Hong Kong-based digital currency exchange BitMEX ditches clients in US, Quebec amid regulatory pressure

- The move by leading bitcoin exchange with turnover of US$965 billion comes amid US action against unregistered entities

- BitMEX pays the highest rent for office space in Hong Kong

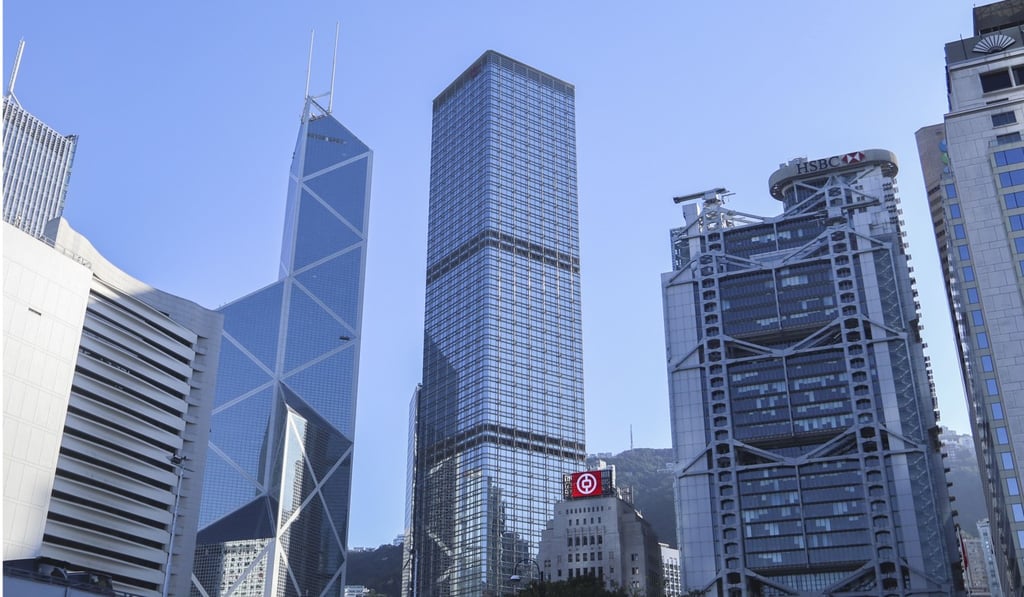

BitMEX, the bitcoin futures exchange that has leased Hong Kong’s most expensive office in Cheung Kong Center for US$600,000 a month, has been shutting down client trading accounts in the US and the Canadian province of Quebec, as global regulators intensify their crack down on unlicensed cryptocurrency trading platforms.

The development comes at the same time as the Hong Kong-based company notifying users in North Korea, Iran, Syria, Cuba, Sudan and Sevastopol in the Crimea since the fourth quarter of 2018 against holding positions or trading on BitMEX, as these are restricted jurisdictions.

According to the company’s website, overall trading volume on the exchange in the past one year stood at US$965 billion.

BitMEX’s move to bar Quebec traders comes after the province’s financial regulator, the Autorité des marchés financiers (AMF), sent a letter to the exchange in early 2018 asking it to close all accounts linked to Quebecois, saying the exchange was not authorised to provide trading services.