are online, as are 23 per cent of beauty and personal care products, OC&C found. Yet only 9 per cent of sales of luxury fashion and accessories are online, they said in joint data.

Luxury brands will have to woo over consumers like Cindy Li, 27, of Guangzhou, China, who bought a roughly US$1,500 Moncler brand down jacket from a physical store.

They are trying.

Valentino fashion seller, for example, launched a “Be My Vltn” digital campaign on WeChat for Qixi this year. The exclusive online limited products sold out at least a week before the Qixi date, analyst Chen said, who attributed the remarkable success to precision marketing of women consumers on WeChat.

Chopard opened its online flagship store on JD.com a year ago, marking the luxury watch and jewellery maker’s first online store in China. Buyers can enjoy the high-end, exclusive white-glove delivery service known as JD Luxury Express.

Meanwhile, US jewellery house Tiffany & Co. opened up an online pop-up store at Tmall’s invitation-only platform for luxury brands, known as Luxury Pavilion. The pop-up store features augmented reality technology and perks to those in Tmall’s loyalty programme.

Moncler achieved double-digit revenue growth in all regions in the first quarter of 2018 in comparison to that of 2017, it said. But China and Hong Kong largely outperformed the growth of the Asian region in the first part of 2018.

Founded in Grenoble, France, in 1952, Moncler made a name for itself as a ski wear brand. While the company was struggling by the end of the 1990s due to fierce competition from other luxury players and sportswear brands in the market, the fashion house made a huge comeback and entered the US$1 billion dollar club by 2016.

“Digitalisation has changed consumers’ habits, and we believe that a stronger digital communication strategy for Moncler in China is needed, coherent with the global digital Moncler attitude, that will find us ready for the winter Olympics Games in Beijing 2022,”said CEO Ruffini, who bought the company in 2003.

Meanwhile, luxury brands are trying to win the confidence of online buyers who are worried they’ll get stuck with cheap knock-offs.

Moncler, for example, has established a special anti-counterfeit department internally to protect its brands.

“The company actively counteracts trade in counterfeit products on the internet by constantly and extensively monitoring, on a global scale, major e-commerce platforms, social networks, search engines and websites which sell counterfeit products or violate Moncler’s intellectual property rights in any way,” Ruffini said.

But for many Chinese, nothing will beat the luxury of shopping in a luxury store.

“Luxury consumers love being pampered,” said Mariana Kou, head of China education & Hong Kong consumer research for CLSA, “to indulge in special in-store experience, and to interact with the staff in the physical shops.”