Cash gains popularity among world’s super-rich amid concerns over political instability, downturn

- Rush to cash was particularly strong among Asia’s UHNW clients in 2018, where 56 per cent more wealth managers reported increased cash holdings

- Sentiment among Asia’s wealthy has soured more than their North American counterparts mainly because of the US-China trade war, Brexit and realignment in Europe

The world’s ultra high net worth individuals (UHNWIs), classified as people holding US$30 million or more in assets, are moving their allocations into cash, according to the latest Knight Frank Wealth Report, released on Wednesday.

Globally, 45 per cent more wealth managers surveyed by Knight Frank reported that their clients increased their cash positions in 2018, and that 27 per cent more managers expected their clients to do the same in 2019. In 2018, 21 per cent more wealth managers reported increases in property holdings and 14 per cent reported increases in private equity, while 7 per cent more reported decreases in equity holdings.

The rush to cash was particularly strong among Asia’s UHNW clients in 2018, where 56 per cent more wealth managers reported increased cash holdings and 25 per cent more reported a decrease in equity holdings. In 2019, 36 per cent expect their Asian clients to increase cash holdings and 20 per cent more expect increased holdings in gold.

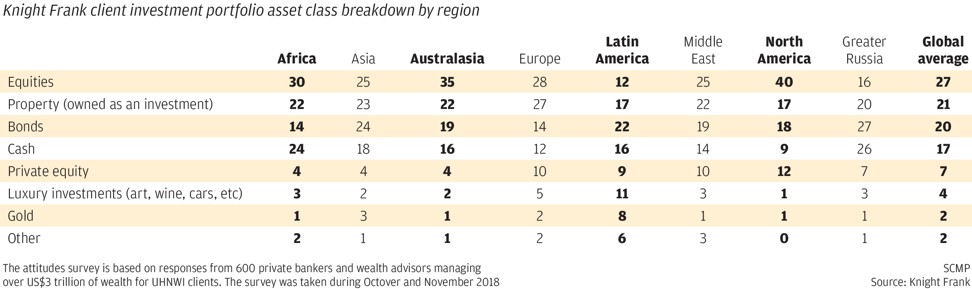

Globally, wealth managers said by a margin of 10 per cent that their clients planned to reduce holdings in equities in 2019. They said that their clients had equity, property, bonds and cash allocated at 27, 21, 20 and 17 per cent respectively in 2018.

Knight Frank surveyed 600 private bankers and wealth advisers managing over US$3 trillion to obtain its results.

Increased cash holdings suggest concerns over political instability and the expectation of a downturn in 2019. Knight Franks’ findings mirror the results of the February Reuters poll of fund managers, which found cash holdings increasing to 7.2 from 6.2 per cent, and recommendations for equity holdings dropping from 48.5 per cent to 45.9 per cent.

Sentiment among Asia’s wealthy has soured more than among their North American counterparts. According to the report, four-fifths of wealth advisers in the US expect their clients’ wealth to rise in 2019, compared to just under two-thirds in Asia. North American UHNWIs had 40 per cent exposure to equities – the highest level among all geographic areas.

Trade tensions between China and the US, as well as worries over Brexit and European realignment are key elements in the souring mood. Such fissures highlight the concern among the world’s wealthy that political instability – driven in part by income inequality – may become the norm.

Ian Bremmer, founder of global political risk research and consulting firm Eurasia Group and a collaborator with Knight Frank, said: “As inequality grows – and, with it the disenfranchisement of large parts of society – the response of UHNWIs needs to be ‘how can we fix this?’”.

“The more immediate response is, ‘What can I do to protect my family?’” he added.

Hong Kong boasts the largest concentration of individual wealth in Asia, says Knight Frank

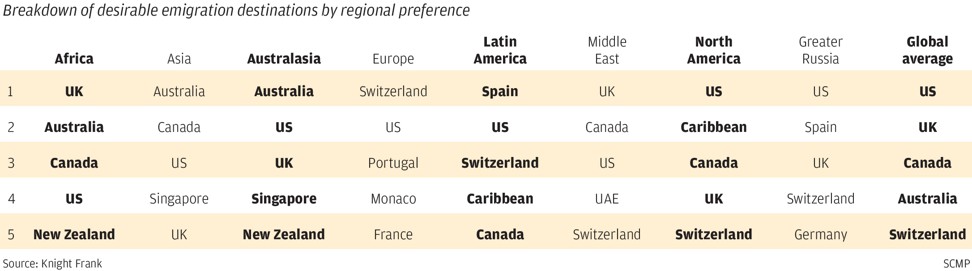

The gloomier outlook for 2019 explains the growing desire among super-rich individuals for second passports and overseas residential property holdings.

Andrew Hay, global head of residential at Knight Frank, said that education used to be the main driver for wealthy people when buying second homes. “Education is still a key consideration – but UHNWIs are also becoming increasingly strategic in response to global uncertainty and political upheavals. As a result they are investing in additional homes in cities and countries where they can see greater levels of stability.”

Obtaining a second passport or citizenship continues to be a major preoccupation of the world’s richest people.

Knight Frank’s Attitudes Survey indicated that 36 per cent of UHNWIs already hold a second passport, up from 34 per cent last year, with 26 per cent planning to emigrate permanently, up from 21 per cent. In Asia, 25 per cent expect to emigrate, while just six per cent of Australians or New Zealanders wish to move.

Countries such as Portugal, Cyprus and Malta have developed residency for investment programmes, which give access to the European Union. Despite efforts to clampdown on such activities by the European Union and the Organisation for Economic Co-operation and Development, other countries have begun offering residency investment schemes, including the tiny former Soviet republic of Moldova, which was recently given access to the Schengen area, and Montenegro.

Among Asian UHNWIs, the top five favoured destinations for emigration are: Australia, Canada, US, Singapore and UK. Australia was also the most popular place in which Asia’s wealthy wished to purchase a residential property.

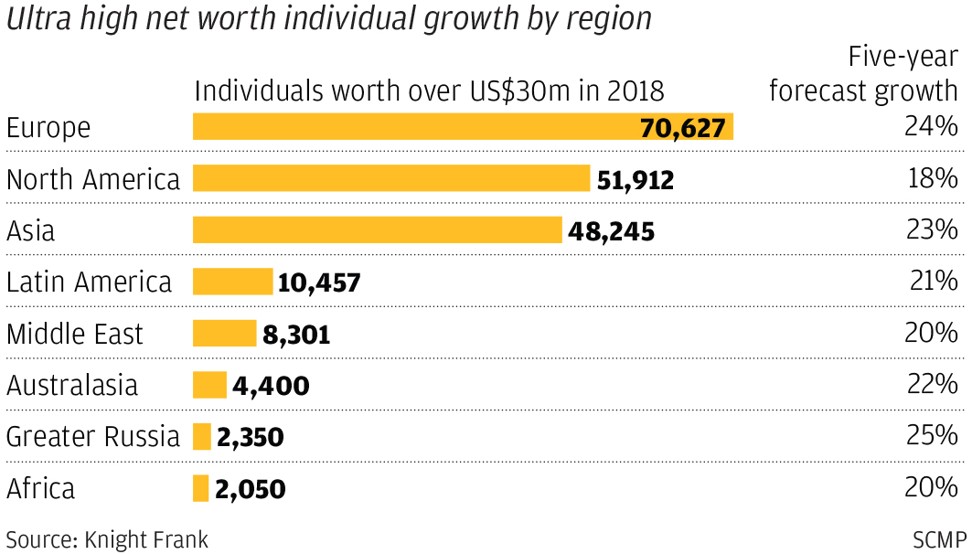

Despite the prospects of a political uncertainty and a potential downturn in markets in 2019, Knight Frank forecasts the global number of ultra high net worth individuals to keep rising, particularly in Asia.

The world’s population of US dollar millionaires is due to rise to 20 million this year. India’s class of ultra wealthy is due to grow 39 per cent over the next five years – the fastest growth rate in Asia. The next fastest is the Philippines at 38 per cent and China at 35 per cent.

India currently has an estimated 1,947 UHNWIs, compared to China’s 9,953. Hong Kong, with 3,010 UHNWIs, is expected to grow between 25 and 30 per cent.

Malaysia, Vietnam and Indonesia are all expected to have growth rates of over 30 per cent in their ultra high net worth population over the next five years.

Europe has a population of 70,627 UHNWIs, North America has 51,912 and Asia (excluding Australia and New Zealand) has 48,245. Europe is projected to increase their ultra high net worths by 24 per cent over the next 5 years, while Asia is due to rise 23 per cent and North America 18 per cent.